Electric utility executives already fretting about slow/no growth in their service territories have another item to add to their growing list of worries: the prospect that many of their commercial customers could begin installing behind-the-meter storage to lower their demand charges.

A recent white paper from DOE’s National Renewable Energy Laboratory and the Clean Energy Group, a nonprofit advocacy organization, shows that it could be economic for almost 28 percent of commercial customers across the country to install batteries at their business sites to cut their electricity consumption during specific periods of the day, thereby reducing their exposure to utility-imposed demand charges. This would amount to a one-two punch for utilities: electricity sales would drop if the batteries were linked with solar and the amount of revenue collected from these charges would fall, not a pretty picture for the utility industry.

The analysis, Identifying Potential Markets for Behind-the-Meter Battery Energy Storage: A Survey of U.S. Demand Charges, does not look at actual rates being paid by commercial customers (the hours involved in collecting that data would almost certainly be cost prohibitive) but rather surveyed 10,000 utility tariffs on file across the country, developed representative load profiles for 10 different building types, and then examined which tariff(s) could be used by the differing buildings. A full discussion of the methodology is including in the study, which can be found here. Once that overall sorting was done, NREL examined the fraction of the overall universe of commercial buildings that could be using tariffs above a threshold of $15 per kilowatt, a commonly used marker for the cost effectiveness of battery storage.

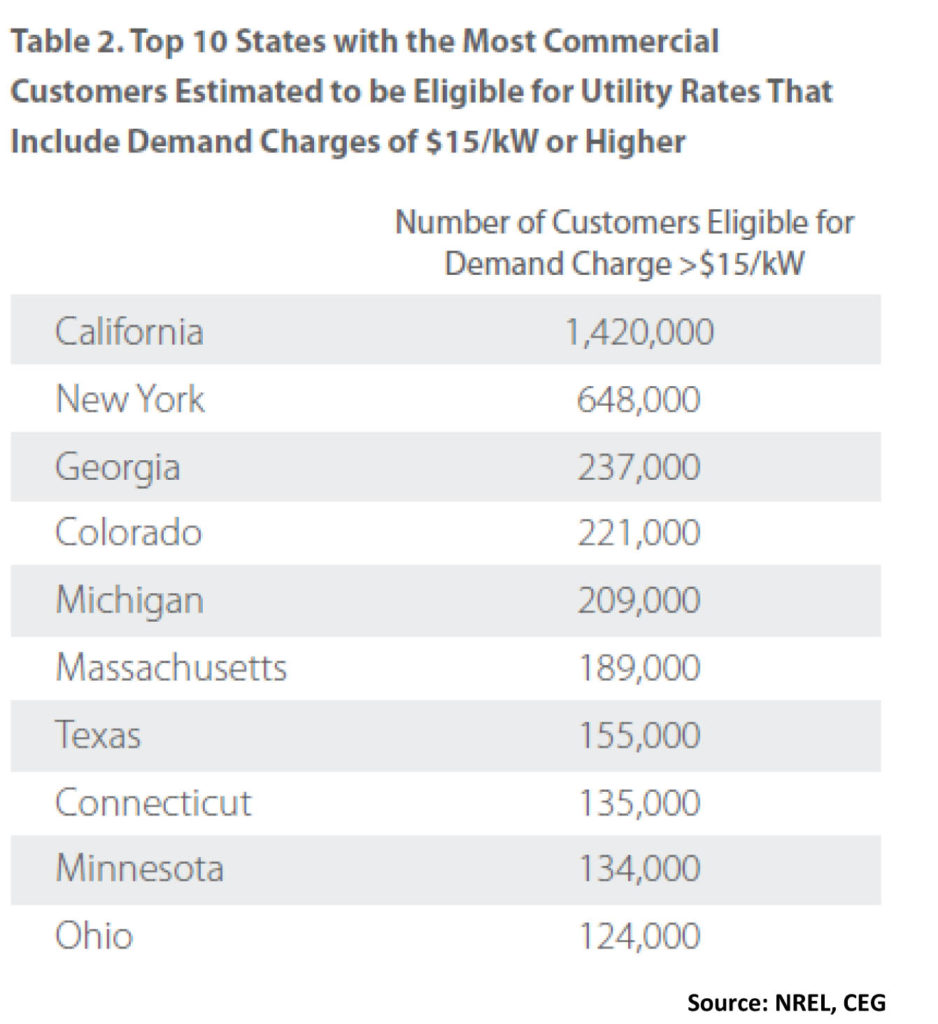

The results were eye-opening. According to NREL, roughly five million commercial customers are eligible for electric tariffs with a demand charge rate of at least $15 per kilowatt—more than a quarter of the 18 million commercial customers in the U.S. Interestingly, the study also found that there are opportunities for this battery-enabled defection in almost every state. California and New York, which have been early and consistent supporters of energy storage initiatives, top the list with the most commercial customers that could be paying demand charges of more than $15 per kilowatt. But as the graphic below demonstrates, the opportunities are spread across the country. Georgia, for example, which is not generally thought of as a high-cost region, is third on the list, with some 237,000 commercial customers potentially paying demand charges above the $15 per kilowatt threshold.

Raising the threshold to $20 per kilowatt would lower the number of potential customers for battery storage to three million, but this still represents a sizable market opportunity that should be worrisome to utility executives nationwide. Given the recent significant price declines in battery costs, looking at a threshold of $10 per kilowatt may be more representative of where the market is heading; in this case, NREL said, six million commercial customers potentially could benefit by looking for a battery storage option to cut their utility demand charge. The study’s authors also noted that if storage costs fall to those levels, it “may alter the bulk power system sufficiently to prompt a reduction in demand charge rates.”

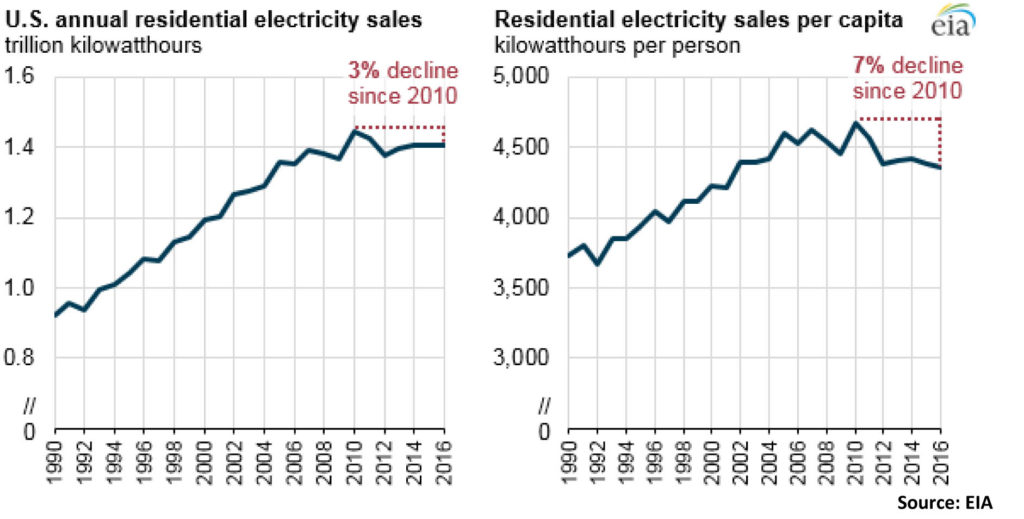

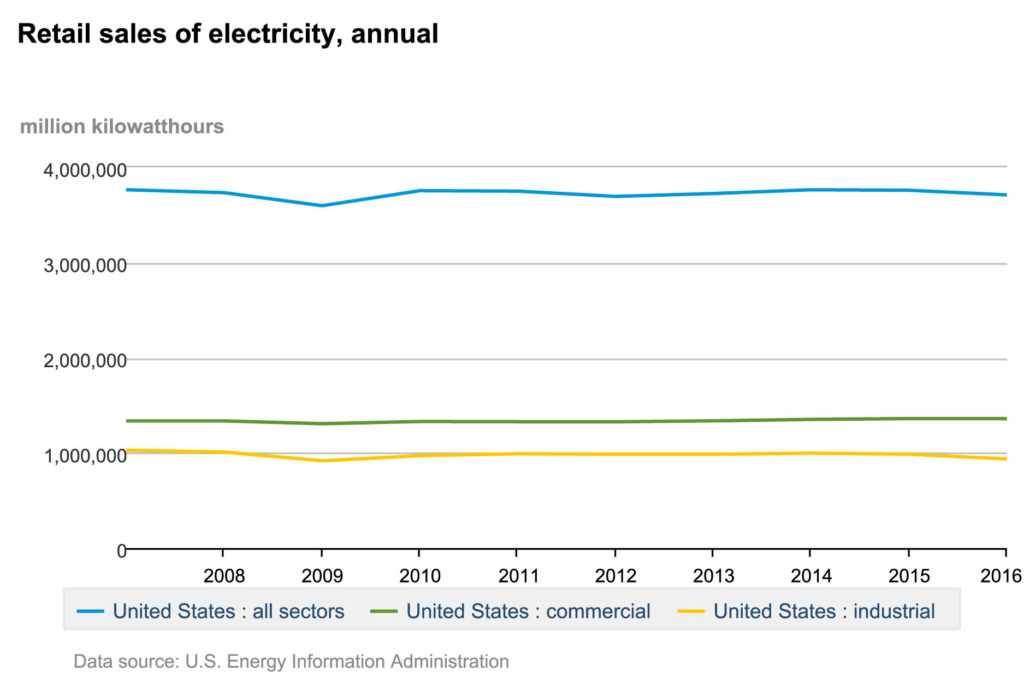

How this will play out is clearly uncertain, but it cannot be good news for the utility industry, which has been troubled for years by flat demand growth. As the Energy Information Administration reported this summer, overall residential electricity sales have dropped 3 percent since 2010 while per capita sales have dropped 7 percent in the same period. (see charts below). The situation is much the same in the commercial and industrial sectors: Looking back to 2007 (before the great recession), sales in both segments are essentially flat as the second chart below illustrates.

With flat sales, utility revenue (from each kilowatt-hour sold) can only increase when regulators okay price increases, something they are generally loath to do, or when the demand charge (already estimated to account for somewhere between 30 and 70 percent of a commercial customer’s monthly bill) is raised. Now, with what amounts to an effective upper limit on those monthly charges, utilities are in a bind, a big bind.

Call it kismet, or whatever phrase turns your fancy, but just days after the NREL report was released August 24, California’s Santa Rosa Junior College announced that it had selected SunPower to install an integrated solar and storage project at its Sonoma County campus. The SunPower system will include 2.6 megawatts of solar coupled with a 1.3 MW/2 megawatt-hour storage unit from California-based Stem Inc.

In the release announcing the project, which is scheduled to come online in 2018, the companies said: “By adding Stem’s software-driven energy storage, Santa Rosa Junior College is expected to see significant demand charge savings.”

Dr. Frank Chong, the college president and superintendent, added that SRJC’s goal in undertaking the project was “to maximize the value of our solar energy system with energy storage. This will cut our energy costs even further.”

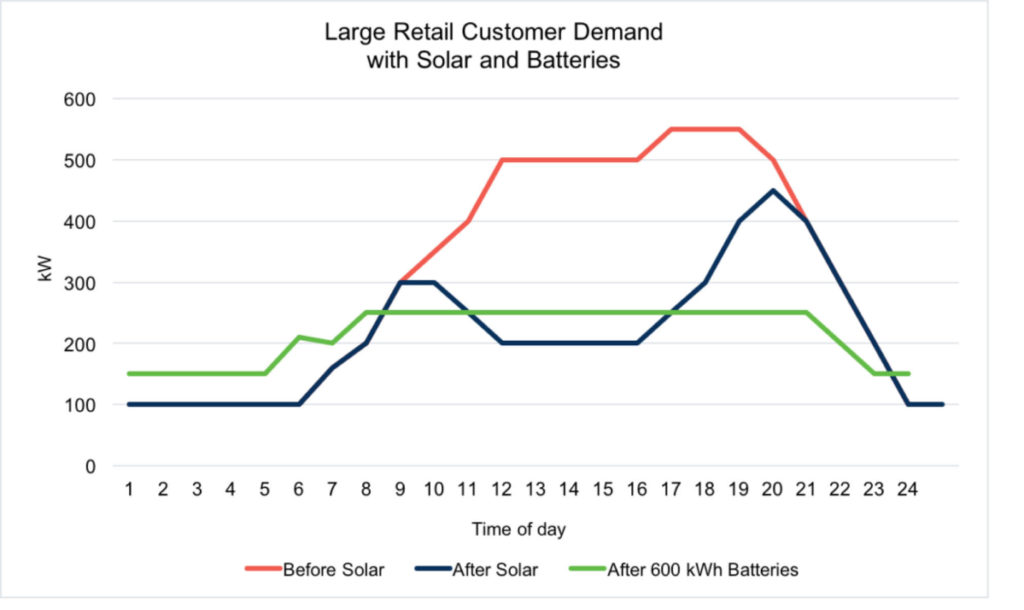

Earlier in August, Jim Lazar, a senior advisor with the Regulatory Assistance Project, had looked at a hypothetical Big Box retailer (think Target or Walmart) with rooftop solar and found that in many cases adding storage would make a lot of sense. The details of his paper can be found here, but the gist of it is that with solar installed, a typical big box retailer has a relatively short peak in the late afternoon. That peak is lower than the facility’s non-solar peak, which reduces the demand charge. But because the peak also lasts for a shorter period, installing batteries to flatten the remaining peak (thus further reducing the demand charge) makes economic sense (see chart below).

Source: Jim Lazar, RAP

As he calculates it, this customer would need about 600 kwh of storage to reduce its peak demand to 250 kw from the previous 450 kw. If the storage cost $200 per kwh (not an unlikely number in the near future), the batteries would cost $120,000. If the company’s demand charge was $10 per kw, the installed storage could save the company $2,000 per month. “So, it’s a five-year payback,” he wrote. And that is before calculating any potential savings from time-of-use rates.

“Every gross dollar the customer saves is one the utility loses,” he added. “[D]emand charges will drive other forms of storage where the charges are high and the number of hours is small.”

If I were a utility CEO I would be worried, very worried.

–Dennis Wamsted

Follow

Follow

One thought on “Storage Puts Utilities

In A Big Bind

On Demand Charges”