The utility industry has been waging a spirited campaign against state net metering policies for months (see my earlier post here), arguing that these programs unfairly benefit residential solar users and force new costs onto both non-solar customers and the companies themselves. However, judging by a recent report from the Rocky Mountain Institute, those arguments are largely moot—solar is going to win regardless. The real question, RMI said, is whether the industry is going to continue fighting the last war—or start figuring out how to profit from this new reality.

The RMI report, The Economics of Load Defection (which can be downloaded here), modeled the costs of solar and solar plus batteries and compared them with today’s utility costs and expected cost increases going forward. What they found was eye-opening:

“Smaller solar-only systems are economic today in three of our five geographies, and will be so for all geographies within a decade.”

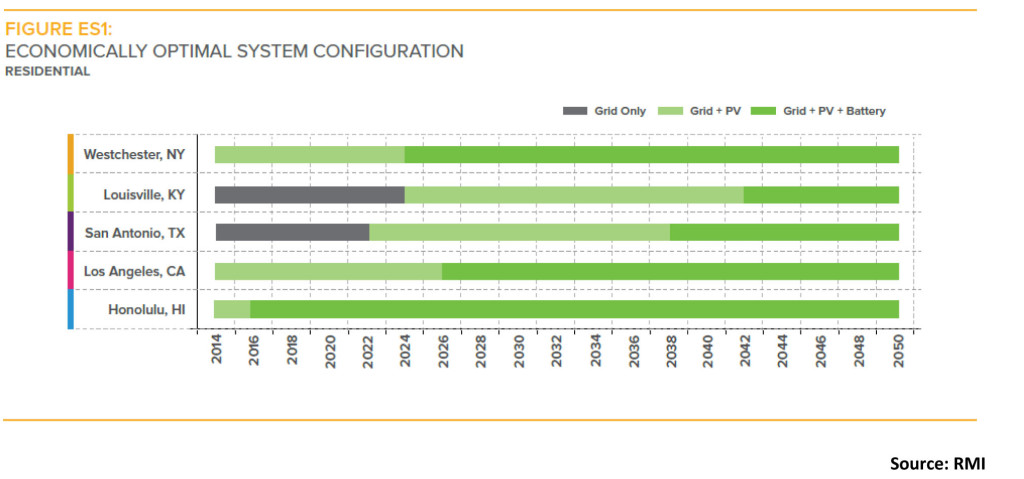

The five areas studied by RMI were Westchester, NY, Louisville, KY, San Antonio, TX, Los Angeles, CA and Honolulu, HI. The residential results from the study are shown in the chart below.

These findings, RMI added, will soon lead to significant load losses for utilities nationwide. Looking specifically at the Northeast, RMI said that in just five years, residential utility load loss there could top 10 percent, cutting utility sales by upward of 3.5 million megawatt-hours annually and trimming utility revenue by an estimated $684 million—and the losses would only increase after that.

What is particularly startling about RMI’s findings is that the organization explicitly excluded net metering from its cost/benefit calculations—and the economics still favor solar and solar plus batteries. As RMI put it: “Our findings suggest that eliminating net metering merely delays inevitable significant load loss. Grid-connected solar-plus battery systems will gradually but ultimately cause a near-total load loss even in net metering’s absence.”

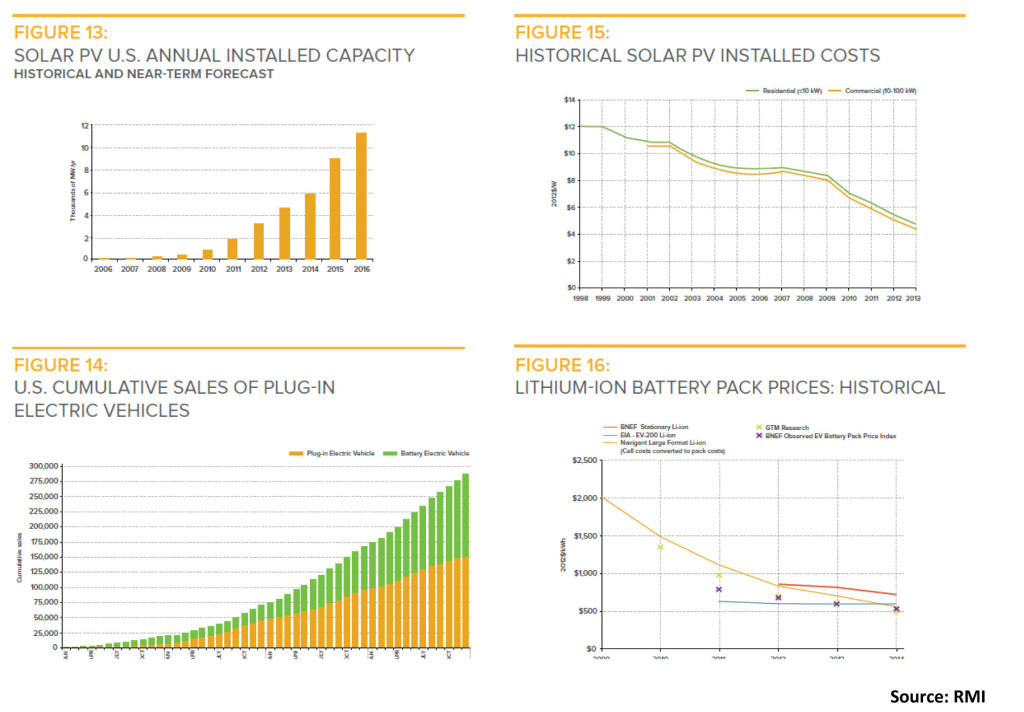

It is important to note that RMI’s study was using data (particularly relating to battery costs) predating the groundbreaking Tesla announcement in late April regarding its new home battery product, the Powerwall. Specifics of that announcement have been covered elsewhere (see the link below to Eric Wesoff’s May 1 story in Greentech Media, or check out the details at Tesla’s site here), but the key point is that residential battery prices almost certainly are now already lower than those used by RMI, and trending downward. The charts below illustrate the trends clearly.

The organization also threw cold water on another current utility effort—proposing new monthly fixed charges for residential customers using solar to cover utility costs. These charges “don’t ‘fix’ the problem,” RMI wrote. “Similar to our ‘with’ and ‘without’ NEM [net energy metering] scenarios, residential fixed charges would likely alter (i.e., delay) the economics for grid-connected solar and solar-plus battery systems, but likely wouldn’t alter the ultimate load defection outcome.”

Ironically, just days before RMI released its report, Phoenix-based APS filed a request with the Arizona Corporation Commission to increase its monthly charge for new solar users from the current $5 a month to roughly $21 a month. And that still wouldn’t cover the utility’s solar-related costs, APS said, adding that a “fair” allocation of costs would require residential solar users to pay as much as $67 a month.

Similar monthly charges have been proposed and/or enacted by Arizona’s other major electric utilities in the past several months. The Salt River Project, which is self-governing and does not need ACC approval for its rates and other customer charges, in February adopted a new demand charge for solar users that is expected to raise monthly costs for new users by about $50. Elsewhere, Tucson Electric Power has proposed cutting the rate it pays for customer-generated solar electricity and UniSource Energy Services just proposed a doubling of its basic service charge to $20 a month and requiring new solar users to pay a monthly fee based on their peak demand use.

Unfortunately, instead of seeking to penalize these customers, utilities should be drafting plans to take advantage of the opportunities presented by these early adopters (and those that are almost certain to follow in their wake). This point was made strongly by RMI, which noted that while customer-sited facilities will certainly lead to load losses for utilities, those same “grid-connected solar-plus-battery systems can potentially provide benefits, services, and values back to the grid, especially if those value flows are monetized with new rate structures, business models, and regulatory frameworks.”

The industry’s past and future crossed paths last month—unfortunately, many utilities are still going in the wrong direction.

–Dennis Wamsted

Follow

Follow

One thought on “The Solar Scenario:

Utilities Can Profit

By Embracing The Future”