In a groundbreaking new study, researchers at DOE’s Lawrence Berkeley National Laboratory have shown that American homebuyers are willing to shell out a significant premium for solar PV-equipped homes. In other words, solar sells and sells big.

The study, with the mind-numbing title Selling Into The Sun: Price Premium Analysis of a Multi-State Dataset of Solar Homes, looked at home sales from 2002-2013 and matched PV and non-PV homes by size, location and several other variables. All told the analysis compared sales information from almost 23,000 homes, 18,871 without PV and 3,951 with PV, spread across eight states (mainly in California, but also including Florida, New York, Massachusetts, Connecticut, Pennsylvania, Maryland and North Carolina).

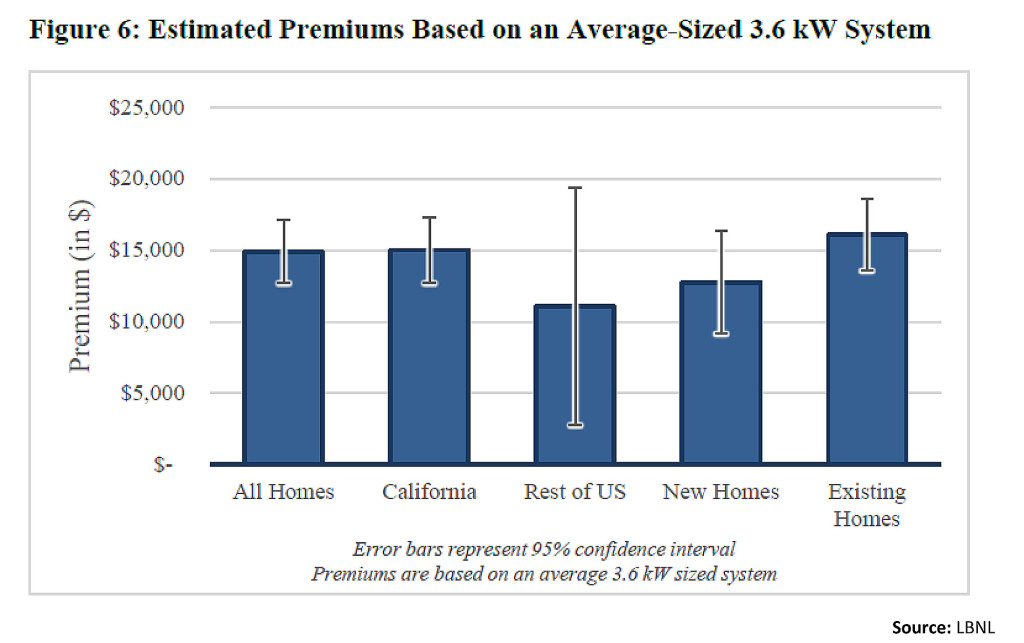

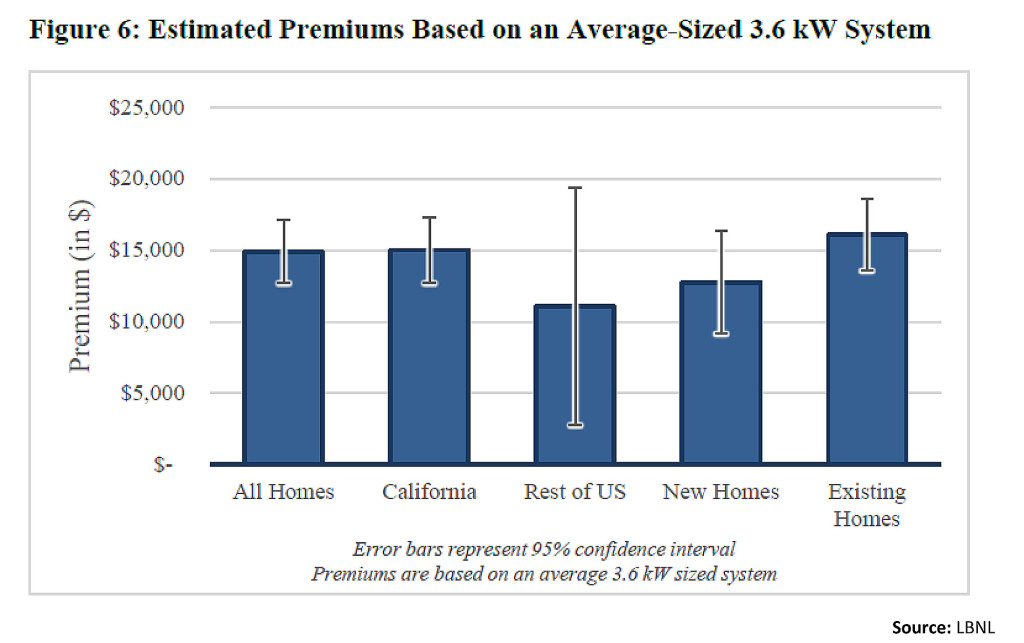

What the authors found was eye-opening: “Home buyers consistently have been willing to pay more for a property with PV across a variety of states, housing and PV markets, and home types.” And the premium is significant, the authors added, running to about $15,000 for an average-sized 3.6 kilowatt-PV system.

Another key finding, the authors said, is that the premium exists regardless of whether the PV system is incorporated into a newly constructed house or retrofitted onto an existing home. In fact, their research shows that the premium was actually slightly higher for PV systems installed on existing homes than it was for PV units incorporated into new construction (see figure below). Do-it-yourselfers take note, PV might be the home retrofit project that actually pays for itself.

Two other interesting findings highlighted by the authors were:

- The PV premiums were consistent throughout the 11-year period of the study, even though the housing market during those years changed significantly, from the boom years of the early-to-mid 2000s, to the recession crash of the late 2000s, and then on to the slow recovery of the early 2010s.

- The PV premium is not a California-specific phenomenon, but rather was found in all eight states; a finding that “should give stakeholders outside of California greater confidence that PV adds value to homes in their markets.”

Previous studies had indicated that such PV premiums existed, the authors continued, but the new study is a better indicator because of the size of the dataset, almost 4,000 PV-equipped homes, its lengthy time frame and broad geographic scope.

One area that bears further investigation, the authors said, is whether the PV premium exists for third-party owned systems. The current research only looked at homeowner-owned units, they said, but since solar PV leasing is becoming such a large part of the market, studying that segment of the industry would be valuable as well.

The study, funded by the U.S. Department of Energy’s SunShot initiative, can be found here.

–Dennis Wamsted

Follow

Follow