Critics of EPA’s pending carbon dioxide regulations harp on the same tired phrases: “The control technology isn’t commercially available.’’ “The rules will cost too much.’’ “The regulations will devastate the coal industry and force utilities to close their coal plants.’’ At hearing after hearing on Capitol Hill this year, these tropes have been tossed out as fact by critical congressmen and industry officials—but are they? Is the control technology available? How much will it cost? And what impact will it have on the coal and utility industries?

The Importance of Technology

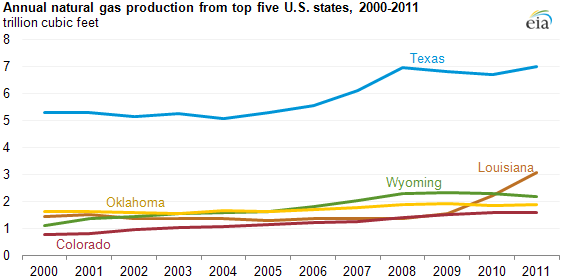

We will get to those questions in a minute, but first I want you to look carefully at the chart below and tell me what’s missing. Take your time, it’s important.

Figured it out yet? Well, if not, don’t be ashamed, it really is just an indicator of how quickly technology can change the status quo. What’s missing is the state of Pennsylvania.

Three years ago the commonwealth wasn’t even on EIA’s list of the top five natural gas producing states; today it is the nation’s second largest producer, pumping out roughly 3.3 trillion cubic feet in 2013 (according to Penn State University figures) compared to the approximately 2.4 tcf produced by Louisiana.

And come back in a year or two and the state of Ohio may also be among the nation’s top five natural gas producers. Production there, largely from the Utica Shale play, is soaring; to the point where this summer EIA promoted the state in its monthly drilling productivity report (one of the go-to references for the industry) and gave the state its own listing instead of lumping it in with “other.” They had good reason to make the change, believe me—production there has climbed from roughly 200 million cubic feet per day at the beginning of 2013 to almost 1.4 billion cubic feet daily by the middle of 2014, and the increase shows no sign of tapering off.

So what does this have to do with the electric utility industry and EPA’s pending carbon dioxide controls? Simply put, everything.

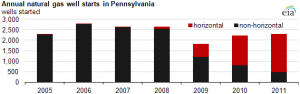

What changed in Pennsylvania (and now in Ohio) is that a combination of improved technology—horizontal drilling and hydraulic fracturing, which lowered production costs—and rising demand made the state(s) an attractive development opportunity. The shale has always been in Pennsylvania; in fact, there are records of shale gas wells being drilled in Erie County in the northwestern corner of the state dating back to 1860. But easier, more economic resources (read Texas and Louisiana) soon took over and the resource sat unused, and largely forgotten. The modern-day development of what is now called the Marcellus Shale resource began in 2004, with the drilling of a vertical well (Renz No. 1) by Range Resources Corporation. The well’s success prompted others, and the rush was on. But even then, most of the early wells were vertical, not horizontal (see chart above). In shale resources, which are characterized by relatively narrow producing seams, that meant a lot of the resource was being left in the ground.

called the Marcellus Shale resource began in 2004, with the drilling of a vertical well (Renz No. 1) by Range Resources Corporation. The well’s success prompted others, and the rush was on. But even then, most of the early wells were vertical, not horizontal (see chart above). In shale resources, which are characterized by relatively narrow producing seams, that meant a lot of the resource was being left in the ground.

Significant, recent improvements in horizontal drilling technology changed the equation, for good. The technology has been around for decades (a 1993 EIA review dates the first true horizontal well to 1929), but was little used until the 1980s and 1990s. And even then, horizontal drilling came at a premium and was limited to oil production. But that changed, and quickly in the early 2000s. Now, driven by horizontal drilling and hydraulic fracturing, shale gas production is expected to account for the bulk of all new natural gas development in the U.S. in the years to come.

The Clean Air Act Example

While similar developments in carbon capture can’t be guaranteed, they certainly can be inferred, particularly if you recall the raucous debates that preceded the passage of the 1990 Clean Air Act Amendments. Similar hearings then, but without the incessant buzz of incoming texts and smartphone-enabled emailing during the droning testimony, came with warnings from the industry that the control technologies were too costly and would prompt sharp increases in electricity prices nationwide.

In the run-up to the passage of the 1990 amendments, the utility industry repeatedly trotted out dire forecasts of the costs of the proposed SO2 reductions, estimating that the rules could cost the industry upward of $7.5 billion annually when fully implemented. Those warnings weren’t accurate; in fact they weren’t even close. Almost as soon as the ink was dry on the new law, the cost estimates began to fall, pushed downward by the development of new and better technology and innovative compliance strategies. By 1993, EPRI, the utility industry’s research and development arm, had cut its compliance cost estimate to $2.7 billion and by 1998 the research entity had cut its estimate again—to just $1.7 billion a year.

What happened? What happened is that the industry got busy figuring out how to make scrubber technology better. By 1990 the industry had a fair degree of experience with scrubbers—they had been mandated for new coal plants in the 1977 Clean Air Act amendments and by the late 1980s some 111 of the units had been installed covering almost 50,000 megawatts of coal-fired capacity. These early efforts had boosted performance and cut costs; one oft-cited work (Willard Boward, Sargent & Lundy) shows the per kilowatt cost dropping from $400 in the 1970s to about $275 in the 1980s.

But more improvements were there to be had, and the 1990 act certainly played a key role in pushing those efforts forward. As David Hart and Kadri Kallas pointed out in a 2010 article on energy innovation, “Post-combustion SO2 controls were installed and improved because they were required by regulators.’’

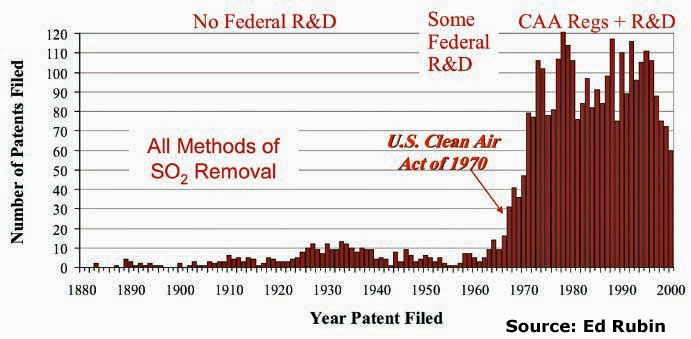

The importance of regulation as a driving force in innovation has also been made by Edward Rubin, a professor at Carnegie Mellon University. In an article published last year by Cornerstone, which represents the world coal industry, Rubin noted that the limits first placed on SO2 emissions in 1970 (and subsequently strengthened/expanded in 1977 and 1990) prompted “a dramatic rise in `inventive activity’ in the area of SO2 control, as measured by the number of U.S. patents filed from around the world.” (see chart below)

Which patents made it into the commercial market is immaterial, but it is clear that many did since scrubber capital costs fell sharply during the ensuing decades—down to about $100 a kilowatt by 2000 according to Sargent & Lundy’s Boward—while operating performance improved—climbing from a baseline of about 80 percent in the 1970s to up to 99 percent today.

Interestingly enough, one of the most influential innovators—Atlanta-based Southern Company—had also been one of the loudest opponents of the 1990 legislation. While publicly working to slow, if not stop outright, congressional action on the CAA amendments, the company was working diligently to develop more cost-effective means of complying with the limits that were being proposed for both SO2 and nitrogen oxides, another major coal combustion byproduct. And they succeeded—probably beyond their wildest dreams.

In tackling SO2 emissions, the Southern research effort latched onto an already proven Japanese scrubber technology, and then proceeded to make it better by designing a corrosion-resistant fiberglass-reinforced vessel for the scrubber to take the place of the conventional metal ones. According to Southern’s internal history of its R&D work (which is a fascinating read, by the way, and can be found here), the new scrubber technology, which has been installed on about 16,000 MW of capacity, saved the company (and ratepayers) an estimated $500 million when compared to installations by other utilities.

The results were just as dramatic on NOx, with Southern pioneering the selective catalytic reduction technology (SCR) that is now used throughout the utility industry. According to Southern, the technology has been installed on 15,000 MW of coal-fired capacity across its system, and has saved the company an estimated $525 million compared to other utility control efforts.

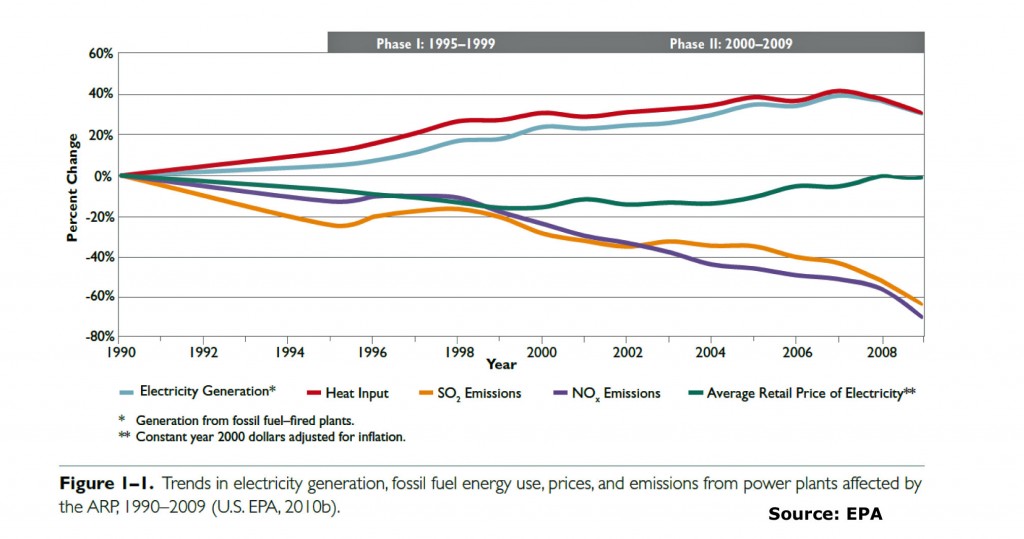

Clearly, a little push from the federal government can have a big impact. And as this chart  makes clear, these technology developments have kept price increases in check—while SO2 and NOx emissions have fallen, and overall electricity generation has increased.

makes clear, these technology developments have kept price increases in check—while SO2 and NOx emissions have fallen, and overall electricity generation has increased.

That push can have a similarly large impact on cutting costs for CO2 controls, even if the industry begs to differ (just as it did in the debate over more stringent SO2/NOx limits).

Costs for current CO2 control technologies are admittedly high, but given the utility industry’s experience in complying with the 1990 Clean Air Act Amendments it would be disingenuous to use today’s numbers to produce an estimate of CO2 control costs in the future.

As the authors of the 1990 conference report on the Clean Air Act Amendments presciently noted: “The assumption that pollution control technology is static is not realistic when analyzing policies which are to become effective in the future.’’

A similar note can be found today on DOE’s carbon capture web page: “Since very little R&D has historically been devoted to carbon capture systems for existing power plants, there is significant potential to reduce the cost and energy demand of CO2 capture and compression processes through technological advancements.”

The point is, it simply isn’t going to cost as much as EPA’s critics say it will to comply with the agency’s new CO2 emissions limits. And here too, it is industry that is going to make sure those costs are as low as possible.

Promising Developments

Southern, as it did during the earlier fight over acid rain, is one of the leading opponents of the proposed EPA CO2 regulations. At the same time, it is also playing a big role in the race to develop cost-effective power plant CO2 controls—notably with the construction of its 582 MW Kemper coal gasification facility near Meridian in eastern Mississippi. The project has suffered through delays and cost overruns not unexpected for a first-of-its-kind facility, but don’t let that overshadow the bigger picture: Sometime next year Southern’s Mississippi Power subsidiary will begin operating a plant that captures at least 65 percent of the coal’s CO2 emissions, bringing the facility’s emissions profile in line with a conventional natural gas facility. In addition, the captured CO2 will be used in enhanced oil recovery efforts that are expected to boost local crude production by about 5,500 barrels a day. The technology, which is designed to use low-rank sub-bituminous and lignite coals, could also give Southern access to the booming electric generation market in Asia; China alone is expected to add upward of 400,000 MW of coal-fired capacity in the next 20 years and the country has huge reserves of these low-rank, less expensive coals.

Other companies also are moving aggressively to develop and commercialize CO2 capture technologies, including NRG Energy, which earlier this year began construction on a demonstration project at its WA Parish plant southwest of Houston. Partially underwritten by $167 million in DOE research money, the project is designed to capture 90 percent of the emissions from a 240 MW slipstream of the 610 MW facility. NRG and its Japanese partner, JX Nippon Oil & Gas Exploration Corporation, will be using a solvent-based capture technology jointly developed by Mitsubishi Heavy Industries and the Kansai Electric Power Company. While only using a portion of the plant’s exhaust, the developers say the project will be the largest post-combustion carbon capture facility on an existing coal plant in the world when it is completed.

Beyond these construction efforts, there isn’t a week that goes by without the announcement of some promising R&D results. Clearly, not all of those will pan out, in fact most will not; but some will, and the long-term cost trend is almost certain to be downward.

History is not on industry’s side. Instead of fighting the proposed new rules through round after round of costly and likely ineffective court battles, the utility industry should be moving now to develop and test the technologies needed to cut CO2 emissions in the years to come.

–Dennis Wamsted

Follow

Follow