Predicting the future is hard, I get it, but it shocks me how abysmally wrong some of the smartest people in the business can be, even with the best information.

For example, in a recent interview with EnergyWire John Rowe, chairman emeritus of Chicago-based Exelon Corp. and a long-time big thinker in the utility industry, acknowledged that he and his executive team essentially missed the coming shale gas revolution: “What we didn’t see, even as late as ’08, we just didn’t see what shale gas was going to do to gas prices. Some of our downside scenarios were at $4 [per mmBtu] gas. We did not see below $3 gas. … I have a wound on my neck from that one.”

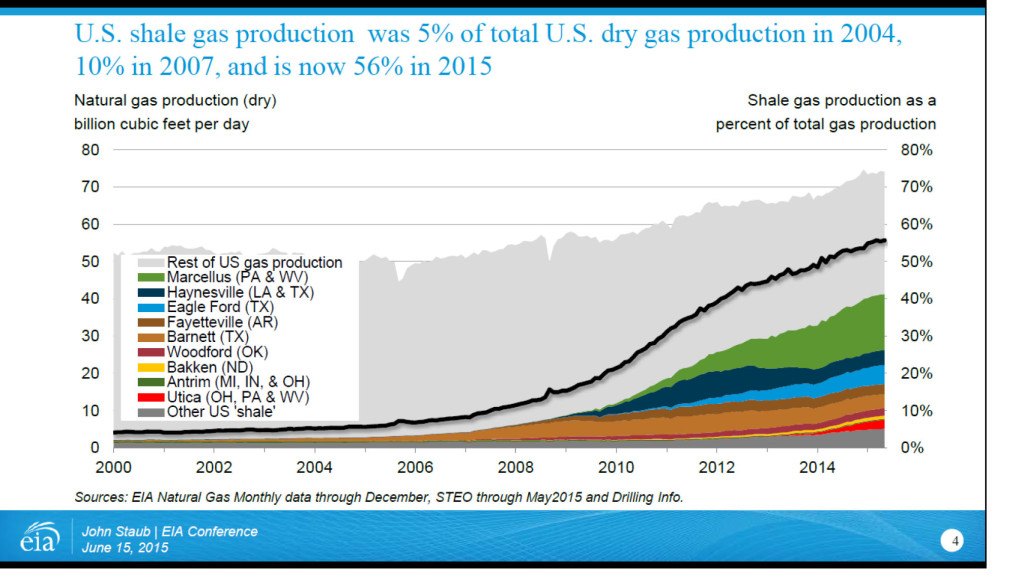

Rowe is hardly alone in having missed the explosion in shale gas production. As I pointed out here, EIA’s 2004 Annual Energy Outlook didn’t even mention the Marcellus and Utica shale resources. Pity that, since output from Marcellus has jumped from basically nothing a decade ago to 16 billion cubic feet a day this year—accounting for roughly 13 percent of overall U.S. output.

And even those folks that “saw” the potential of unconventional oil and gas resources were completely off in terms of timing, meaning that for all intents and purposes they missed the coming revolution as well. For example, Scott Nyquist, a director in McKinsey’s Houston office, wrote recently: “We did see shale coming, but we were way off in terms of how fast mass-scale production would happen and how low costs would go.” In other words, while I commend his willingness to revisit the firm’s 2007 predictions (which can be found here), McKinsey missed it too.

This 10-year transition has changed the energy equation entirely. Rowe and his executive team were forecasting gas prices to weigh the economics of Exelon’s nuclear-heavy generation fleet. At the time, nuclear looked like a clear winner; from October 2002 through the end of 2008, monthly spot prices for natural gas at the Henry Hub, the nation’s leading trading point, never fell below Rowe’s downside scenario of $4 per mmBtu. Since 2010, monthly prices have only been above $5 per mmBtu three times. More telling, EIA’s latest short-term energy outlook (which can be found here) forecasts that Henry Hub prices will average just $2.89 per mmBtu this year and just $3.21 per mmBtu in 2016. Rowe’s downside price of $4 per mmBtu is now an upside outlier. No wonder Exelon’s nukes are struggling.

Analysts also missed the surge in solar production over the past 10 years, with most forecasts from the mid-2000s calling for slow, steady growth. In 2005, for example, EIA predicted that grid-connected photovoltaic and solar thermal generation would climb from the 0.7 billion kilowatt-hours of electricity produced in 2003 to roughly 6 billion kwh in 2025. According to EIA’s latest online statistics, the U.S. produced 50.2 gigawatt-hours per day from solar in 2014—about 18.3 billion kwh or more than three times its earlier estimate for 2025.

EIA’s 2005 forecast was made before the enactment of the solar investment tax credit, which has helped the industry tremendously, and before the sharp drop in module prices that began in the late 2000s and is continuing at a slower pace today. But that is precisely my concern: Point in time forecasts are almost by definition going to be wrong since they cannot predict out of the norm developments, and few, if any, analysts are willing to bet their reputation on a hunch about the future.

Certainly the folks at McKinsey weren’t willing to go out on that limb, as Nyquist acknowledged in his recent review of the firm’s ’07 outlook: “Photovoltaic (PV) installations have taken off much faster than we expected. Costs fell steeply, driving adoption. The compression of costs happened throughout the solar-energy system, from sourcing raw materials to manufacturing to installation and service. We expected costs to fall to $2.40 per watt by 2030 but weren’t bullish enough; in fact, they are on course to hit $1.60 per watt by 2020.”

Let’s see, $2.40 by 2030 versus $1.60 by 2020—that is going to lead to a whole different economic decision-making process.

My point here is not to criticize EIA, McKinsey or anyone else willing to try and forecast the future; my point is to ask what is happening today that we will look back on in 10 years and say, “How did we miss that?”

I am not a forecaster, but I think the answer is the ongoing development in the energy storage sector. Developments occur here seemingly on a daily basis; utilities are scrambling to study the various available technologies and moving ahead with installation plans in a number of states, while developers are plowing ahead with R&D efforts to improve their systems’ performance. It sounds, in many ways, like the beginning of the solar power boom cycle of 10 or so years ago.

And yet, it is easy to find folks willing to overlook the developing tsunami. For example, earlier this month the Breakthrough Institute’s Loren King wrote: “And while the recent progress in storage technology is worth celebrating, scalable utility-scale storage remains a distant dream.” To me this sounds strikingly similar to the conclusion reached years ago by Rowe and his Exelon analysts about natural gas prices—they knew there was shale gas around, but they couldn’t wrap their heads around its potential impact.

Battery storage units are being installed today, and they are making money. These units may not be “utility scale” or “scalable” at the moment, but I think it would be foolhardy to dismiss those developments as “a distant dream.”

Tesla is but one player in this rapidly developing market, but I think it serves as a good proxy, and its recent 2nd quarter earnings call [the quoted text below is from Seeking Alpha, the full transcript is available here] shows just how fast the segment is moving. Responding to a question about the company’s battery storage efforts, Elon Musk, the company’s chairman and CEO said:

“Yeah. I do want to preface this with some degree of uncertainty, because this is quite new…but the demand has been really crazy,…it’s well over $1 billion worth of Powerpacks and Powerwalls [Tesla’s commercial and residential storage offerings, respectively]…and that’s with no marketing, no advertising, no sales force.

“…[W]e’re basically sold out of what we could make in 2016 at this point…. And I mean that growth rate is probably going to just, keep going at quite a nutty level.”

Some of Musk’s enthusiasm may be overstated, but the reality is large-scale economic storage really would change everything in the utility business, just as the rise of unconventional resources changed the natural gas industry.

Where do you think we will be in 10 years? I’m betting on Musk and the storage boys to change the equation. You?

–Dennis Wamsted

Follow

Follow