It is increasingly clear that the economics of nuclear power don’t add up. Just in the past two and a half years, for example, seven plants at six sites have been shut down due to uneconomic performance or massive equipment repair costs—and other plants are on the chopping block. Similarly, the two ballyhooed active construction projects, in Georgia and South Carolina, are seriously behind schedule and way over budget. Nonetheless, utility executives and regulators in a number of states still have not gotten the message, notably in Florida and Virginia where executives at Juno Beach-based Florida Power & Light and Richmond-based Dominion soldier on, pushing new reactor proposals whose economics, simply put, just don’t add up and could leave ratepayers holding the bag for billions of dollars in nuclear construction costs.

The charade is particularly obvious in Florida, where FPL, a unit of NextEra Energy, annually goes through a process with state regulators to show the feasibility of a proposed two-unit, 2,200 megawatt addition to its existing facility at Turkey Point south of Miami. The yearly dance was completed last month with regulators signing off on FPL’s feasibility analysis as “reasonable” and approving the utility’s ability to recover from ratepayers the roughly $25 million it will spend this year on the reactor proposal.

A closer look at FPL’s analysis, however, shows that, at best, it stretches the boundaries of what can be considered reasonable. In particular, there is the little matter of whether the plant will be built and operated for 40 years, or 60.

It does make sense to operate expensive, capital-intensive facilities such as nuclear plants for as long as is safely possible, and many utility companies in the U.S. currently have sought and received 20-year license extensions from the federal Nuclear Regulatory Commission to operate their reactors for 60 years. FPL is one of those companies, having secured NRC license extensions for its existing Turkey Point units (numbers 2 & 3) as well as its two reactors at St. Lucie. (There even is talk about the possibility of some reactors seeking a second 20-year extension, bringing the total operating life to 80 years.)

However, those extra 20 years don’t come free. In fact, there are significant new costs involved in relicensing a reactor and stretching its operating life from 40 to 60 years. For example, when Xcel Energy decided to relicense its single unit Monticello plant it spent $665 million to increase the plant’s capacity and repair/refurbish/replace equipment throughout the unit in order to secure its 20-year NRC life extension. Similarly, the Minneapolis-based utility spent $280 million to replace the steam generator at Unit 2 of its Prairie Island nuclear facility in order to pave the way for that reactor’s 20-year license extension.

But FPL is now blurring the lines and using the estimated costs for the new reactors’ initial construction(an ever-changing number, but currently pegged at between $10-$15 billion, with total project costs, with financing, at upward of $20 billion) and spreading them out over both a 40-year and a 60-year operating life—without adding any additional capital costs. This new math, which FPL used for the first time in its 2014 feasibility analysis, does exactly what the utility wants: The economics of the plant do look better when calculated over a 60-year period. However, it is a sleight of hand that can’t be economically justified since the capital costs used in the calculation are for a plant that will operate for 40 years.

It is interesting to note that even when FPL extended the expected operating life of the two new reactors to 60 years, it still could only show that the project would be “clearly the economic choice’’ in eight of the 14 scenarios it studied. (See the May 1, 2015, testimony of FPL’s Richard Brown in docket 150009-EI; it can be found here.) In the other six scenarios it is a toss-up, or as FPL says, “this project may be economic.” Call me old-fashioned, but committing upward of $20 billion for a project that “may be economic” seems like a leap of faith only a company guaranteed to recover its costs through ratepayer surcharges would advocate.

Beyond this, the projected economics of the Turkey Point reactors rely heavily on the future price of carbon dioxide emissions—and here again the utility is stretching the bounds of credulity in its assumptions. In its feasibility analysis, the utility uses data from ICF International, a Fairfax, Va.-based consulting firm, that projected carbon dioxide emissions control costs through 2030, and then extrapolates 50 years into the future. The extrapolation, based FPL says on “guidance” from ICF, takes the forecasted compliance cost of $31 per ton in 2030 steadily upward to an almost-unbelievable $617 a ton in 2080. As a witness for the city of Miami testified during the proceeding, the estimate simply doesn’t pass the common sense test. For starters, the reality is no one knows what the price of CO2 compliance—or any other environmental cost for that matter—will be in 2080. It would be just as plausible to assume the compliance costs then would be $100 a ton—but that wouldn’t be good for FPL’s feasibility analysis.

Unfortunately, it is not just FPL that believes in “impossible things” as the Queen so memorably said in Alice In Wonderland; the state’s public service commission staff also has bought into the fiction. Since no one submitted a competing analysis, the staff wrote in its recommendations memorandum on the case for the Florida PSC, it can’t analyze the reasonableness of FPL’s numbers. “Therefore, staff is not persuaded that the company’s forecast of environmental compliance costs related to C02 is unreasonable.” Perhaps a little in-house analytical work would have done the trick?

A third issue that doesn’t even make it into the annual FPL feasibility filing is the little issue of decommissioning. Cleaning up a closed nuclear site, regardless of whether it operates for 40 or 60 years, takes a lot of money. How much, you ask? Try an estimated $517 million PER reactor, according to FPL’s latest license application documents on file with NRC. These funds will be collected from ratepayers once the proposed reactors enter commercial operation—but for reasons unknown they aren’t even considered in the annual feasibility fleecing in Florida. “Curiouser and curiouser,” said Alice.

Finally, there is the provident provision included in Florida’s nuclear cost recovery legislation that allows utilities to exclude already spent funds when they calculate a project’s ongoing economic feasibility. This allowed FPL to exclude $254 million this year from its calculation of Turkey Point 6&7’s cost-effectiveness. Mind you, those costs are still being recovered from ratepayers, but they don’t count when deciding whether it still makes sense to build the new units. Curiouser and curiouser indeed.

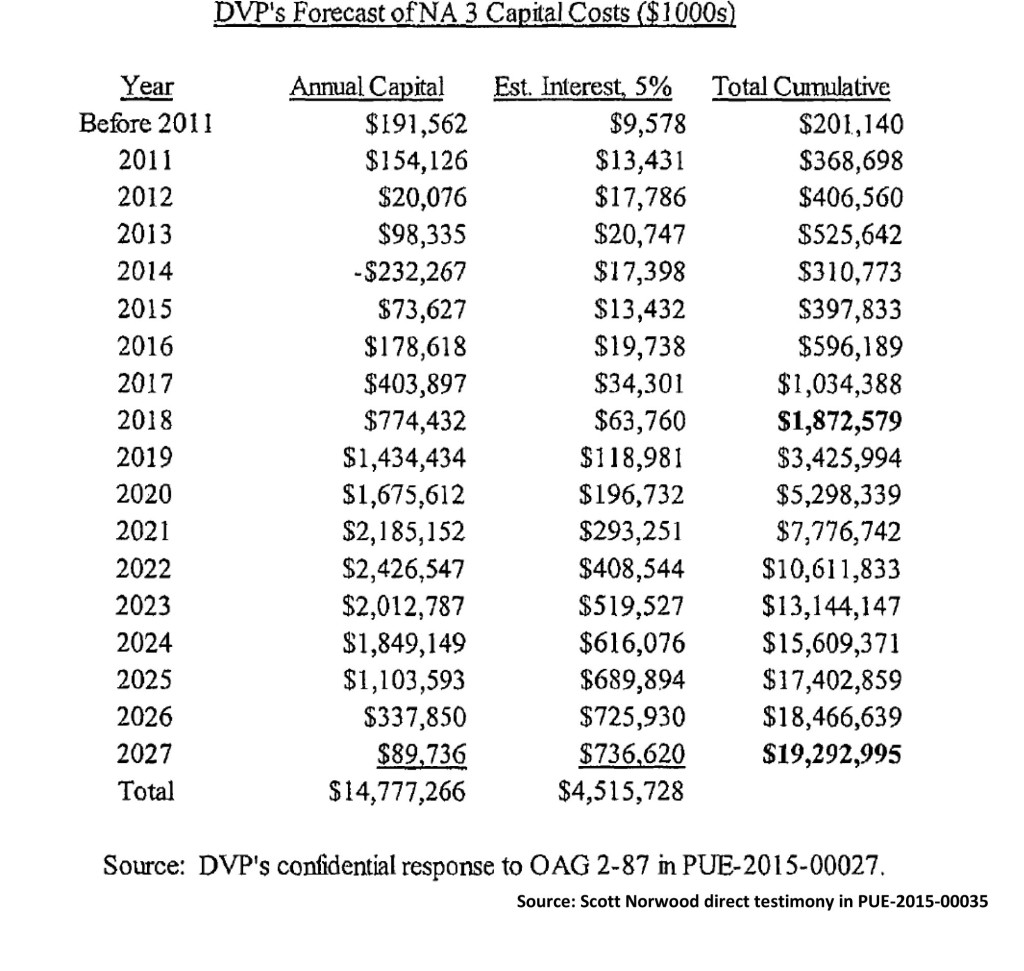

Perhaps nowhere though are things as curious as in Virginia, where the following chart was released during the State Corporation Commission’s recent hearings on Dominion’s 2015 integrated resource plan.

The reactor under consideration, North Anna 3, which would be built alongside Dominion’s two existing pressurized water reactors at the Louisa County, Va., site, is a 1,470 MW design developed by GE and Hitachi known as the ESBWR or Economic Simplified Boiling Water Reactor. While it may be simplified, it has never been built and the industry’s track record with first-of-a-kind construction is, to put it kindly, not impressive—just ask Southern Company about its Vogtle experience with the first-in-the-U.S. AP1000 designed by Westinghouse.

Given those first-of-a kind construction realities, and with the total estimated capital costs for the reactor already at almost $15 billion, and the total costs with financing nearing $20 billion, you might have expected someone at the utility or perhaps a member of the commission, to say, “You know what, this looks like it isn’t going to be a cost-effective investment, let’s take a closer look.”

While those cautionary notes were not forthcoming from the commission or Dominion, Scott Norwood, a Texas energy consultant retained by the Virginia Office of the Attorney General, did call for some common sense in his testimony on the Dominion IRP proceeding. Norwood pointed out the planned North Anna reactor “is significantly more costly than the least cost plans (“LCP”) identified through the IRP analyses of other available generating resource alternatives.” (Norwood’s testimony can be found here.)

And it is not as if Dominion just conducted an either/or analysis, Norwood continued: The company studied 19 different scenarios for its least cost plan for the current IRP—and the North Anna project is more expensive than all of them. In addition, and this is a point worth underscoring, Norwood said the North Anna project was not even the lowest cost means of complying with the Environmental Protection Agency’s recently released final carbon dioxide control rules (the much-discussed Clean Power Plan). Finally, as a reference for the scope of the costs involved, Norwood concluded by noting that at its current projected capital cost, North Anna 3 already is projected to cost more than 10 times what the utility’s most recent combined cycle natural gas plant, the roughly comparable 1,358 MW Brunswick facility, took to build.

It is past time for utility executives and their regulators to take a step back and reassess. An honest look at the real costs of nuclear power will show that the economics don’t add up. It is time to stop believing in impossible things.

–Dennis Wamsted

Follow

Follow

Dennis, your article is an encouraging sign, if a bit predictable after the announcement of Watts Bar 2 nuclear coming online next month (the only thing more predictable would have to be the brief shot of adrenaline the solar industry received after the last meltdown).

Make sure you let TVA know about your research – they seem to be pretty excited about having 80 years worth of dependable, clean baseload power. Don’t worry – Tennessee solar enthusiasts, like Tennessee handgun owners, will be permitted to keep their playthings.

The question becomes, “Why would they want to?”

TVA is famous for its wasteful expense and high electricity rates.