In a little-noticed report last month, Deutsche Bank’s markets research team walked through recent developments in the solar and storage industries and offered several bold predictions with enormous ramifications for the U.S. utility industry.

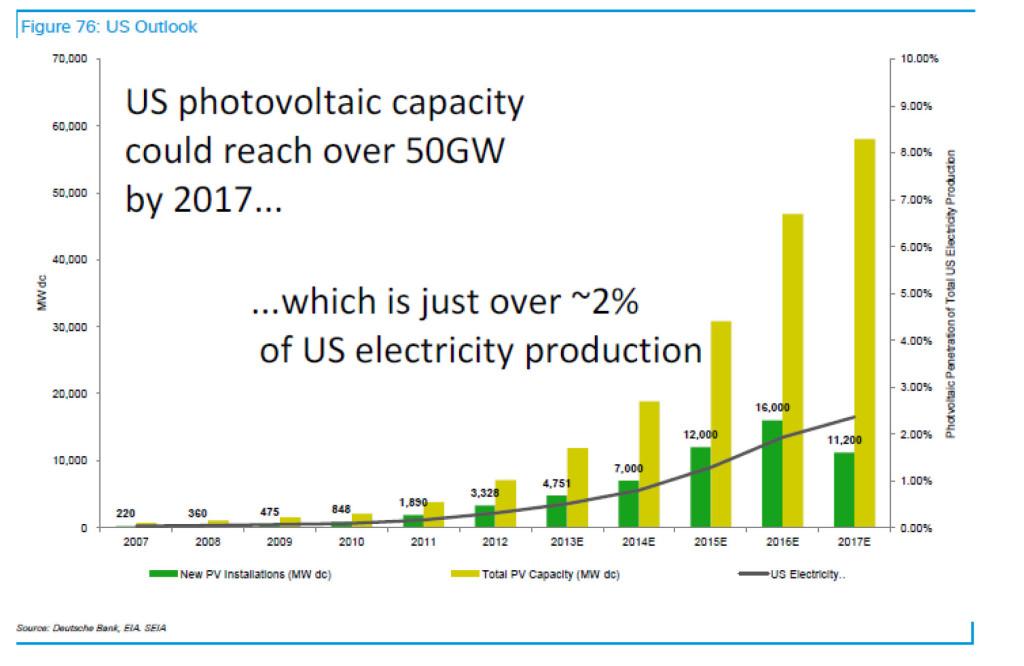

For starters, the company projected that by the end of 2016 total installed solar PV capacity could hit 47,000 megawatts (dc), with more than half of that being built in the next two years. Specifically, Deutsche Bank (DB) forecasts annual installations this year will total 12,000 MW and then jump to 16,000 MW in 2016. By comparison, just 10 years ago there was essentially no installed PV capacity in the U.S. The DB report, Crossing the Chasm, can be found here.

Out of this total, DB estimates that at least 20,000 MW, and perhaps as much as 30,000 MW, will be distributed generation. The push toward rooftop solar, whether on commercial or residential facilities, is expected to be so strong, DB added, that it will largely cushion the blow from the scheduled 2017 step-down of the investment tax credit (ITC). That year, the company said, new PV installations should still top 11,000 MW—easily topping any previous 12 months save the projected 2015-2016 boom years.

And these aren’t just forecasts. San Francisco-based Pacific Gas & Electric Company announced this week that it now has 150,000 solar-using customers spread across its California service territory—with 45,000 of those being added in 2014 alone. On average, the company said, it is now connecting about 4,000 new solar customers every month.

The rationale for the solar surge is easy to understand, DB continued—it all comes down to economics.

The cost of distributed generation facilities, which DB defines as units generating less than 20 kilowatts, currently ranges from $2.50-$4 per watt—down sharply from a decade ago. And the bank expects the downward trend to continue: “We believe we can see 10-15 percent annual reductions in system cost/watt over the next several years.” If that pans out, DB continued, the levelized cost of electricity for a distributed PV system would drop to 8-14 cents per kilowatt-hour—putting the technology at grid parity in a host of states.

Even following the expected drop in the ITC from 30 percent to 10 percent in 2017, DB said, PV solar will be at grid parity in an estimated 41 states plus the District of Columbia. In short, the company said, “we see solar becoming increasingly mainstream as it passes cost competitiveness with traditional forms of generation. While we will likely see some utilities fight at every step of the way (because it threatens their business model), we expect system economics will ultimately win in the longer run….”

Beyond this, DB said major reductions in electricity storage costs are going to upend the industry—not necessarily put utilities out of business, but change how they go about their business.

The cost reductions on the storage side have been so dramatic, DB said, that many of the estimates in its own paper are likely already outdated. For example, in an explanatory graph introducing a chart comparing different storage technologies, DB wrote: “Based on our checks many of these costs are already lower than published literature would suggest. Therefore, the costs below are likely conservative.”

The case of lithium-ion batteries is illustrative, DB said, pointing out the upfront cost for these batteries at the beginning of 2014 was in the $1,000/kwh range—but it had fallen to just $500/kwh by the end of the year. Continued reductions in the 20-30 percent per year range are “likely,” DB predicted, “which could bring conventional lithium-ion batteries at commercial/utility scale to the point of mass adoption potential before 2020.”

DB continued: “Using conservative assumptions and no incentives, our model indicates that the incremental cost of storage will decrease from ~14 cents/kwh today to ~2 cents/kwh within the next five years.” Coupled with expected declines in PV costs, this will make solar + batteries “a clear financial choice in mature solare markets in the future,” the bank concluded.

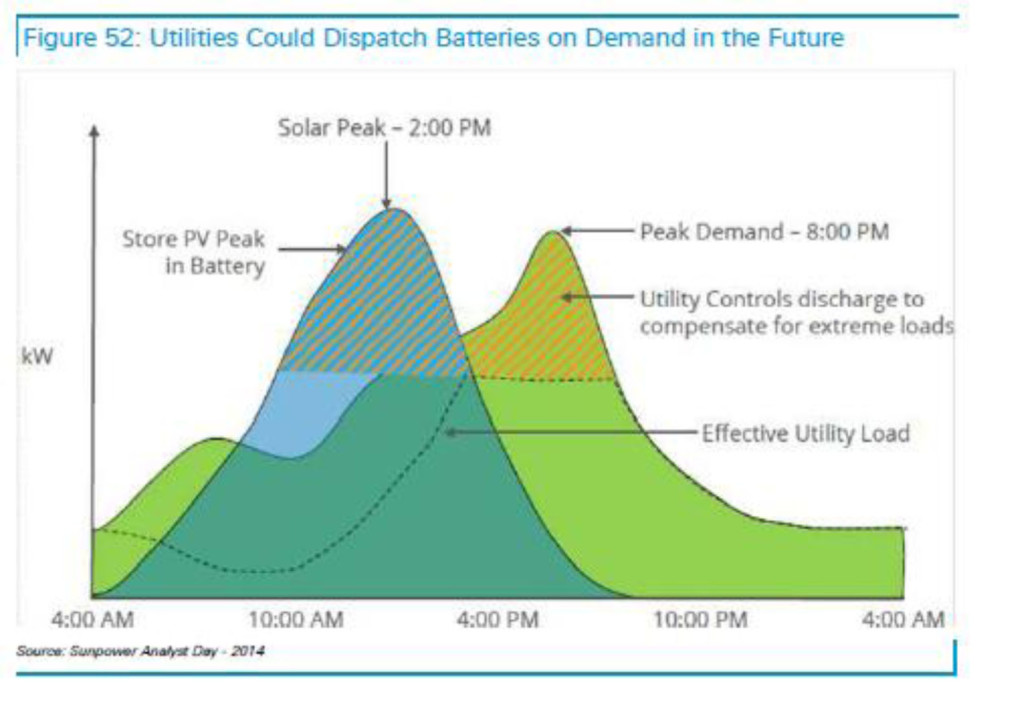

But this should not be seen as the beginning of the end for utility companies, DB continued. In fact, linking batteries and distributed PV could be a whole new business opportunity.

“We see a substantial opportunity for utilities to utilize smart grids through residential battery aggregation.” With the right incentives, DB continued, utilities could aggregate solar and batteries, and use it as a single source of load reduction. This aggregation (see chart below) could be used to reduce peak demand and reduce the amount of seldom-needed, and expensive, peaker plants, benefitting everyone.

Navigant Research also expects substantial growth in the storage market in the near term, projecting that demand for distributed energy storage systems worldwide will climb almost 10 times in the next three years, rising from 276 MW in 2015 to nearly 2,400 MW in 2018. In a mid-March report, Community, Residential, and Commercial Energy Storage, the company said growth will continue in the longer term as well, with overall demand pegged to hit 12,000 MW by 2024. Navigant noted in its release touting the new report that the market for distributed storage “has exceeded expectations for growth and market volume in recent years”; clearly this raises the possibility that even the company’s healthy forward-looking growth projections may not be aggressive enough.

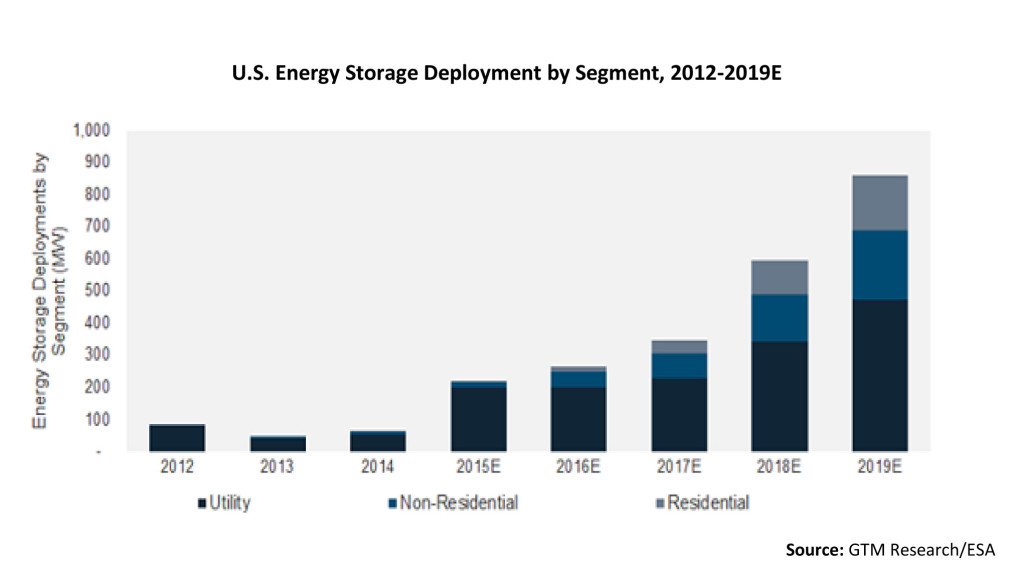

Looking just at the U.S., GTM Research says 2015 is shaping up to be a banner year for the storage industry, projecting that 220 MW will be deployed during the year, more than three times the 2014 level. “And growth should continue at a rapid clip thereafter,” GTM said in its inaugural energy storage report, which was prepared in conjunction with the Energy Storage Association.

“The U.S. energy storage market is nascent, but we expect it to pick up more speed this year,” said Shayle Kann, senior vice president at GTM Research. “Attractive economics already exist across a broad array of applications, and system costs are in rapid decline. We expect some fits and starts but significant overall growth for the market in 2015.”

One of the most intriguing findings in the GTM-ESA report is its expectation of sharp growth in behind-the-meter storage installations, such as in residential PV or commercial demand charge applications. By 2019, the reports anticipates that fully 45 percent of the storage installations across the U.S. will be behind the meter, up from just 10 percent currently. And that 45 percent will be of a much larger market than today—by then GTM expects total U.S. storage to hit 861 MW annually.

The next few years look interesting, to say the least. Stay tuned.

–Dennis Wamsted

Follow

Follow