What a difference a few years can make: In 2008 there were 22 megawatts of utility-scale solar photovoltaic generating capacity in the U.S., today that number has jumped to more than 8,100 MW—and more is on the way.

There are a number of reasons behind this growth—including significant declines in PV module prices and the long-term enactment in 2006 of an investment tax credit for solar installations—but perhaps most important was the financing push provided by the Department of Energy’s Loan Programs Office. Yes, that is the same office bashed repeatedly by Republicans in Congress and the conservative media for gross mismanagement and “crony capitalism” (whatever that really means).

But the reality is, the loan office works, and works well.

In a report released earlier this month, the office pointed out that developers had announced projects with a total capacity of more than 6,000 MW, including a number that were larger than 100 MW, by 2009 “but could not get commercial lenders to provide all of the loans necessary to fully finance construction of the projects.” This reticence was not surprising—after all the industry had no project development history, meaning a commercial lender that opted to underwrite one or more of the projects would have been taking on significant risk.

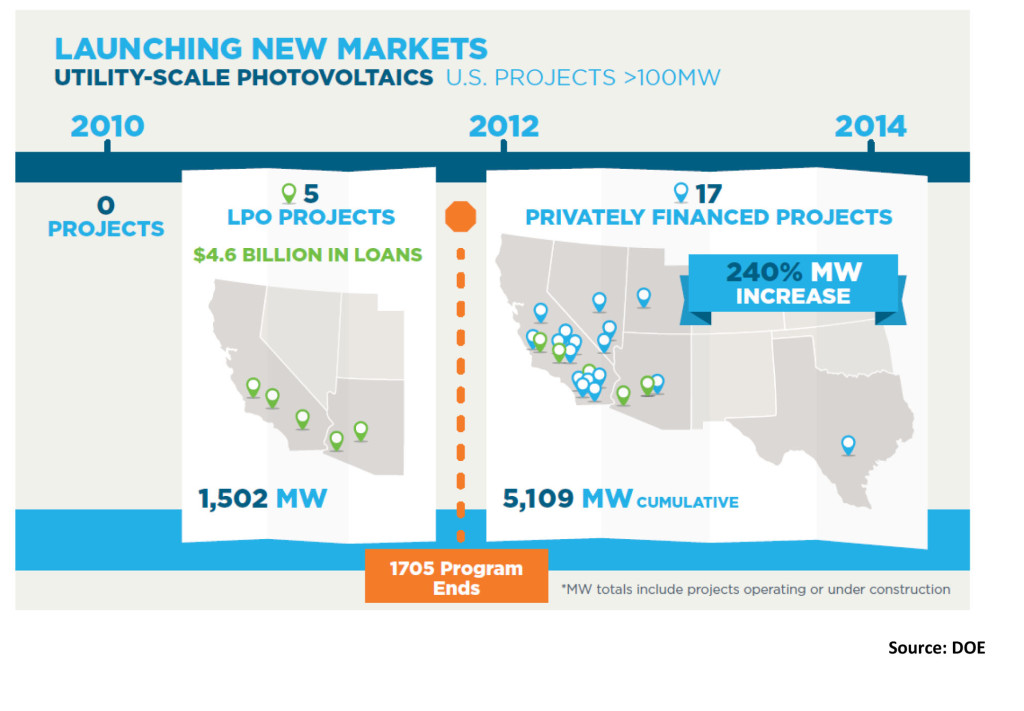

To push the market—and prevent the projects from becoming little more than pretty architectural pipe dreams—the DOE loan office stepped in and provided $4.6 billion in loan guarantees (through Section 1705 of the American Recovery and Reinvestment Act) to the first five utility-scale PV plants larger than 100 MW in the United States. These five projects, with a total installed capacity of more than 1,500 MW, transformed the financial landscape according to the DOE report, Powering New Markets: Utility-Scale Photovoltaic Solar (the report can be found here). Since those first five projects, all of which are now in commercial operation, commercial lenders have stepped into the market and financed an additional 17 projects larger than 100 MW (totaling 3,600 MW of new capacity in all).

“LPO’s work on the nation’s first five utility-scale PV solar projects laid the foundation for what has become a robust market that is now purely commercially financed,” the report noted. “The history of utility-scale PV solar in the U.S. shows how LPO can launch a new market, work with lenders to understand and expand the market, and then step aside to let the private markets take over.”

And forecasts show that the rush of utility-scale PV development is going to continue for at least the next two years (the existing solar ITC is slated to drop from 30 percent to 10 percent at the end of 2016). For example, DOE’s Energy Information Administration projected earlier this month that the amount of utility-scale solar capacity will jump by more than 60 percent from year-end 2014 to year-end 2016, with about half of that new capacity to be built in California.

Similarly, the Solar Energy Industries Association reports that construction is under way on 4,526 MW of new utility-scale PV capacity, and projects with an additional 9,967 MW of capacity have signed power purchase agreements (PPAs) in hand—meaning construction likely will begin soon. Added to the 8,137 MW of existing utility-scale PV, this would push total installed utility-scale capacity to more than 22,500 MW. In addition, while admittedly less certain, SEIA also reports that projects totaling more than 27,000 MW have been announced but do not yet have PPAs locked up.

No matter how you look at the data it is a far cry from the 22 MW of utility-scale solar that was generating electricity just seven years ago.

Republicans on the Hill may be loath to admit it, but DOE’s willingness to step in and underwrite the crucial first few utility-scale PV projects truly changed the game, and changed it for the better.

–Dennis Wamsted

Follow

Follow