The Energy Information Administration’s Annual Energy Outlook is always chock full of interesting data, and the 2017 version, released uncommonly early last week, is certainly no exception. For its part, EIA highlighted the prospect of the U.S. becoming a net energy exporter in the near future, a far cry from the import-dependent years that drove policymakers crazy in the late 1900s and early 2000s. But from my perspective, the key takeaways can be found in EIA’s analysis of electric sector market shares in a reference case including the outgoing Obama administration’s climate change-fighting Clean Power Plan and a second case assuming the CPP is withdrawn, as the incoming president and his team have said they intend to do.

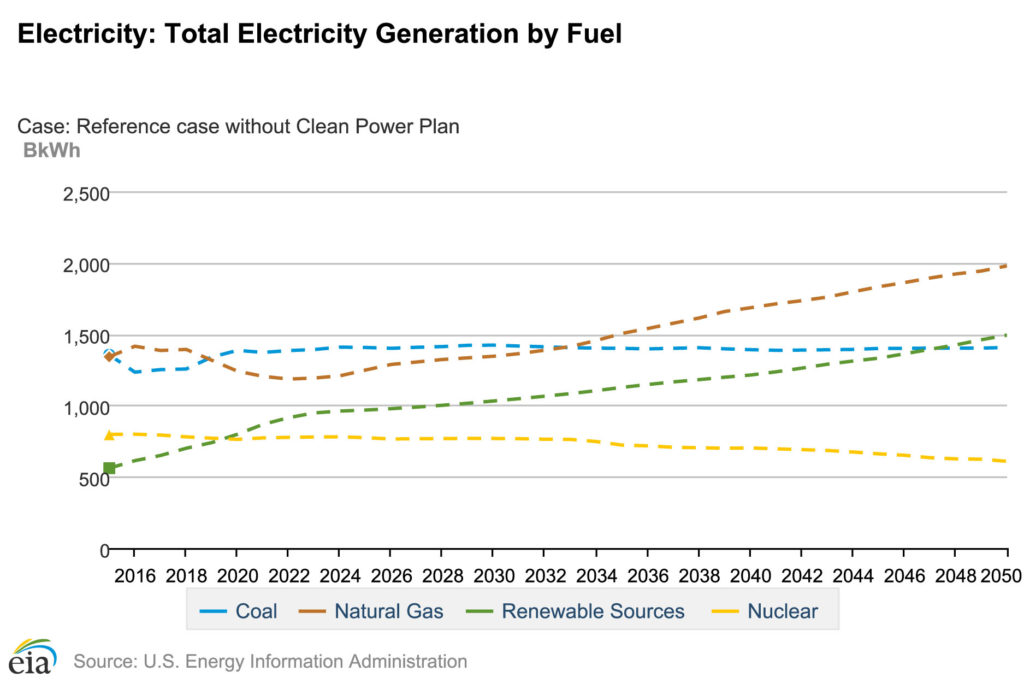

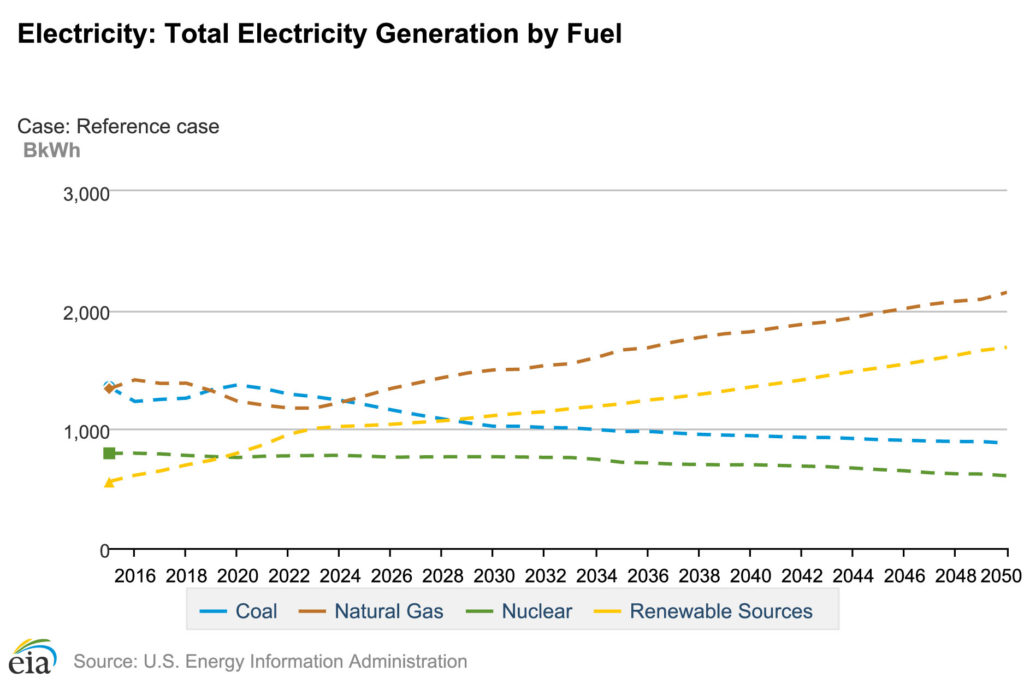

For starters, regardless of its assumptions, EIA sees no growth going forward for the nuclear power industry. In both its reference case, which incorporates the CPP and should, as a result, favor the construction of non-carbon emitting generation resources, and its no-CPP case, EIA comes up with the same results. Nuclear generation is expected to decline slowly from now through 2040—falling from 797 billion kilowatt-hours in 2016 to 701 billion kwh in 2040 as units are retired (either due to economic or age-related reasons) and no new reactors (save the four currently under construction in Georgia and South Carolina) are brought online. [Charts showing the generation outlook in both cases are included below; the complete EIA Outlook can be found here.]

In contrast, EIA’s assessment of the renewable sector shows strong growth in both the CPP and no-CPP scenarios, indicating that the ongoing electric industry transition is likely to continue. From its starting point of 612 billion kwh in 2016, renewable generation is expected to climb to 1,354 billion kwh in the CPP forecast and 1,212 billion kwh in the supposedly less favorable no-CPP outlook. Clearly, the Clean Power Plan is not central to the renewable sector’s future growth. On a side note, EIA expects renewables to pass nuclear in 2020 in both scenarios for the third spot In the nation’s electric generation hierarchy behind coal and natural gas.

The third major finding in EIA’s analysis is that withdrawing the CPP is not going to lead to a resurgence in coal generation. To be sure, keeping the plan in place will hammer coal, pushing generation down from 2016’s already low total of 1,232 billion kwh to just 945 billion kwh in 2040. But withdrawing the plan really isn’t going to help the industry at all, with EIA seeing coal-based output bouncing around from its current level back to above 1,400 billion kwh in the 2020s and early 2030s before then falling to a projected 1,390 billion kwh in 2040. This slightly higher output, which almost certainly will be due to higher utilization rates at existing plants and not new construction, would still represent a decline in coal’s share of the electric generation market: By 2040 in this scenario, coal would account for an estimated 27.8 percent of annual electric generation, down from 2016’s already low level of 30.3 percent.

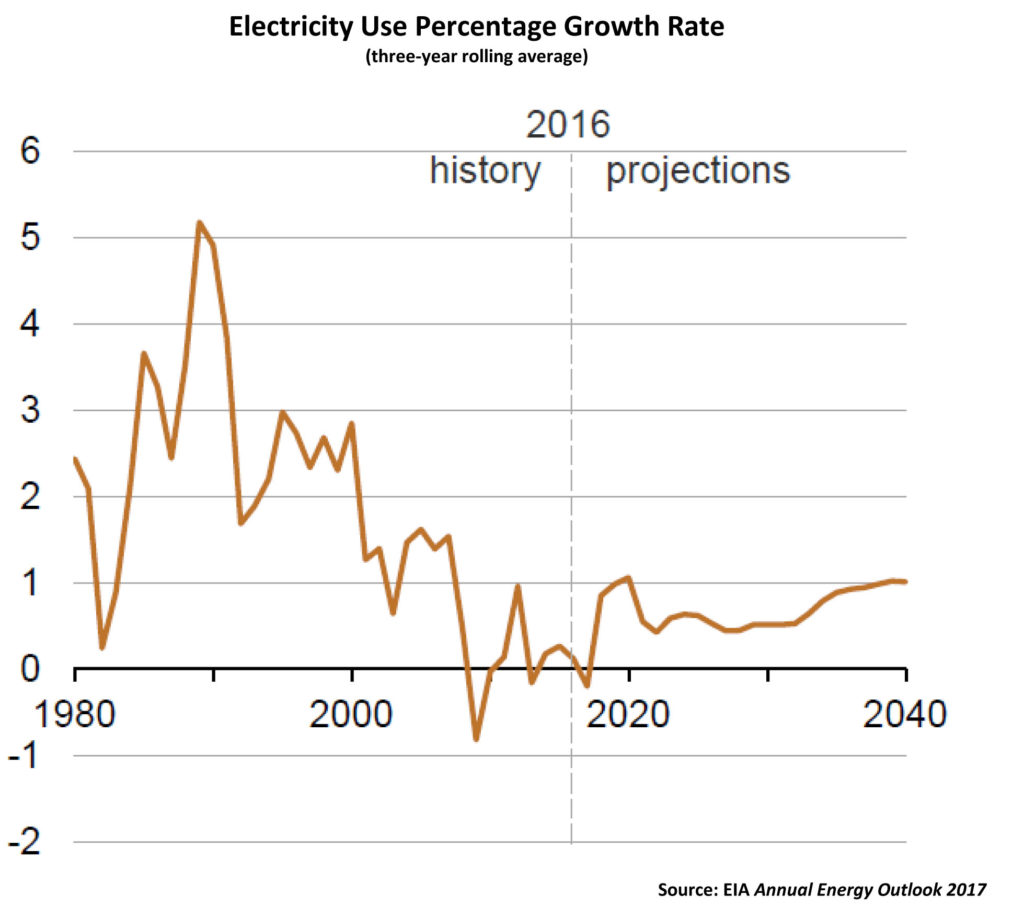

As in recent analyses, EIA expects long-term growth in electricity use to be, in my word not theirs, anemic. Growth has been trending downward for years–the three-year rolling average hasn’t been above 2 percent nationally since 2000–and the outlook going forward is for more of the same. Through 2040, EIA projects that total electric sales will only climb by an estimated .7 percent per year; hardly a figure worth cheering about if you are an electric utility executive.

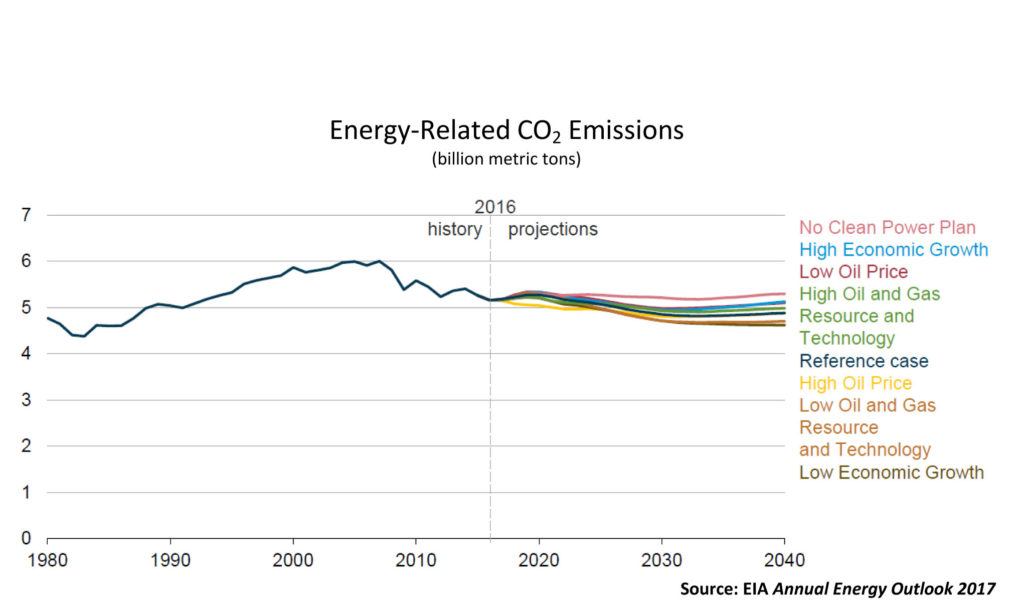

The agency’s outlook also shows that in almost all the scenarios it studied (in all, EIA examined eight cases) carbon dioxide emissions are going to decline or at least flat line in the years to come. Even in the no-CPP case, emissions are projected to remain well below the peak levels set in the 2000s.

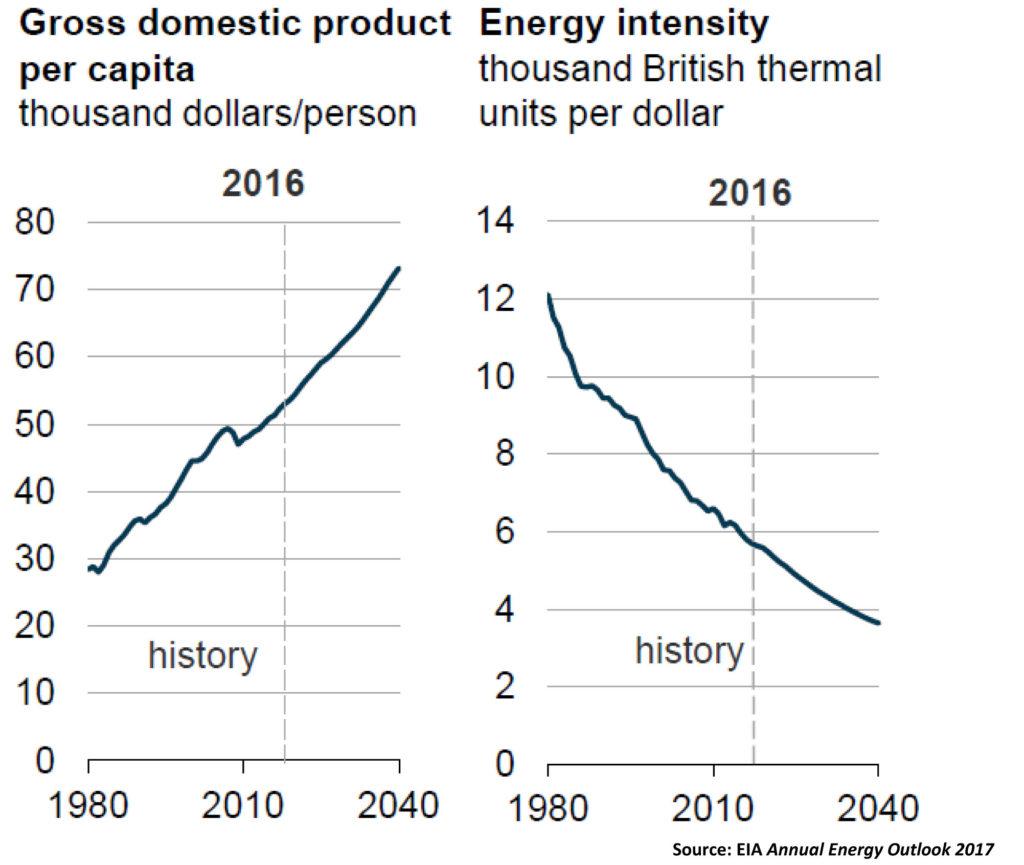

The projections concerning both future CO2 emissions and electricity demand growth underscore the larger changes under way in the U.S. economy, which EIA expects to chug along at a steady 2.2 percent growth rate through the forecast period. Appliance efficiency standards, higher vehicle gas mileage standards (EIA expects transportation energy use to peak in 2018), the LED revolution and the general transition to a more service-oriented economy are changing the status quo, enabling steady economic growth without a commensurate increase in energy demand and its related emissions.

Take it all together, and the real takeaway is that large industry-wide changes are going to trump any policy pronouncements coming out of Washington designed to restore the status quo ante.

–Dennis Wamsted

Follow

Follow