There was a news nugget in the American Wind Energy Association’s latest market report (released last week, the executive summary can be found here) that should be required reading for electric utility executives everywhere: Non-utility purchasers (that is, corporate and institutional customers) signed power purchase agreements (PPAs) for more than 1,300 megawatts of windpower in the fourth quarter of 2015—accounting for roughly 75 percent of the total.

Translation: Corporate America is going green and if you don’t give them what they want, they are going to get it on their own.

This transition has been under way for some time—Whole Foods, for example, said it planned to go all-in for windpower in 2006 and Walmart signed its first major windpower deal in 2008—but it wasn’t until 2013 that the change really began to take hold. Since then, it has been an entirely different story, almost an overnight transition from “meh” to “let’s do this.” According to data from RMI’s Business Renewables Center, corporate buyers signed power purchase agreements for more than three gigawatts of new wind and solar power in 2015, two and a half times the 1.2 GW of green power purchased in 2014. And this is just the beginning, says Hervé Touati, head of the BRC. “Despite this incredible success, less than 20 corporations have been active in this space since its inception. This is just a start….”

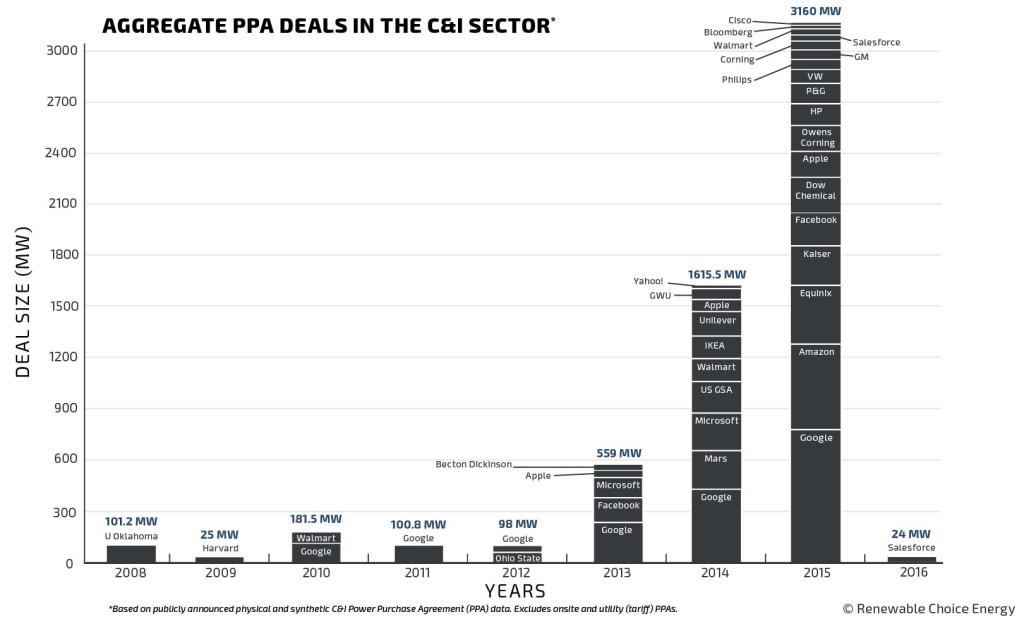

The chart below, from Boulder, Colo.-based Renewable Choice Energy, has slightly different numbers, but the graphic representation of the growth in corporate America’s interest in green energy is impressive. It also underscores Touati’s point above, that this is just the beginning.

Of particular interest, Touati said, is that companies outside the information and communications technology (ICT) sector now are beginning to look for their own green power options. For example, Corning Inc. said in December that it had signed a contract to purchase about 50 MW of capacity from a solar farm in North Carolina.

“Corning now belongs among a select group of companies that have taken action on renewable procurement through long-term contracts,” said Touati. “Beyond pioneers from the ICT sector, we are seeing…large corporations such as Corning—coming from a variety of industrial and services sectors—entering the market for the first time as fast followers. It is a strong indication that long-term renewable energy contracts are becoming increasingly relevant to all Fortune 500 companies, and will soon become the standard way of running business.”

Procter & Gamble (P&G) offers another example of the growing interest in green energy options outside the ICT sector. The company signed a contract last October with EDF Renewable Energy to buy the output from a new Texas wind farm to meet 100 percent of the electricity needs of its fabric and home care brands, such as Tide, Cascade, Mr. Clean and Dawn.

P&G’s recent contract isn’t likely to be a one-shot deal either, as the corporation has signed on to the Obama administration’s business climate pledge—agreeing to use 30 percent renewable energy in its operations by 2020, with a long-term goal of moving to 100 percent. While a moving total, P&G is one of more than 150 companies that have signed the pledge to date, and while each corporation’s goals are unique, the trend is clear: Renewable energy is going to get a huge boost as these firms implement their pledges.

While overnight transitions are difficult, electric utility executives have begun to respond, as evidenced by Duke’s first-of-its-kind contract late last year to supply Google with 61 MW of solar power through its green source rider program. The beauty of the program is that Google gets the green power it wants, Duke gets to keep a major customer, and the utility’s other customers don’t have to pay anything extra.

“Google was a driver behind Duke Energy seeking approval for the Green Source Rider,” Rob Caldwell, senior vice president of Duke’s distributed energy resources business unit, said in announcing the contract. “Having Google as the first company to publicly announce its participation is extremely satisfying. We believe this will lead to similar announcements in the future.”

Ten other states have programs similar to Duke’s North Carolina green option on the books, but clearly this is an option that needs to be universally available.

Corporations across the board are considering green power to meet internal sustainability goals—such as Google, which has pledged to move to 100 percent renewable energy for its operations—and because of renewables’ increasingly competitive economics—here Walmart is a great example since it has moved strongly into renewable energy while still making sure its projects “make good business sense” as one executive said last year. With the recent extension of both the production tax credit and the investment tax credit, the economics are only going to become more favorable, and more and more projects are going to make good business sense.

John Powers, vice president of business development at Renewable Choice Energy, echoed those themes in AWEA’s press release last week citing the strong 2015 results. “2015 saw unprecedented adoption of long-term renewable energy from corporate, industrial and institutional customers in the US,” Powers said, “This growth was triggered by the compelling economics in certain grid regions alongside a growing understanding in the developer community of how to meet the unique needs of the corporate buyer. With the extension of the PTC and ITC, we anticipate that this sector will continue its rapid growth; it really is the new market for renewable energy.”

In other words, the utility industry has a choice: Offer its customers what they want—competitively priced solar and wind power—or watch as those customers contract for it on their own.

–Dennis Wamsted

Follow

Follow