Few noticed, but the seeds for the coal industry’s survival and the utility industry’s ability to keep coal-fired capacity in its generation portfolio were sown in the past couple of months.

One of those seeds was the official opening Oct. 2 of SaskPower’s Boundary Dam integrated carbon capture control project in Estevan, Saskatchewan. The project will capture 90 percent of the carbon dioxide generated at the 110 megawatt facility, an estimated 1 million metric tons annually (as well as 90 percent of the facility’s sulfur dioxide emissions), using Shell Oil’s Cansolv process. The CO2 is being sold to Cenovus, a Calgary-based oil company, which will be using it in enhanced oil recovery (EOR) operations at the Weyburn field in the southern portion of the province. A portion of the captured CO2 also will be piped to SaskPower’s nearby research facility where it will be injected about two miles underground in a brine-filled sandstone formation to prove that deep storage is a safe, workable alternative. That portion of the project will be overseen by Canada’s Petroleum Technology Research Center (PTRC).

The project has a $1.4 billion price tag, but the utility is quick to note that the CCS portion is just $600 million, with the remainder going to refurbish the aging power plant and install the SO2 controls. The Canadian government contributed $240 million to the project.

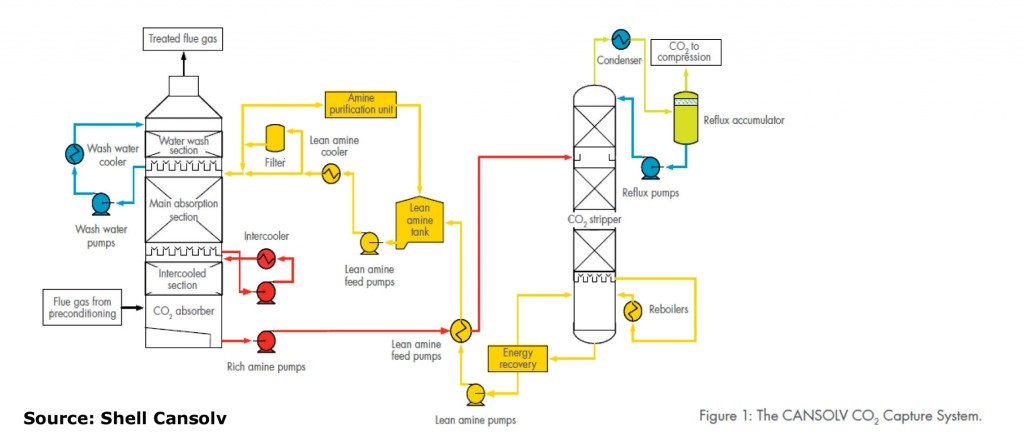

Shell’s Cansolv technology (see graphic below) is a closed loop system that uses regenerable solvents with proprietary amines to capture the targeted flue gases. At Boundary Dam, the SO2 will be captured first, then the CO2. The SO2 will be processed for use as a feedstock in a sulfuric acid plant. Not having to buy/transport limestone (a traditional means of SO2 control) and the availability of markets for both the captured SO2 and CO2 are expected to improve the system’s economics.

“The opening of the SaskPower Boundary Dam CCS project marks an important step for the CCS industry, as it demonstrates the viability of large-scale post-combustion CO2 capture,” said Lori Motherwell, president and GM at Shell Cansolv. “It’s also an important moment for Shell Cansolv, as it is our largest CO2 capture project so far, proving the technology at industrial scale and paving the way for future developments.”

One such development is already on the drawing board, as the Peterhead demonstration in Scotland, now in the engineering and design stage, is expected to use Shell’s Cansolv CO2 capture technology.

Other seeds are being sown in the United States—notwithstanding the utility industry’s current doom and gloom about the future viability of coal-fired electric generation.

The groundbreaking last month at NRG Energy’s WA Parish plant southwest of Houston is one such seed. That project, which is being partially funded through a $167 million DOE grant, is designed to capture 90 percent of the CO2 emissions from a 240 MW slipstream of the 610 MW facility. NRG has entered into a 50/50 partnership with Japan’s JX Nippon Oil & Gas Exploration Corporation to build the facility, which will use a solvent-based capture technology jointly developed by Mitsubishi Heavy Industries and the Kansai Electric Power Company. While only using a portion of the plant’s exhaust, the developers say the $1 billion project will be the largest post-combustion carbon capture facility on an existing coal plant in the world when it is completed; commercial operation is currently scheduled for late 2016.

Like the Boundary Dam project, the captured CO2 from the Parish plant will be used in the nearby West Ranch oilfield for EOR operations that are expected to boost output at the field from its current 500 barrels per day (b/d) to as much as 15,000 b/d. The oil field, in which NRG holds a 25 percent stake, holds an estimated 60 million barrels of oil that can be recovered through EOR operations. Clearly, that revenue stream (a gross amount of $375,000 per day assuming 3,750 barrels of output at $100 per barrel) will help trim the project’s overall costs.

One state to the east, another seed is taking root near Meridian, Mississippi. There, construction on Southern Company’s 582 MW Kemper IGCC facility is entering its final phase. The plant, which is being built by Southern’s Mississippi Power subsidiary, is a first-of-its-kind gasification plant that will convert local low-rank lignite coal to synthesis gas that will then be used to power a combined cycle electric generation power block. The conversion process will cut the coal’s CO2 emissions by an estimated 65 percent, bringing the facility’s emissions profile in line with a conventional natural gas facility. In addition, the captured CO2 will be used in EOR efforts that are expected to boost local crude production by about 5,500 barrels a day.

The project has suffered through delays and some significant cost overruns, but once up and running—full commercial operation is currently scheduled for the first half of 2015—the plant will showcase a technology that not only will be useful in the United States, but could also give Southern access to the booming electric generation market in Asia; China alone is expected to add upward of 400,000 MW of coal-fired capacity in the next 20 years and the country has huge reserves of these low-rank, less expensive coals.

In other words, while the near-term outlook for coal may be bleak, these newly sown seeds, given some time and nourishment, provide plenty of hope for the future.

–Dennis Wamsted

Follow

Follow