I was at Home Depot this weekend (so many tools, so little time) and they had a special on LED lights that caught my attention—a four pack of dimmable 60-watt replacement LEDs was selling for $9.88, or just under $2.50 a bulb. I’m not the type to track day-to-day pricing for much of anything, but the display caught my attention because I had just finished reading the Energy Department’s latest report on the status of the LED market—which found that the typical dimmable 60W replacement bulb in 2016 cost roughly $8 apiece.

This is important for two reasons. First, DOE assumes that LEDs are steadily going to account for an ever-larger percentage of the installed lighting stock in the United States, estimating that by 2035 86 percent of all the lighting in the country will be LEDs of one type or another and that these vastly more efficient lights will cut primary energy use by 3.7 quadrillion British thermal units (Btus)—that’s a lot of electricity that will no longer be needed, about 10 percent from the 2016 level, in fact, when roughly 37.5 quads were used to generate electricity in the U.S. (Paying attention out there in utility land?) But those DOE forecasts rely heavily on pricing assumptions, and if the current price of the most commonly used LED has already tumbled below $2.50, down roughly 70 percent from just a year ago, that means the nationwide take-up of LEDs almost certainly will be faster than DOE currently estimates.

Second, the sharply declining price of this lowly light bulb is a symbol of the massive changes under way in the energy industry, such as the steep declines in solar and windpower costs, the surge in corporate interest in cleaner energy and the plateauing of electricity demand. These changes are largely market-driven and, thankfully from my perspective, outside the reach of politicians on either side of the aisle.

The DOE report, Adoption of Light-Emitting Diodes in Common Lighting Applications, is dated July 2017, but I don’t think it was posted then and I certainly don’t think the department has said much, if anything, about it. (It’s probably not good form in the current regime to tout the success of DOE funding in helping to cut energy use, but I digress.) For those interested, it can be found here.

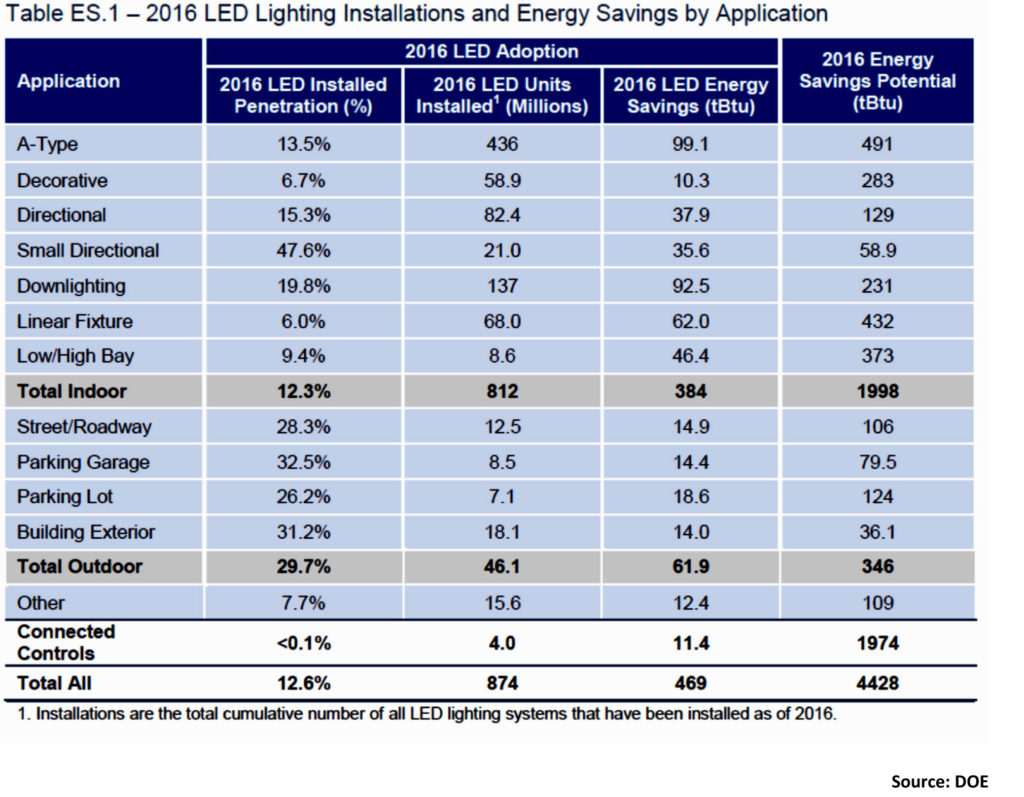

Overall, the report estimates that the number of installed LED products nationwide quadrupled from 2014 to 2016, rising from 215 million units to some 874 million. That amounts to 12.6 percent of all installed lighting, DOE said, and those more efficient lights saved an estimated 469 trillion Btus in 2016 alone–way up from the 143 trillion Btus saved in 2014.

By far the largest market segment is the screw-in A-type, which is the light most commonly used by American homeowners. Overall, an estimated 436 million of these LED bulbs had been installed by the end of 2016, almost half of the national total. Despite that, A-type LEDs still only account for 13.5 percent of this sector, meaning there is plenty of room for growth. And there is little doubt that this growth is continuing. In sales figures released last month covering the first half of the year, the National Electrical Manufacturers Association reported that A-type LED sales have been well above 25 percent of the overall market for the last four quarters.

By far the largest market segment is the screw-in A-type, which is the light most commonly used by American homeowners. Overall, an estimated 436 million of these LED bulbs had been installed by the end of 2016, almost half of the national total. Despite that, A-type LEDs still only account for 13.5 percent of this sector, meaning there is plenty of room for growth. And there is little doubt that this growth is continuing. In sales figures released last month covering the first half of the year, the National Electrical Manufacturers Association reported that A-type LED sales have been well above 25 percent of the overall market for the last four quarters.

Elsewhere, the DOE report underscores the importance going forward of the linear and the low/high bay market segments (these are the lights typically found in office buildings and big box stores, respectively), which currently are dominated by relatively cheap, relatively efficient fluorescent lighting. These two segments are much smaller in number than the A-type sector (there are an estimated 91 million low/high bay units, for example, compared to more than three billion A-type fixtures), but because they are used for commercial and industrial applications and are on for far more hours per day than the two per fixture that is the norm for households, there is much more opportunity for future savings from LED conversion. In 2016, for example, the roughly 8.6 million low and high bay LED installations saved an estimated 46.4 trillion Btus; in contrast, the 436 million A-type bulbs saved 99.1 trillion Btus.

Beyond the savings from more efficient LEDs, DOE added, these two market sectors could benefit enormously from the addition of controls to operate the lighting, essentially systems to make sure 60-floor skyscrapers don’t stay lit all night because the cleaning crew forgot to turn off the lights. According to DOE, if all the linear fixtures in the U.S. were converted to LEDs overnight, that would save an estimated 432 trillion Btus annually. But if those converted LEDs were then hooked up to control systems, that could save an additional 967 trillion Btus a year—clearly a real market in the making.

Here too, NEMA sales figures show strong growth, with first-half 2017 results for linear LED fixtures topping 21 percent of the market, a sharp increase from the prior quarter and light years above the barely readable 1-2 percent market share of just two years ago. It is also noteworthy since DOE’s report estimated that linear LEDs accounted for just 6 percent of the market overall in 2016—growth is clearly on the way.

Growth is also clearly on the way in the renewables sector, particularly in the corporate drive for ever-cleaner electricity supplies. The latest deal tracker (see chart below) from RMI’s Business Renewables Center tells the story—the corporate world is intensely interested in boosting its usage of wind and solar

Two things are notable about the expanding corporate renewables drive. First, it is not just the business titans that are jumping into the game, increasingly it is small- to medium-size firms as well. Second, and equally important, these corporations aren’t just signing these deals for a good play on the daily news cycle, they make economic sense.

On this second point, Kimberley-Clark’s September announcement that it planned to buy 245 MW of wind capacity from two projects (one in Texas, the other in Oklahoma) to help cover about 33 percent of the electricity used in its North American manufacturing facilities is illustrative. The projects, said Lisa Morden, head of sustainability at Kimberly-Clark, will provide “significant multimillion-dollar costs savings from energy….by 2022.”

And you don’t have to be big to benefit from these deals. Last month, Akamai Technologies, a mid-sized server company, signed a deal with Infinity Renewables for just a 7 MW slice of a new 80 MW wind farm the developer is building in Texas. That helped Akamai meet its environmental goals, but it also was able to secure cost-effective electricity since it bought into a larger project. As Matt Langley, Infinity’s vice president of finance and origination, explained: “A 7 MW project would not have been economically viable. If we had to build a 7 MW wind farm, we would charge a very high price for that energy. When we build an 80 MW project, we can offer its buyers the same price that Facebook or Walmart would get.”

Prices do matter, and they have been falling steadily in both the wind and solar sectors. The current administration is clearly no fan of either resource, and there is the distinct possibility that it may impose tariffs of some form or another on imported (mainly Chinese) solar photovoltaic modules to try to aid two troubled domestic PV manufacturers, but the damage has been done. Those companies can’t repeal the laws of economics—the only thing tariffs would accomplish would be to take money out of the pockets of consumers and give it those floundering companies. (Sort of like the pending tax reform bill, but I digress, again.) Solar PV prices may flatten for a bit, installations may slow (especially for price sensitive utility-scale projects), but this would amount to little more than closing the door after everyone had left.

Similarly, on windpower, tax writers in the House of Representatives are considering lowering the production tax credit (again as part of the consumer-funded corporate tax relief bill floating around Capitol Hill) even though it is already scheduled to phase out in a couple of years. Like solar, this might hurt, a bit, in the short run, but with 84,944 MW of installed capacity and another 13,759 MW under construction (plus yet another 15,875 MW in ‘advanced development,’ according to the American Wind Energy Association), the industry isn’t going anywhere.

Sometimes the day-to-day battles, and even temporary setbacks, can obscure larger, broader developments. That is certainly the case in the electricity business: A transformation is under way that is reshaping the industry, and there isn’t anything that is going to stop it.

–Dennis Wamsted

Follow

Follow

Ok, i love the way that you think and the way that you write. Are you sure that the President won’t make you Energy Secretary?