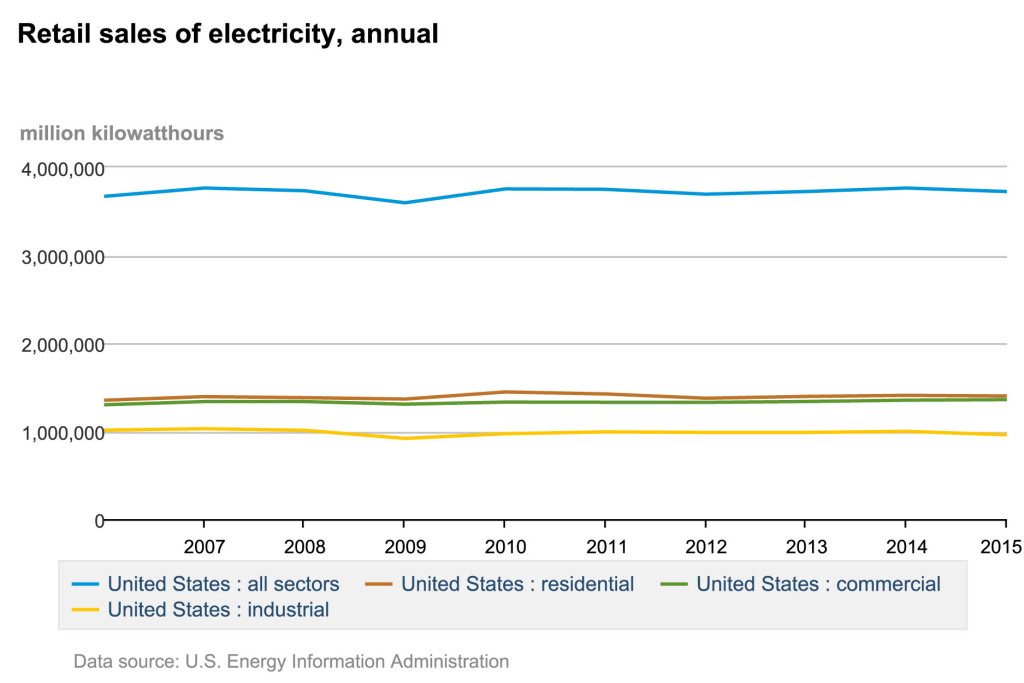

If you just glance at the chart below you will dismiss it out of hand—boring, you’ll yell, why are you wasting my time with that graphic, you’ll ask. But take a second, closer look and you’ll see that this graphic tells a compelling story, that of the collapse of the electric utility business model.

Retail sales of electricity in the United States have flat-lined for the past decade: In 2006 total retail sales were 3,669,919 million kilowatt-hours (kwh), in 2015 they were 3,724,525 million kwh. Do the math, that’s an increase of just 54,606 million kwh—or less than 1.5 percent total in 10 years.

And it’s not like one sector acted as a major drag on growth, they all essentially flat-lined, as the chart so clearly indicates. For the number-addicted out there the specifics (the numbers don’t add up exactly because of the exclusion of a small amount of transportation-related electricity consumption) are:

- Residential sales climbed 48,364 million kwh during the decade, a rise of 0.35 percent per year;

- Commercial sales rose 58,675 million kwh during the period, a 0.45 percent annual increase; and

- Industrial sales fell 52,735 million kwh during the 10 years, a 0.52 percent annual decline.

In essence, sales are treading water. If this were a hospital, the doctors might be saying it’s time to take the patient off life support.

Interestingly, while the industrial sector’s sales are down, the number of customers is up. Doing more with less; sounds like an efficiency commercial to me. EIA’s customer data only goes back to 2008, so the sales numbers are slightly different, but since 2008 industrial sector sales are down slightly more than 5 percent while the number of customers is up 4.9 percent. And lest anyway dismiss the rise in customer numbers as nothing more than a relic of the 2008-2009 recession, it is worth noting that the number of industrial customers actually hit its low point in 2011, well after the recovery was under way. If you use the 2011 bottom, the number of industrial customers has jumped almost 85,000 in five years (an 11.65 percent increase) while electricity sales to the sector have fallen 32,753 million kwh, or 3.4 percent, during the same period.

A smaller, but still measurable split is apparent in residential sales—despite the increasing electrification of households nationwide. Since 2008, the number of residential customers has climbed by 4.78 million (a 3.8 percent increase) while sales have risen by only 1.4 percent. That increase, slightly more than 19,000 million kwh, is essentially nothing when looked at on a per customer basis. Assuming my math is right, 19,000 million kwh is 19 billion kwh. Divide 19 billion by the number of residential customers in 2008 (125,037,870) and you get 152 kwh per customer—or roughly an additional 12.6 kwh/customer/month. That, in turn, is the same as each customer leaving one 60 watt light bulb on for seven hours a day every day of the month. In other words, not much.

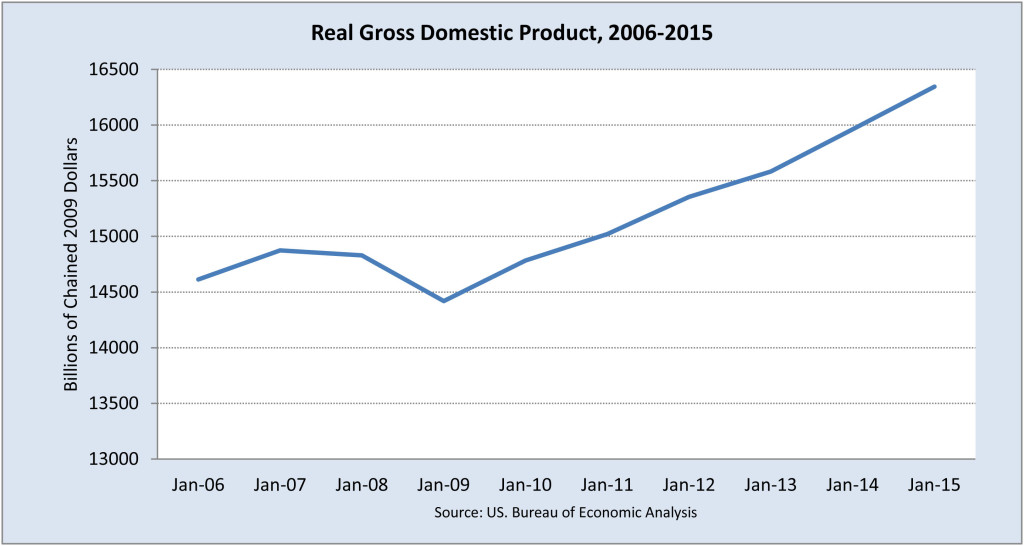

While utility sales have stagnated, the U.S. economy has moved ahead smartly (see chart below). If you start in 2006 as above, U.S. gross domestic product has climbed 11.84 percent in the past 10 years. It’s not an overwhelming increase, pulled down by the 2008-2009 recession, but it dwarfs the increase in electricity sales: Annual GDP growth, at just under 1.2 percent, almost matches the total increase in electricity sales, which climbed less than 1.5 percent over the entire 10-year period. It seems clear that the linkage between economic growth and electricity sales—they moved almost in lockstep between 1975 and 1995—has been broken.

The split between the two measures is even more pronounced if you start in 2009, at the low point in electricity sales and GDP caused by the Great Recession. Since then, electricity sales have climbed 3.5 percent, or about 0.5 percent annually. In contrast, GDP has risen 13.36 percent, or just under 2 percent annually. Clearly, two measures’ links are tenuous, at best.

Interestingly, in three years since the end of the recession (2011, 2012 and 2015), electricity sales actually have fallen from the prior year’s levels. In contrast, GDP has risen steadily since 2009. The collapse of the linkage between electricity sales and economic growth is bad news for many electric utilities, which still by and large make their money by putting steel in the ground. Slow or no growth in electricity demand translates into less need for new generation, and with less steel going into the ground a utility’s rate base grows slower, or not at all, cutting into profit potential.

But there are other options.

For example, the Northwest Power and Conservation Council’s latest regional plan estimates that industrial output in the four-state area (which includes Washington, Oregon, Idaho and Montana) will rise 36 percent over the next 20 years, climbing from $125 billion to $170 billion. However, because of the region’s long-running emphasis on energy efficiency—efficiency is treated as a resource in NPCC’s planning efforts, putting it on an equal footing with new generation—NPCC estimates that this growth can be achieved without building any new generating capacity, which currently stands at 20,000 average megawatts.

In announcing the plan, council chair Henry Lorenzen said: “By investing in energy efficiency at the levels recommended in the plan, we’ll be able to grow our economy without initiating an aggressive program to build new generating resources, and we’ll keep Northwest electricity rates low and maintain our quality of life.”

And that quality of life clearly remains high, as population growth in the four-state area continues to outpace growth in the U.S. as a whole.

This type of out-of-box thinking (well, it’s actually old-hat thinking in the Northwest, where efficiency efforts have kept annual energy growth at less than 0.5 percent since 1995) is going to be essential for utilities looking to prosper in the years to come.

–Dennis Wamsted

Follow

Follow

Dennis, your pro-renewables perspective is appreciated, but first: you conveniently chopped off data from pre-2006 which shows total retail sales 10% higher since 2001, with residential 17% higher and commercial 26% higher.

Second, your thesis that “economic growth and electricity sales are no longer linked” is one not shared by the people who went to all the trouble to gather the data in your graph (EIA):

“Although efficiency policies have primarily focused on electricity use in the residential and commercial sectors, the slowing of electricity sales growth over the past decade is dominated by declining electricity sales to industry, which mainly reflect economic factors.”

http://www.eia.gov/todayinenergy/detail.cfm?id=25352

Efficiently outsourcing electricity – and emissions – to China may bode well for American generation at first glance, but it’s not an optimal strategy for addressing climate change. Is it?