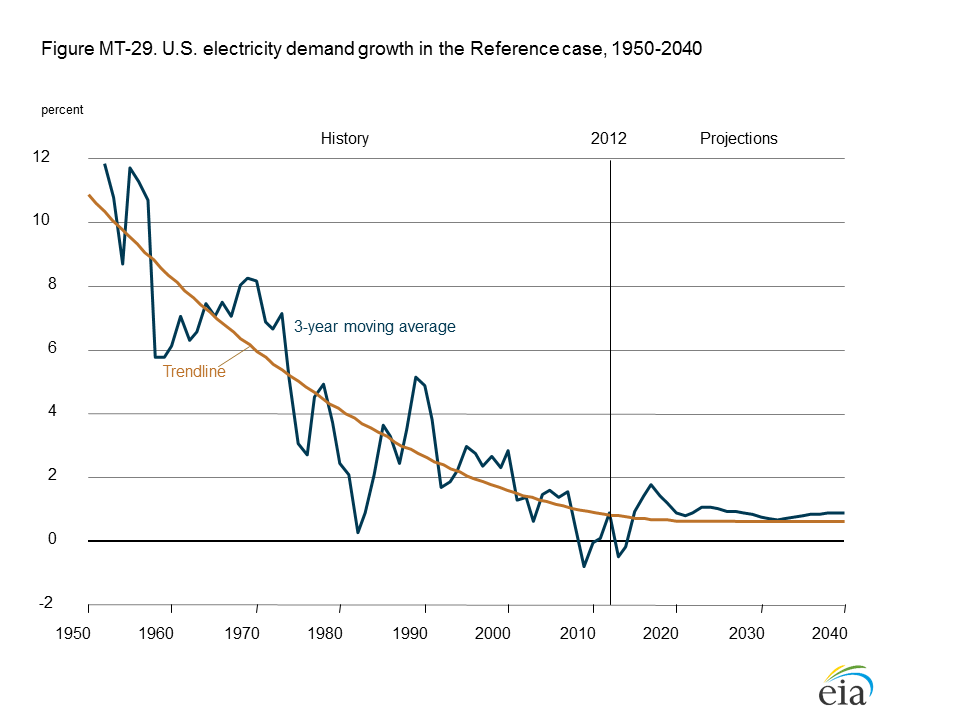

It is enough to make utility executives wake up in a cold sweat each and every night: Growth in electricity demand has essentially flatlined and it shows no signs of returning. EIA’s latest forecast (see chart below) showing growth at about 1 percent annually through 2040 is worrisome enough. But it may be about to get even worse.

In a little-noticed report released earlier this month, Navigant Research projected that residential utility customers will invest “more than $625 billion cumulatively, in DER [distributed energy resources] from 2014 through 2023.’’ Now, while that is a global total, it is still a lot of money in anybody’s book.

In a little-noticed report released earlier this month, Navigant Research projected that residential utility customers will invest “more than $625 billion cumulatively, in DER [distributed energy resources] from 2014 through 2023.’’ Now, while that is a global total, it is still a lot of money in anybody’s book.

The investment surge will be driven both by innovations in distributed renewable power resources making the technologies more efficient and the development of a host of new financing mechanisms that have made the technologies more attractive to smaller residential users, Navigant reported. These developments are “giving customers greater control of their energy consumption—turning some homes into miniature power plants that generate all the power they consume and even deliver power back to the grid,” said Neil Strother, principal research analyst with Chicago-based Navigant.

In the U.S., the most visible of these developments is the booming market for distributed solar photovoltaic installations. But there are a number of other intriguing options outlined in Navigant’s report, Residential Energy Innovations, including the development of what it calls residential combined heat and power (resCHP). In addition, Navigant said, “residential energy storage systems, vehicle-to-grid and vehicle-to-home systems that enable plug-in electric vehicles (EVs) to receive and provide power from and to the grid, and increasingly sophisticated home energy management tools are all likely to deliver more capability to homes and integrate onsite generation and storage in new and innovative ways.” [For more information on Navigant’s report, contact them here.]

Exactly what impact the broader adoption of these new technologies will have on residential electricity demand is uncertain at this point, but I think it is safe to say that it won’t cause demand to increase. In fact, if new work by Greentech Media is on target, it could push residential demand growth in the U.S. down to nothing in the years ahead.

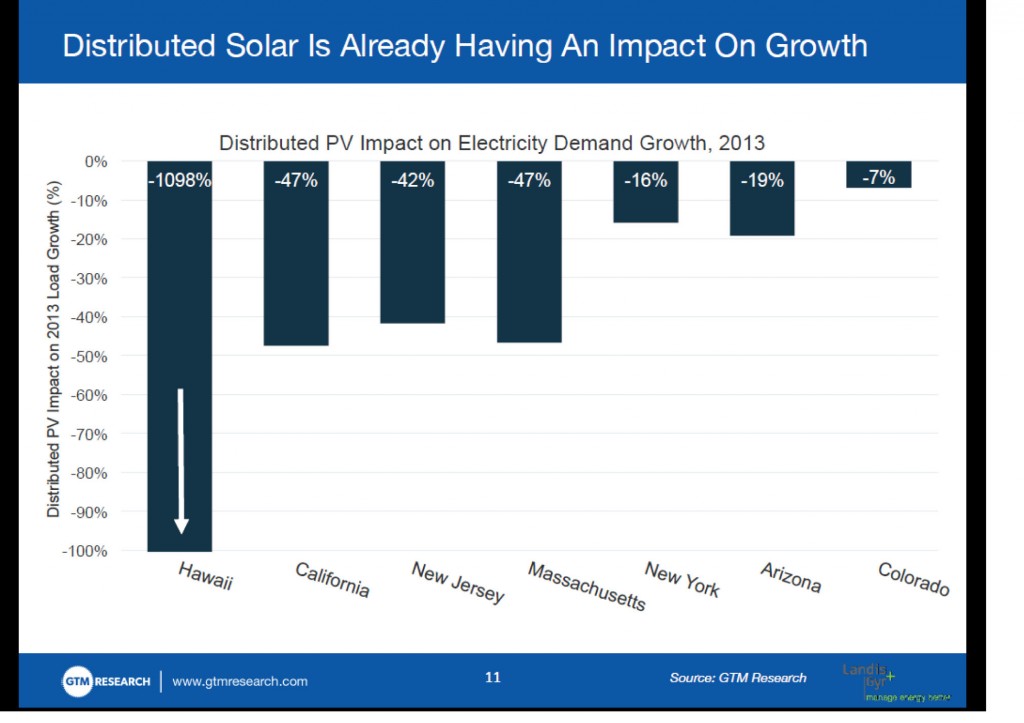

In a webinar this week, Shayle Kann, a senior vice president at GTM Research, pointed out that the distributed PV installed in three leading states—California, Massachusetts and New Jersey—likely cut residential demand growth in those states in half in 2013 alone. In other words, EIA’s forecast of 1 percent growth may be little more than wishful thinking for utility executives there. And by 2016, Kann continued, it could push demand growth in those states to zero.

Distributed PV is still an incredibly small portion of the nation’s overall electric generation mix, Kann pointed out. In 2013, he said, the 1.9 gigawatts of installed distributed PV likely generated about 2.7 million megawatt-hours of electricity—accounting for just 0.04 percent of the nation’s total output. And even in the three states noted above, distributed PV accounted for less than 0.5 percent of total electric output.

But as the chart above clearly demonstrates, it can have a disproportionate impact on utility demand growth—and that is likely keeping utility executives up at night nationwide.

–Dennis Wamsted

Follow

Follow