Dominion’s 2016 integrated resource plan is on the docket at Virginia’s State Corporation Commission this week: The hearings would be a perfect time to explore the utility’s plan for addressing the massive changes sweeping across the electricity industry, but it’s not going to happen. Instead, Dominion will defend a document seemingly developed in a time warp, when there were no options other than central station, utility-generated power and the term distributed energy resources was still a twinkle in Amory Lovins’ eye.

Here’s all you really need to know: In the Richmond, Va.-based company’s 307-page IRP (which can be found here), the term distributed energy resources only shows up once, on page 112, when the company references the federal Department of Energy’s definition of a microgrid: “…a group of interconnected loads and distributed energy resources within clearly defined electrical boundaries that acts as a single controllable entity with respect to the grid…”

Now, to be fair to Dominion, the utility does talk about distributed generation, but generally in terms designed to underscore its potential risks while downplaying any possible benefits. Its discussion of future energy resources, for example, which begins on page 88, includes a number of standard beefs about renewable resources—they aren’t dispatchable, they are intermittent and they add uncertainty to system operations. The topper, though, appears on pages 95-96 when the company talks about distributed photovoltaics: “While the grid may not be adversely impacted by the small degree of variability resulting from a few distributed PV systems, larger levels of penetration across the network or high concentrations of PV in a small geographic area may make it difficult to maintain frequency and voltage within acceptable bands. On a multi-state level, it is possible that the resulting sudden power loss from disconnection of distributed PV generation could be sufficient to destabilize the system frequency of the entire Eastern Interconnection.” [Emphasis added]

Well, maybe. But the same could be said about the potential impact of the “sudden power loss” from Dominion’s four operating nuclear reactors. There’s no point to such a statement other than to scare regulators and legislators and to justify the status quo ante. Problem is, the changes roiling the industry—corporate demands for more renewable power, steadily falling wind and solar prices and the growing customer (both commercial and residential) interest in and demand for distributed resources—can’t be wished away.

Six years ago I wrote a story on windpower for Edison Electric Institute’s Electric Perspectives magazine that is a useful reference (the story, in the September 2010 issue, can be found here). At the time, Xcel Energy’s Colorado operating unit (Public Service Company of Colorado) was touting the fact that it had met more than 10 percent of its native load energy demand in the prior 12 months from windpower. And at times in the overnight hours, it had been able to meet more than 30 percent of its energy needs from wind.

Discussing those results, Tom Imbler, then the vice president of commercial operations for Xcel, said: “If you had asked me in 2007 if this was possible, I would have said, no, you can’t do that.”

But you can, and Xcel did—and it didn’t stop there. By 2014 wind was providing almost 20 percent of its system needs in Colorado and in 2015 it set a record for daily wind production, covering more than 50 percent of the state’s electricity needs through its windpower resources on Oct. 2. All of this was done without negative impact on the system’s reliability or major integration costs (Perhaps the topic of a future post, given Dominion’s high integration cost estimates for solar power in its IRP.), and the company has additional growth in the works.

In the same 2010 article, Jesse Langston, vice president of utility commercial resources at OG&E Electric Services, the utility unit of OGE Energy, had a similar reaction. “Five years ago,” he said, “we were scared of 2-percent wind.” By 2012, with the completion of the company’s Centennial wind farm, the utility was meeting 10 percent of its system needs with wind. And EIA reports that wind today accounts for 17 percent of the state’s electricity generation.

Dominion does not have the onshore wind resources of either Colorado or Oklahoma, but that is not the point. The point is, Dominion needs to embrace the changes so evident throughout the industry, not cower behind an IRP that represents days gone by.

In sharp contrast to Dominion’s reticence, California’s SCE is moving forward aggressively with plans to accommodate obvious customer interest in distributed energy resources. At a panel presentation last month, Ron Nichols, president of Rosemead, Calif.-based SCE, said the utility estimates that by 2025 1.5 million of its customers will be using some form of distributed energy resource, whether that is rooftop solar, onsite energy storage, electric vehicles, energy management, or a combination of some or all of the above.

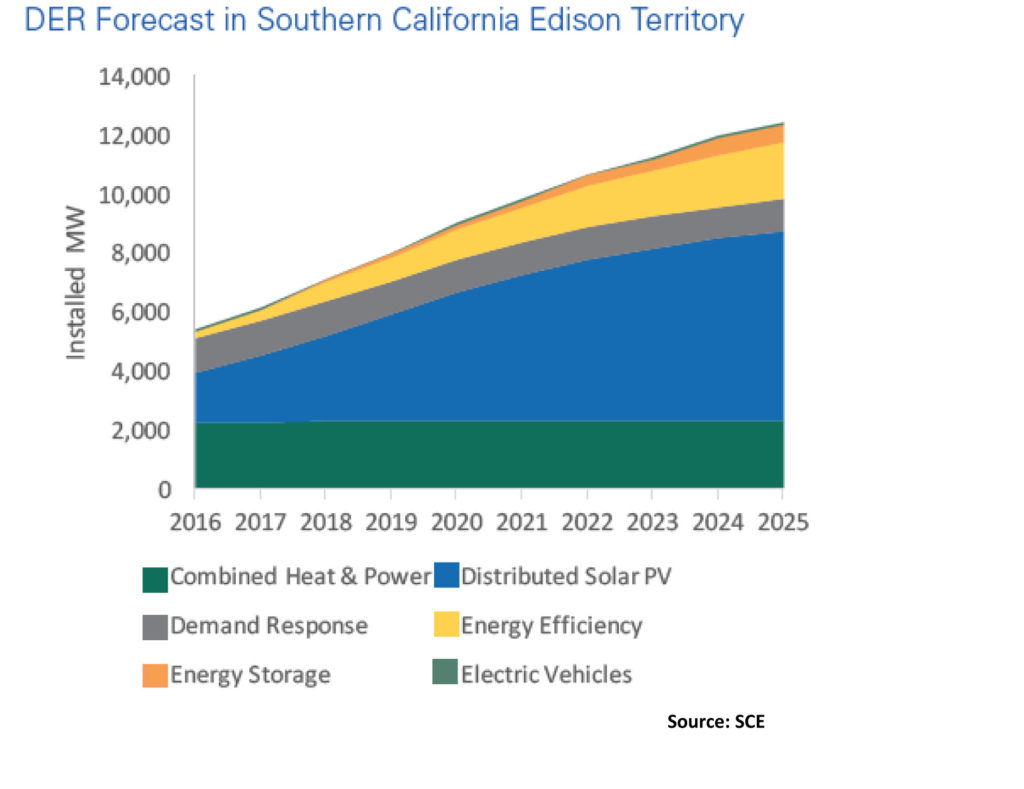

In a white paper released along with Nichols’ presentation, SCE outlined the steps it believes need to be taken to make sure those 1.5 million (or more) customers actually can plug in and play on. (The paper, The Emerging Clean Energy Economy: Customer Driven. Modernized. Reliable., can be found here.) The utility’s recommendations are interesting and surely will be debated long and hard before the California Public Utilities Commission, but the real eye-opener is SCE’s DER forecast (see chart below).

By 2020, which is essentially tomorrow for a utility planner, the company estimates that it may have almost 4,000 megawatts of distributed PV on its system. And that will be just the beginning, with SCE forecasting continued increases, perhaps reaching 6,000 MW by the forecast end point in 2025. All told, the company estimates that DERs in its service are likely to more than double during the coming 10 years, climbing from more than 5,000 MW today to about 12,000 MW in 2025.

While that projected growth could prompt a few to say “it can’t be done,” SCE has a different take:

“These massive changes to the grid and markets will take time—possibly more than a decade—to accomplish. But, if utilities, regulators, and distributed energy providers come together now with a sense of urgency, the foundation developing now will be established by the turn of the decade: with functioning markets for DERs, a modernized grid in priority locations, informed customers, proven resource providers, and reduced carbon emissions. Underpinning this, utilities will evolve to become facilitators of customer choice and the clean energy economy by unlocking the benefits of DERs while enhancing the reliability critical to everyone.”

All good corporate speak, to be sure, but the point is simple. Rather than obstruct and fight the change, SCE is saying, let’s get it done.

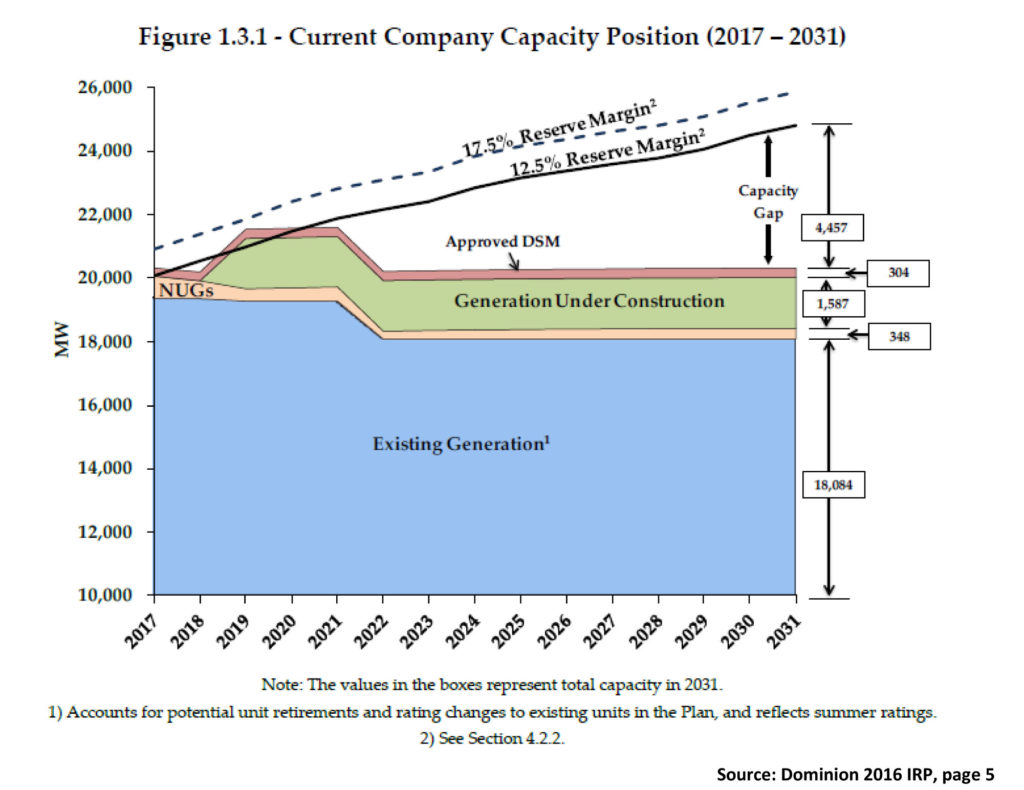

Dominion, on the other hand, is still wedded to the utility-knows-best model, which is evident from the generation forecast in its IRP (see chart below). I dare you, find some distributed energy resources in it.

Now clearly some, perhaps even most, of the differences in approach stem from the different regulatory schemes in the two states. Dominion is in a traditionally regulated state while SCE is not. But to customers today that doesn’t really matter, they want and are increasingly demanding the ability to use distributed energy resources, regardless of where they live.

For example, in a recent analysis, Paul Stith, a transportation product manager for Black & Veatch, offered up an opportunity, and a warning, for today’s utilities: “We see a window for utilities to embrace distributed energy resources and develop new partnerships with customers. The costs and capabilities of these technologies are evolving rapidly, and if utilities do not seize the emerging opportunities, other new market entrants certainly will.”

Virginia’s regulators may not be requiring Dominion to plan for the looming DER future, but Dominion should be doing it anyway. Leading the transition is a lot more productive than trying to play catch up down the road.

–Dennis Wamsted

Follow

Follow