The country’s nascent energy storage industry had much to be thankful for in November—a record-shattering procurement announcement by Southern California Edison, active discussion in Texas of a monumental storage proposal, and two large Illinois projects that are slated for commercial operation sometime next summer.

SCE said in early November that it planned to purchase 261 megawatts of energy storage resources for use in its Los Angeles-area service territory. That total pales in comparison to the 1,382 MW of new gas-fired capacity the utility announced the same day (all part of its plan to replace the baseload capacity it lost when the 2,150 MW San Onofre nuclear power plant was shuttered in January 2012), but as Colin Cushnie, SCE’s vice president for energy procurement and management pointed out when the winners were announced, “This procurement effort…marks the first time SCE has contracted with energy storage projects through a competitive solicitation.”

And, while small in overall terms, the California Energy Storage Alliance noted that the SCE announcement represents the “largest grid-connected energy storage purchase in U.S. history.”

The storage winners in the SCE solicitation were:

- NRG Energy Inc. – .5 MW

- AES – 100 MW

- Stem – 85 MW

- Advanced Microgrid Solutions – 50 MW and

- Ice Energy Holdings Inc. – 25.6 MW.

Two things stand out about the winning bids: They account for five times more storage than SCE was required to purchase and more than half of the total will be installed “behind the meter’’ or out of SCE’s direct control. Specifically, the Stem, Advanced Microgrid and Ice Energy projects will all be installed on the customer side of the meter according to SCE. (More information about the SCE solicitation can be found here.)

Millbrae, Calif.-based Stem should be feeling particularly pleased given that its win in the SCE procurement came just weeks after the company announced an agreement with Extended Stay America to install battery storage units in 68 of the hospitality company’s California locations.

Janice Lin, CESA’s executive director, admittedly has a bias toward the storage business, but her comments after the SCE announcement are still valid: “This is a monumental decision…. The fact that SCE far exceeded the minimum amount of energy storage they were ordered to purchase after comparing multiple solutions head to head, demonstrates that energy storage can be competitive with other preferred resources on both performance and value, and that it’s now an integral part of the utility planning tool kit in California.”

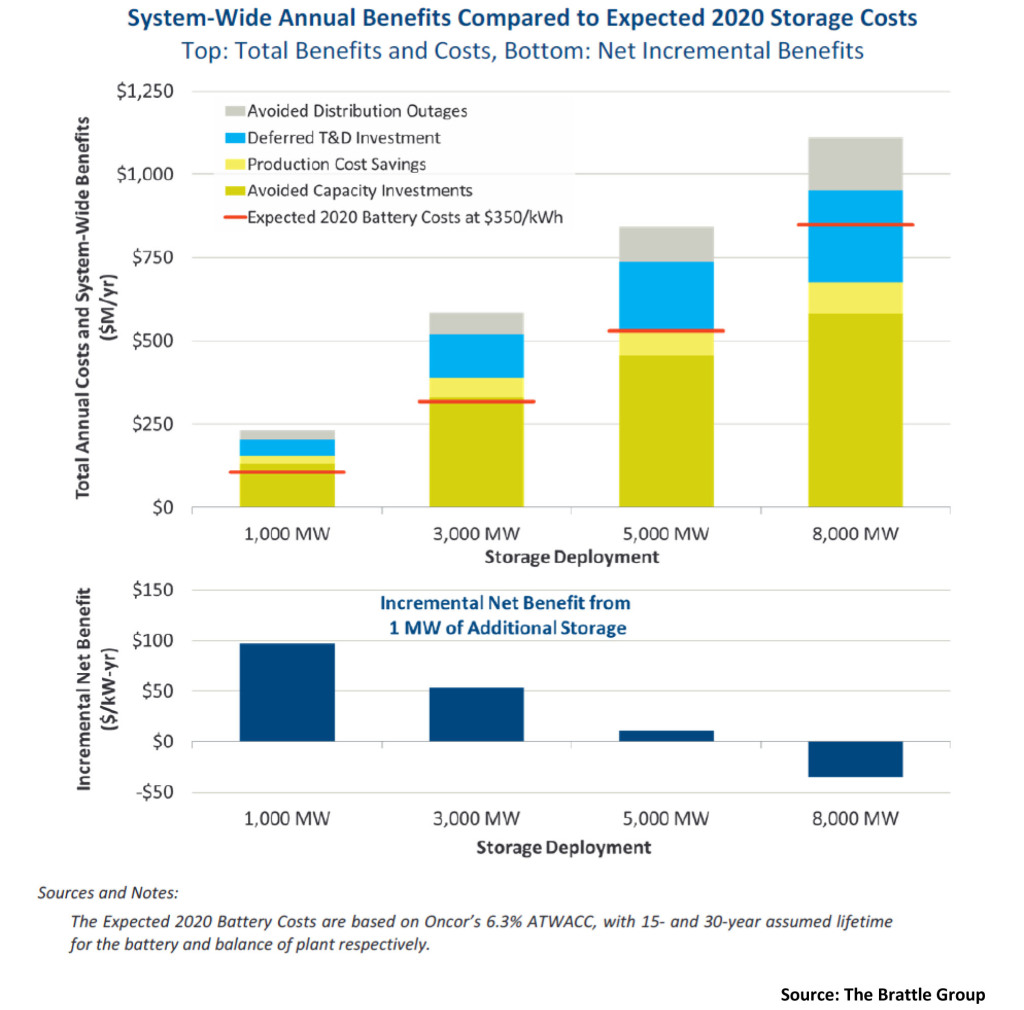

In Texas, where big is almost always better, the talk was about a proposal floated by Oncor, one of the state’s competitive transmission and distribution companies, to construct upward of 5,000 MW of storage to take advantage of the state’s huge windpower resources. The proposal is far from a reality, indeed it really consists of little more than the findings from a Brattle Group study commissioned by the Texas utility, but it is significant both because of its size and the fact that it was submitted voluntarily.

Using an estimated installed cost of roughly $350 per kilowatt-hour—which is an aggressive figure at the moment but not out of the realm of possibility—the Brattle study found that “the customer benefits would significantly exceed costs,” according to lead author Judy Chang.

But the benefits are diffuse (see chart above), including avoided distribution outages, deferred transmission and distribution investment and delayed or avoided construction of new generation resources. Operating independently, Chang continued, “these entities…will not be able to capture the full value of the storage to viably support the magnitude of investments that could be cost-effective for [Texas].”

Consequently, the authors recommended changes in the state’s regulatory framework that would enable investors to capture the combined value of these diffuse storage-related benefits.

Clearly, that will entail serious negotiations and almost certainly will not happen in the near term. But the point is, storage makes sense—and there are companies willing to bet big on its potential. (A copy of the Brattle study can be found here.)

While much smaller in scale, Renewable Energy Systems Americas announced two Illinois-based projects last month that will be up and running long before the Texas debate is settled. RES Americas, based in Broomfield, Colo., said it is building two 19.8 MW battery energy storage systems in Commonwealth Edison’s service territory outside Chicago. The two units, which will each have the ability to store 7.8 megawatt-hours of energy, are expected to begin commercial operation by next August. The projects will be used to provide frequency regulation service in the PJM ancillary services market.

The energy storage industry looks to be on the cusp of something big.

–Dennis Wamsted

Follow

Follow