The bright shiny package the coal industry unwrapped Christmas morning—the one it hoped was filled with rising and lasting demand for the black rock—is actually little more than a pretty box filled with empty promises delivered by the country’s new cheerleader in chief.

Just 10 years ago, coal was the clear top dog, accounting for just under 50 percent of the electricity generated annually in the U.S. (Coal’s total in 2006 was 48.9 percent, the last year it actually topped the 50 percent level was 2003.) This year, coal is likely to play second fiddle to the surging natural gas sector; the Energy Information Administration’s latest Short Term Energy Outlook (released Dec. 8) estimates that coal will account for 30.4 percent of the nation’s electric generation this year, below the 34.1 percent stake controlled by natural gas. And no amount of industry wishful thinking or presidential conceit is going to change that—the markets have changed.

For starters, according to EIA data, just under 50 gigawatts of coal-fired capacity has been retired since 2010. That capacity (and by extension those markets for coal) is never coming back. And before anyone goes off about what a waste it is that this capacity has been lost, it is worth noting that the average size of these retired units was just over 123 megawatts (hardly an efficient size for a coal-fired plant) and, on average, they were more than 50 years old (meaning, in reality, that it was time to retire them in any case). Economics drove those retirements, just as economics will drive future decisions—a point that has been acknowledged repeatedly by utility executives since the election.

The most direct of these statements came from Gerard Anderson, chairman and CEO of Detroit-based DTE Energy. In an interview with Emily Lawler of mlive.com posted Nov. 25, Anderson said: “All of those retirements [the company has already shut three coal plants and has plans to close another eight in the years ahead] are going to happen regardless of what Trump may or may not do with the Clean Power Plan.” The company is moving toward natural gas and renewables, he concluded: “I don’t know anybody in the country who would build another coal plant.”

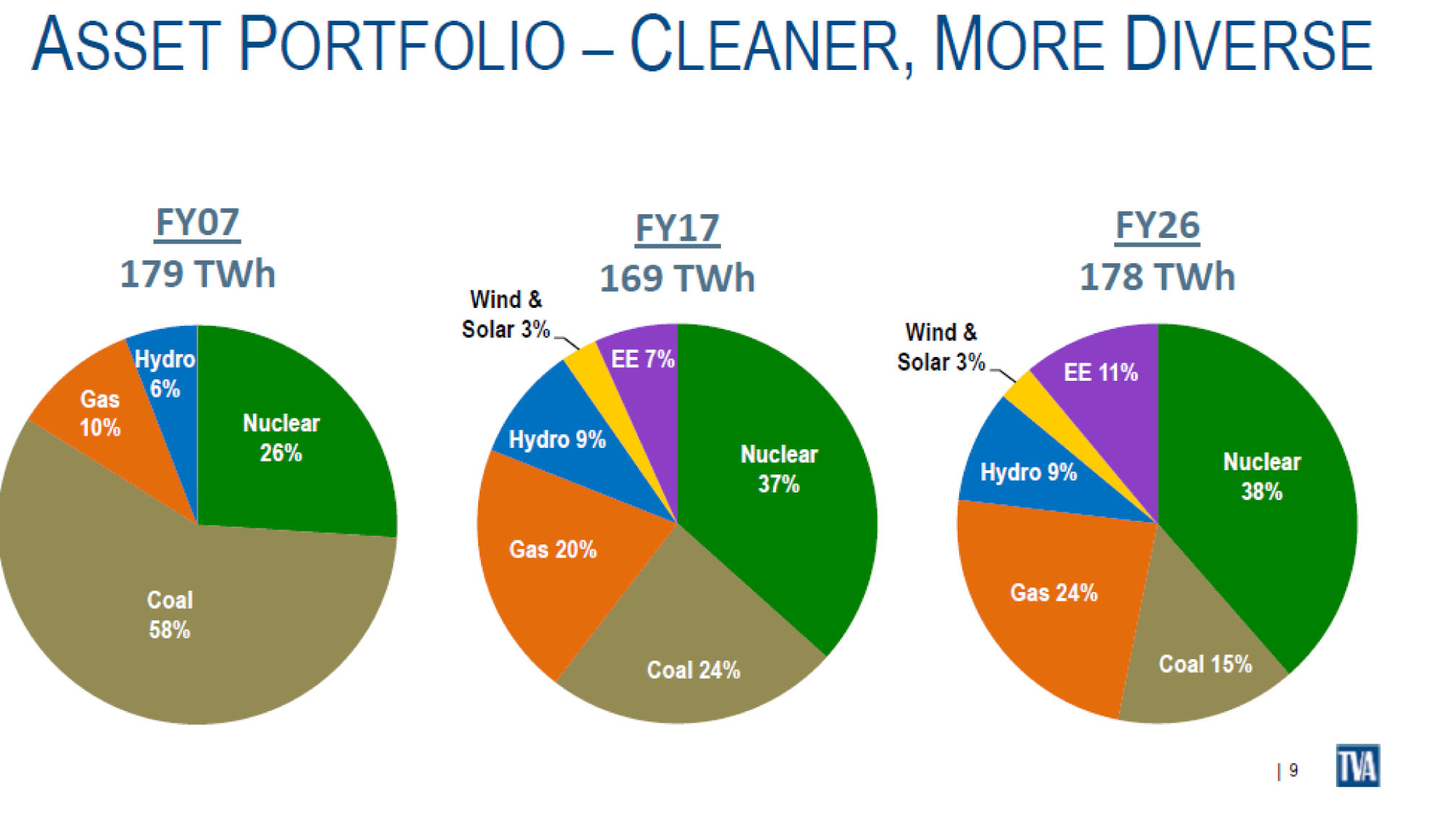

And Anderson is far from alone. Utility industry leaders across the country are moving their companies from heavily coal-dependent portfolios to cleaner, more diverse generation mixes—driven there not just by government regulation, but also by changing economics and strong customer preference for cleaner fuels. Here, the Tennessee Valley Authority is a great example. In its fiscal 2016 earnings conference call (also after the November election), Bill Johnson, TVA’s president and CEO, pointed to the changes at the authority since 2007 (see chart below), changes that already have resulted in a cleaner, more diverse generation portfolio, with more to come.

Another key point in the TVA graphic above concerns the authority’s demand expectations. In 2026 it expects overall electricity demand in its sprawling service territory to total 178 terrawatt-hours—this represents a 5 percent increase from current levels, but is still below the 2007 level of 179 twh. In that kind of slow growth environment, big new coal plants are simply unneeded, and the older, inefficient and dirty units are expendable.

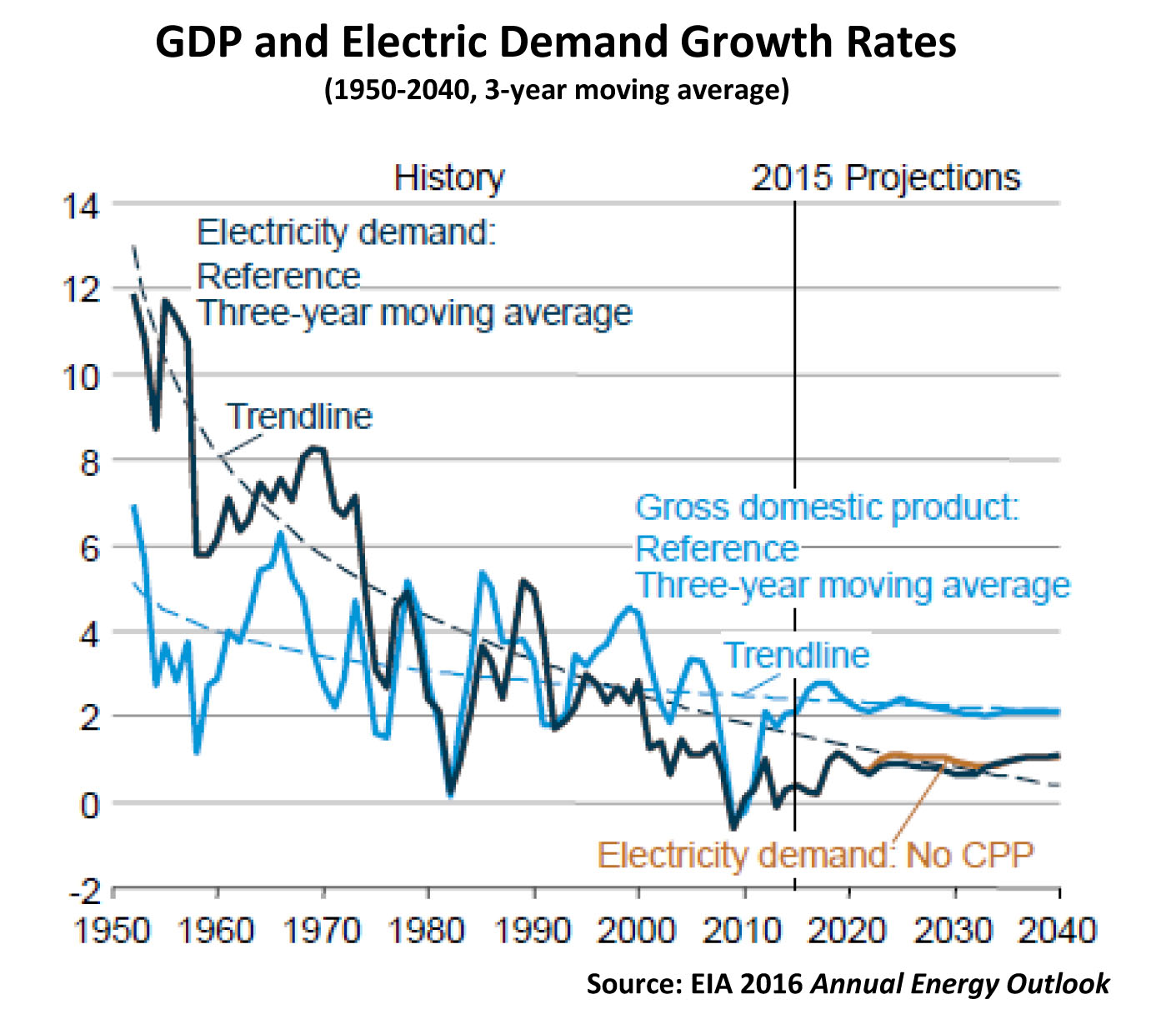

It is important to note that TVA’s experience is not unique; in fact, it is the new national norm. Electricity demand growth is not rising at past rates and most forecasters don’t expect any significant increase in the years ahead (see chart below). In its 2016 Annual Energy Outlook, for example, EIA looked closely at future demand growth, and found it, shall we say, anemic. Through 2040, growth is expected to average roughly 1 percent per year, as demand is offset by energy efficiency measures, government mandated appliance standards and a nationwide transition to a more service-oriented economy. That is hardly an environment requiring the construction of big new power plants.

Environmental regulations clearly have played a role in pushing the utility industry away from coal—here again though, before anyone starts yelling about the alleged war on coal, remember that even with these new tighter standards coal still isn’t as clean as natural gas, and never will be able to compete with nuclear, wind or solar on an emissions basis. And in any case, it is the decade-long transformation in the natural gas industry, driven by fracking and horizontal drilling, that has been the real driver in toppling King Coal.

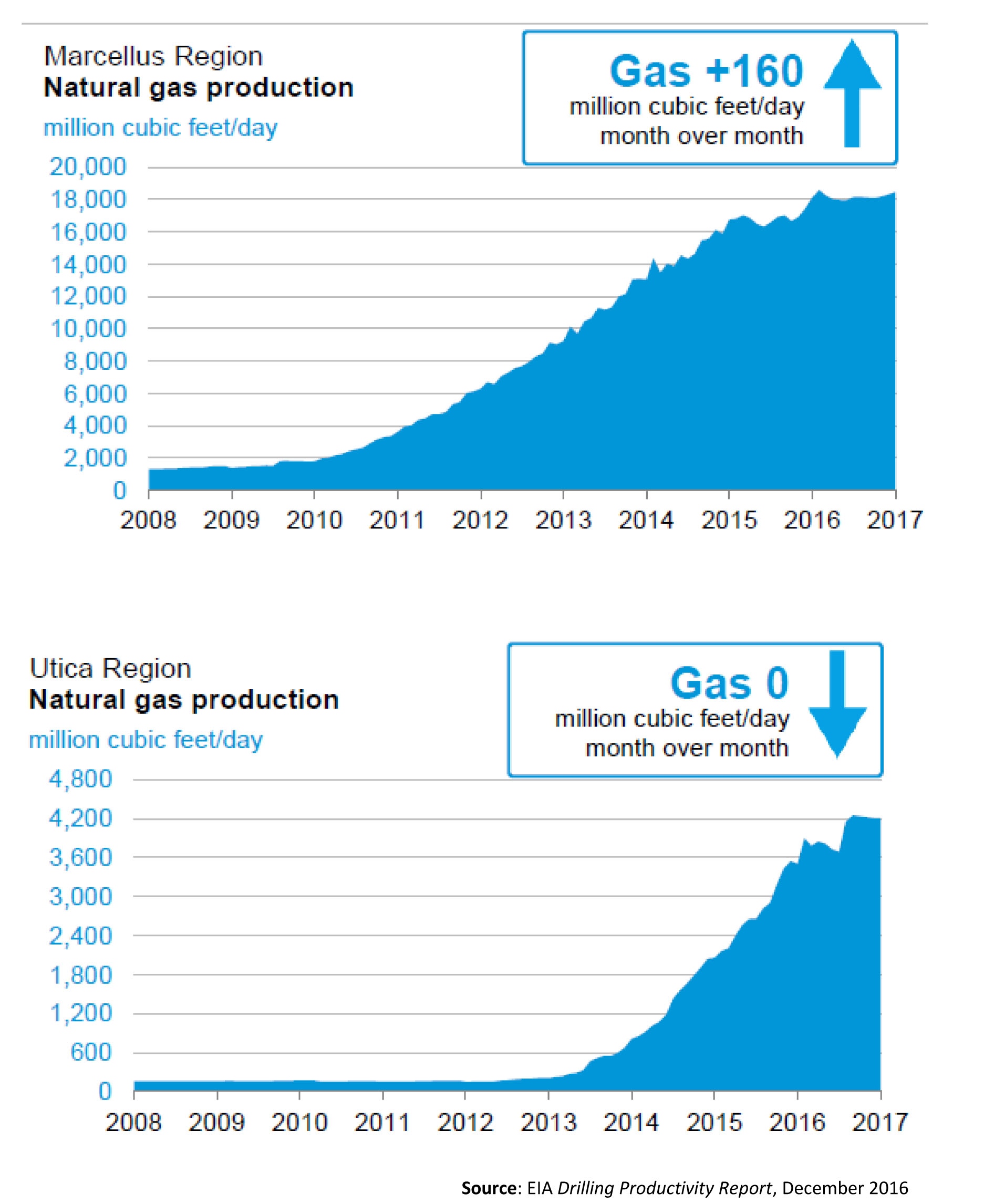

The two charts below tell the whole story. Natural gas production from the Marcellus and Utica shale formations (which sprawl across New York, Pennsylvania, West Virginia and Ohio) now totals roughly 22.2 billion cubic feet per day, up from essentially zero 10 years ago, and accounts for almost 30 percent of daily U.S. output. That production, coupled with technology-driven increases elsewhere, has pushed prices down sharply and held them down—since 2009 annual prices at the Henry Hub trading point have never gone higher than $4.37 per million British thermal units, helping to erase gas’ old premium fuel, premium cost stereotype.

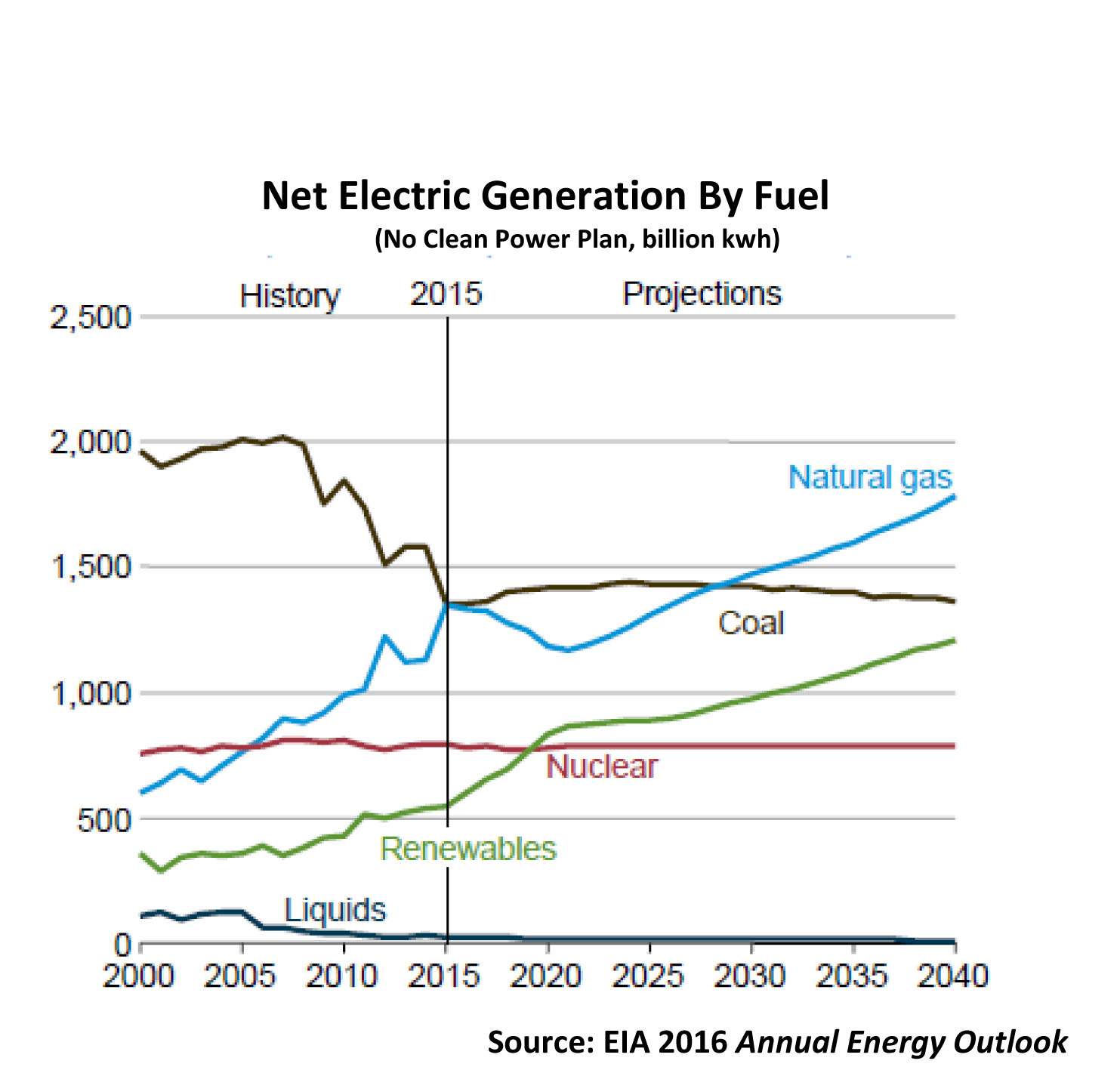

With natural gas supplies plentiful and prices low and stable, coal confronted competition that it found hard to beat—as illustrated in EIA’s annual electric market share statistics, which have shown a slow, steady erosion in coal’s importance since 2008, mirrored by a steady increase in natural gas-fired electric output plus the rapid rise in solar and wind generation.

As with the natural gas transformation, coal is facing strong competition from the renewable industry, particularly wind and solar, that simply didn’t exist a decade ago—here too, the markets have changed and wishful thinking is not going to restore the status quo ante.

Ten years ago, the windpower industry was still a relative newcomer, with 11,450 MW of installed generating capacity. Today that total is more than 75,000 MW, with an additional 13,000+ MW currently under construction and another 6,000+ MW in the advanced stages of development. Wind clearly has arrived, given EIA statistics showing that the industry now generates more than 5 percent of the nation’s electricity. And before anyone starts complaining about the unfairness of the federal production tax and investment tax credits (PTC/ITC), let’s stipulate upfront that every fuel used in the electric generation sector enjoys some form of federal subsidy—which one you choose to highlight depends on which industry you are trying to defend/skewer. For those interested in a good article about the subsidies benefitting the nation’s coal producers, I would encourage you to read this piece.

The transition in the solar industry has been even more dramatic. From essentially zero installed utility-scale generation capacity as late as 2008, the amount of operating capacity jumped to 14 GW by the end of 2015—and that is clearly just the beginning. The latest Solar Market Insight report (prepared quarterly by Greentech Media and the Solar Energy Industries Association) estimates that more than 10 GW of utility-scale generation will come online this year alone (out of a projected national total of 14.1 GW). Importantly, Greentech and SEIA see this growth continuing at least through the end of the decade, projecting that another 20 GW of capacity will come online by 2020. [The executive summary and information about the full report can be found here.]

The growth in the wind and solar industries over the past decade underscores another reason why coal’s dethroning represents the new status quo and not a temporary turn of events—jobs. The incoming president spent much of the campaign harping on the need to protect and promote American jobs, and here solar and wind put the coal industry to shame. According to the latest solar census by the Solar Foundation, a nonprofit research entity affiliated with SEIA, there were more than 200,000 solar industry jobs at the end of 2015, 150,000 of which were in the installation and manufacturing sectors—the same blue-collar jobs so prized by the new administration. Data from the federal Bureau of Labor Statistics indicate that there were an estimated 32,840 jobs in the construction and extraction sectors of the coal industry at the end of 2015. (Overall, BLS put the number of coal mining jobs at just under 70,000.) While not quite the job-producer that solar is, wind industry jobs still easily outnumber those available in the coal sector: According to statistics from the American Wind Energy Association there were 21,000 wind-related manufacturing jobs at the beginning of 2016 and 38,000 project development and construction jobs. All told, AWEA said, the industry accounts for some 88,000 jobs.

Another key factor to keep in mind is where those solar and, in particular, wind jobs are located. Earlier this year, AWEA released data showing that 86 percent of all the wind generating capacity in the United States is located in congressional districts represented by Republicans. In other words, even if the new administration isn’t wind’s biggest fan, the industry is likely to have strong congressional support in the years to come.

Finally, and totally out of the purview of the incoming fossil-friendly administration, is the strong push in the corporate world to green their energy portfolios. This transition has gained a great deal of traction, particularly as corporations have learned that not only is it good public relations, but perhaps more importantly in the current context it also is good business—it saves them money. And last time I checked, that was an overriding imperative for most corporate executives. Earlier this year, General Motors announced its commitment to secure 100 percent of its energy needs from renewable energy by 2050. Admittedly, this is a long way off, but it sets the tone for future corporate energy decisions. GM is clearly doing this in part for the PR benefit, but the reality is the company also expects the move to save money; already the company said its renewable efforts were saving the manufacturer some $5 million annually.

And GM is far from alone in its green energy goals. Back in May, for example, 60 major U.S. firms—including GM as well as Facebook, Google, Microsoft and Walmart among others—announced the formation of the Renewable Energy Buyers Alliance, whose goal is to develop 60 GW of new renewable energy resources by 2025.

Put it all together and it is clear that no amount of cheerleading (or Twitter bullying) is going to reverse the massive market transitions of the past decade. The chart below does a good job of capturing the issues facing the coal industry—even without the Trump tarred-and-feathered Clean Power Plan, growth and coal are not likely to be seen in the same sentence in the future.

It can be hard to capture the scope of these changes, because they have occurred so quickly and in so many different areas, but Minnesota state Rep. Pat Garofalo, a Republican who chairs the House energy committee (technically the House Job Growth and Energy Affordability Policy & Finance Committee) nailed the transition in an article written by Sam Brodey of the Minnesota Post. In that article, Garofalo, speaking specifically about the affordability, efficiency and availability of natural gas and windpower, said: “This is kind of like DVDs versus VHS. It’s just happening. Nothing you can do to stop that.”

Truer words were never spoken. Coal may have a new cheerleader in chief, but its problems remain.

–Dennis Wamsted

Follow

Follow

2 thoughts on “New Cheerleader In Chief Can’t Change Coal’s Fall, Rise In Gas, Renewables”