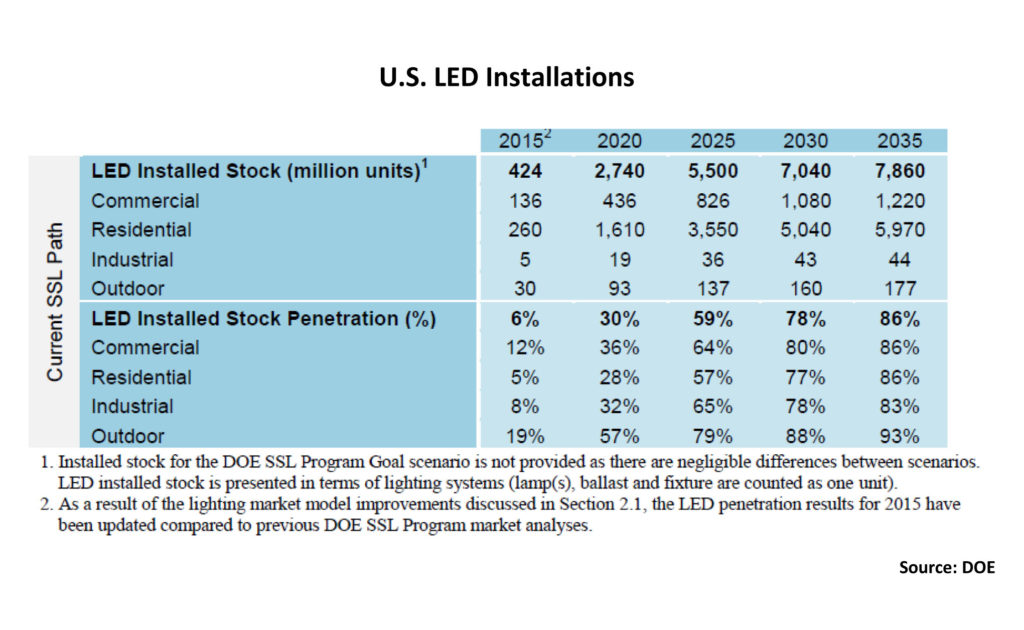

The LED revolution is in full swing: DOE’s latest market data show that the number of installed light emitting diodes almost doubled in just a year, climbing from 215 million at the end of 2014 to 424 million by the end of 2015, while cutting energy consumption by 280 trillion British thermal units (compared to 143 trillion Btu a year ago). This is still a relatively small amount—overall the U.S. consumed 97.8 quadrillion Btus in 2015, of which about 5.8 quads were for lighting—but DOE says it “is just the tip of the iceberg.”

That has got to strike terror in the hearts of electric utility executives everywhere. Already starved for growth—overall retail sales of electricity in the U.S. in 2015 totaled just over 3.7 trillion kilowatt-hours (kwh), essentially unchanged from 2007—utilities are now seeing real erosion in lighting-related demand, erosion that could turn into a landslide in the next 5-10 years and beyond.

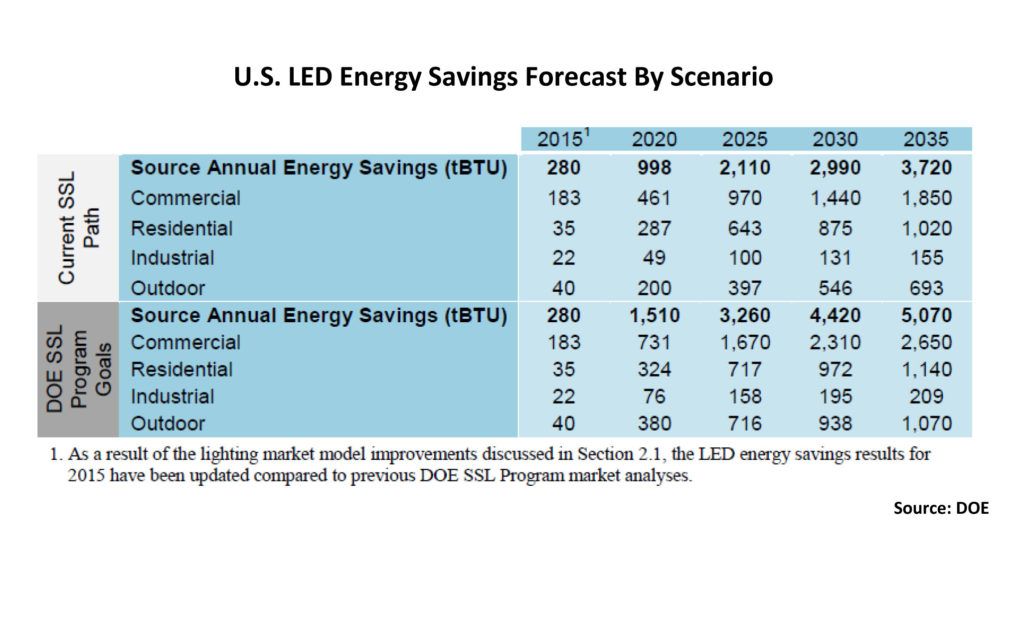

On the residential side, for example, DOE projects in Energy Savings Forecast of Solid-State Lighting for General Illumination Applications (which can be downloaded here) that the number of LEDs installed in homes nationwide will soar in the next five years, from 260 million at the end of 2015 to more than 1.6 billion in 2020 (see installation chart below). This will push energy savings up significantly as well, from 35 trillion Btu in 2015 to an estimated 287 trillion Btu in 2020.

But because the average residential light is only on for about two hours a day, it is the commercial and outdoor lighting sectors, where lights commonly are in use for 10 hours or more daily, where the real savings will be found. On the commercial side, for example, DOE expects that the number of installed LEDs will climb from 136 million in 2015 to 436 million in 2020, pushing the energy savings from 183 trillion Btu to 461 trillion Btu. Similarly, outdoor LED applications (for roadway lighting, parking lots and garages) are expected to jump from 30 million units today to 93 million in 2020, with energy savings soaring from 40 trillion Btu to 200 trillion Btu.

And these figures, DOE notes, just assume current levels of technology adoption. If the department’s price and product performance goals are met and the use of lighting controls, particularly connected versus non-connected LEDs, becomes more common the energy savings will ratchet up further, faster. Under this scenario, total savings in 2020 would top 1,500 trillion Btus (1.5 quads), a 50 percent jump from the business as usual case (see chart below).

Carried out to the end of the forecast period, the savings get even larger as more and more connected LEDs are installed. Allowing for the broad use of individual savings options such as timers, dimmers and motion sensors, as well as the wider adoption of whole building energy management systems, lighting controls are going to transform the industry in the years ahead. All told, DOE forecasts that the widespread use of lighting controls through 2035 (the end of the current forecast, earlier forecasts stopped at 2030) could save more than 2.3 quads of energy annually, with connected LEDs accounting for 1.7 quads of that total.

Carried out to the end of the forecast period, the savings get even larger as more and more connected LEDs are installed. Allowing for the broad use of individual savings options such as timers, dimmers and motion sensors, as well as the wider adoption of whole building energy management systems, lighting controls are going to transform the industry in the years ahead. All told, DOE forecasts that the widespread use of lighting controls through 2035 (the end of the current forecast, earlier forecasts stopped at 2030) could save more than 2.3 quads of energy annually, with connected LEDs accounting for 1.7 quads of that total.

On the pricing front, while this admittedly is just one data point, a recent Home Depot flyer tells me that the industry is well on its way to meeting the price points in DOE’s more aggressive technology adoption scenario. In the flyer, the big box company touted an 8-pack of 60-watt LED replacement A-type bulbs (the screw-in variety that make up the bulk of installed residential lighting) for $12.97—or just $1.63 per bulb. While not dimmable, the bulbs are a perfect replacement option for traditional floor and table lamps, and already beat competing CFL and halogen options and are on par with remaining incandescent options given the LED bulbs much longer operating life. It is also worth noting that when I wrote about last year’s DOE forecast (click here for that story), prices for similar 40 and 60-watt equivalent LEDs were in the $2.50-$3/lamp range, which as I wrote then, were “prices unheard of just a year or so ago.” Clearly the same thing can be said today.

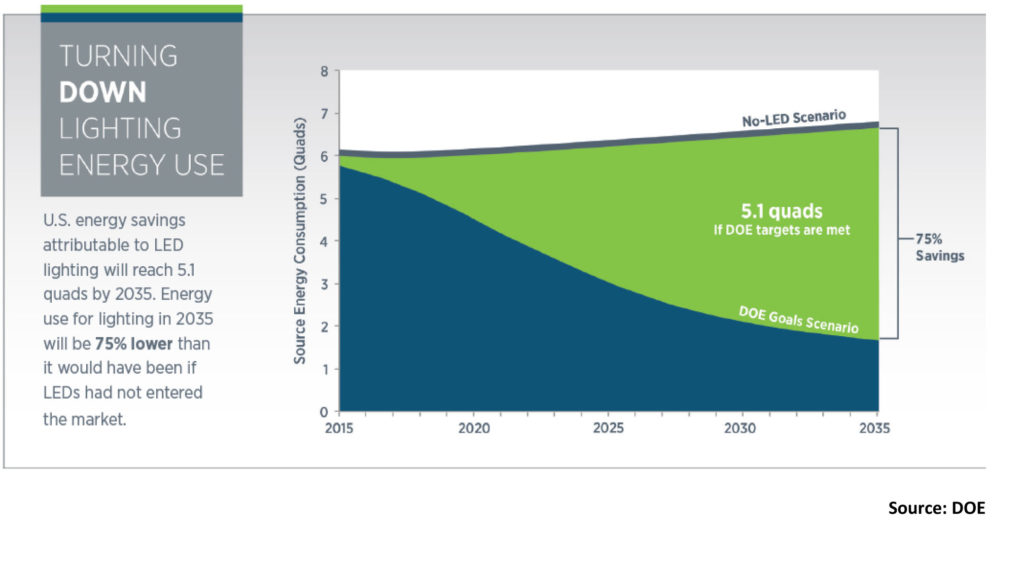

Rolling all the estimates together, the potential savings are spectacular. DOE forecasts that while the number of installed “lighting products” will climb from 6.9 billion today to 8.6 billion in 2035, energy consumption in the lighting market will tumble by at least 3.7 quads per year by 2035, and perhaps by as much as 5.1 quads annually—that is a lot of lost sales for the electric utility industry. Looked at on a cumulative basis, the totals are even scarier (at least from the utility perspective–the green in the graphic below represents lost electric sales). DOE estimates that LEDs will cut energy consumption by a total of 42 quads through 2035 under its business as usual case, and by as much as 62 quads under its quicker technology adoption scenario. Those 20 quads of additional energy savings, DOE says, would be enough to power 90 percent of the homes in the U.S. for one year.

The LED revolution has begun indeed; utilities nationwide are going to have to recalibrate their growth models to account for it since those sales aren’t coming back.

–Dennis Wamsted

Follow

Follow

2 thoughts on “‘Just The Tip

Of The Iceberg’–

DOE LED Update”