It’s planning time in the electric utility industry, and a raft of new reports make two points abundantly clear:

- Efforts to “save” the coal industry are bound to founder since utilities, as a group coal’s largest customer by far, have moved on and are planning a cleaner future in which the black rock’s current share of the electricity market, in the low 30 percent range, is as high as it’s ever going to get.

- Vanishingly small increases in demand (and the occasional outlook for declines) will be a major issue for the industry in the next 10 years.

In its latest 10-year power plant siting plan, for example, Florida Power & Light pointed out that it was continuing its efforts “to move away from coal-fired generation.” In total, the utility said it planned to take 1,216 MW of coal-fired generation off its system by the first quarter of 2019. (FPL’s site plan can be found here.)

Similarly, in its recently filed 2017 integrated resource plan (IRP), PacifiCorp, the sprawling utility holding company that serves 1.8 million customers in six western states, said its preferred generation portfolio going forward “reflects a cost-conscious transition to a cleaner energy future.” Through 2028, PacifiCorp said it would be able to meet its system-wide power needs through demand side management (DSM), new renewable (primarily wind) generation and short-term purchases on the wholesale market. Looking longer-term, the company said it planned to shutter 3,650 MW of coal-fired capacity by 2036. (PacfiCorp’s IRP and other backup information can be found here.)

To the south, Tucson Electric Power offered up a similar plan in its just-filed 2017 IRP. “TEP will continue to diversify its generation portfolio and reduce its significant reliance on coal by expanding cost-effective renewable resources, particularly solar,” the company told Arizona regulators. Existing plans will lead to the retirement of 508 MW of coal-fired capacity over the next five years, TEP said, adding: “This reduction in coal resources will result in significant cost savings for TEP customers and will result in meaningful reductions in air emissions and water consumption.”

The company’s goal, TEP continued, “is to serve at least 30 percent of our retail load from renewable resources by 2030.” Arizona has an existing state statute calling for its utilities to reach 15 percent renewable by 2025. (TEP’s IRP and other information can be found here, scroll down once you are there.)

Finally, Xcel Energy, long a significant player in the utility renewable generation arena, kicked it up another notch last month, announcing plans for 11 new wind farms in seven states that would add 3,380 MW to its system. By 2021, the company said, wind could supply nearly 35 percent of its total energy needs.

Ben Fowke, Xcel’s president, chairman and CEO, was direct: “Our plan delivers on both economic and environmental fronts, as we provide customers the cleaner, renewable resources they want, while continuing to deliver the reliable and low-cost energy they need.”

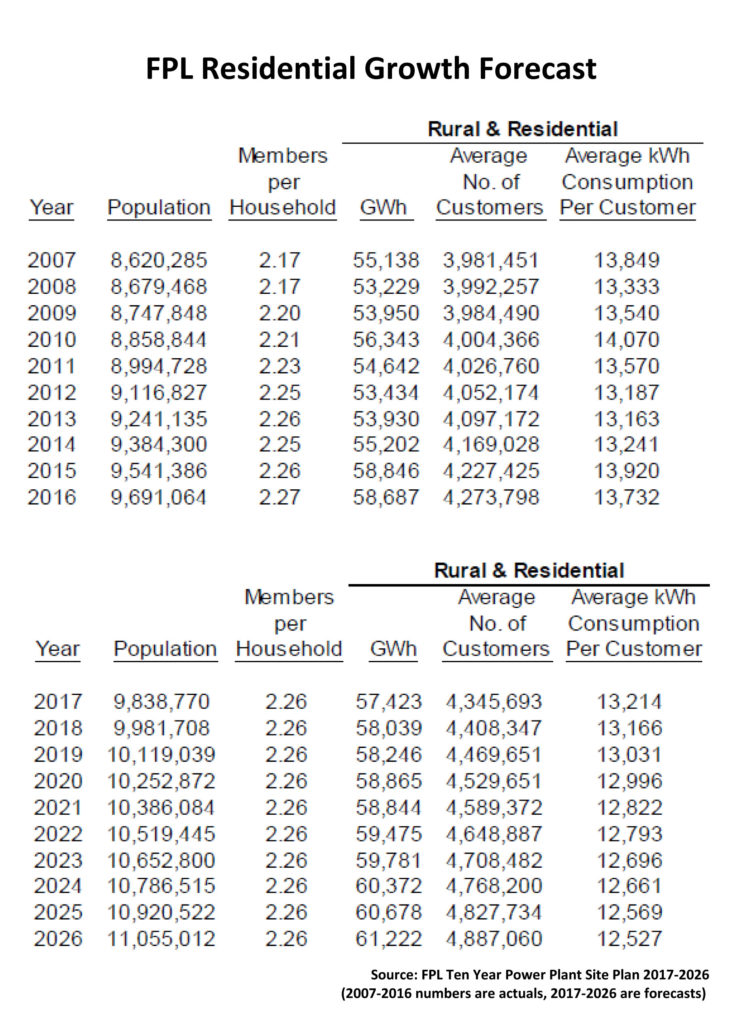

The collapse in demand growth also looms large in these new utility planning documents, with uncertain implications going forward, particularly for utilities such as FPL that operate in a traditional regulatory environment. The chart below shows FPL projections for residential demand growth in the coming 10 years compared with actual figures for the past 10. Given that residential demand accounted for more than 53 percent of the utility’s sales in 2016, it is worth digging into these numbers in greater detail.

For starters, FPL expects per capita electricity consumption to drop steadily during the coming decade, falling from 13,732 kilowatt-hours per customer annually to 12,527 kwh by 2026. This decline, due to state and federal efficiency standards, coupled with other reductions, is expected to reduce the utility’s peak demand by 2,041 MW in 2026 and reduce annual energy consumption by more than 8,000 gigawatt-hours (gwh).

Given the expected decline in per capita consumption, the forecasted increase in demand can be traced directly to expected increases in population, and this is where we get to the fun part. In its forecast, FPL estimates that customer growth in its service territory will rise by 12.45 percent in the coming 10 years. The company was similarly optimistic in its 2015 siting report, pegging future growth at 13.2 percent, and in 2016, estimating future growth at 13.7 percent. The interesting thing about these forecasts is that actual growth over the prior 10 years has not been nearly that high; in its 2015 report the 10-year prior average was 8.9 percent, in 2016 it was 8.2 percent, and for the current iteration growth in the prior 10-year period averaged just 7.3 percent.

Using FPL’s optimistic population forecast, residential demand is pegged to climb about 6.6 percent through 2026, rising from 57,423 gwh to 61,222 gwh. But plug in the actual number for the past 10 years (7.3 percent) and the outlook is much different: Then electricity use in 2026 would be an estimated 58,412 gwh—less than the actual levels in both 2015 and 2016.

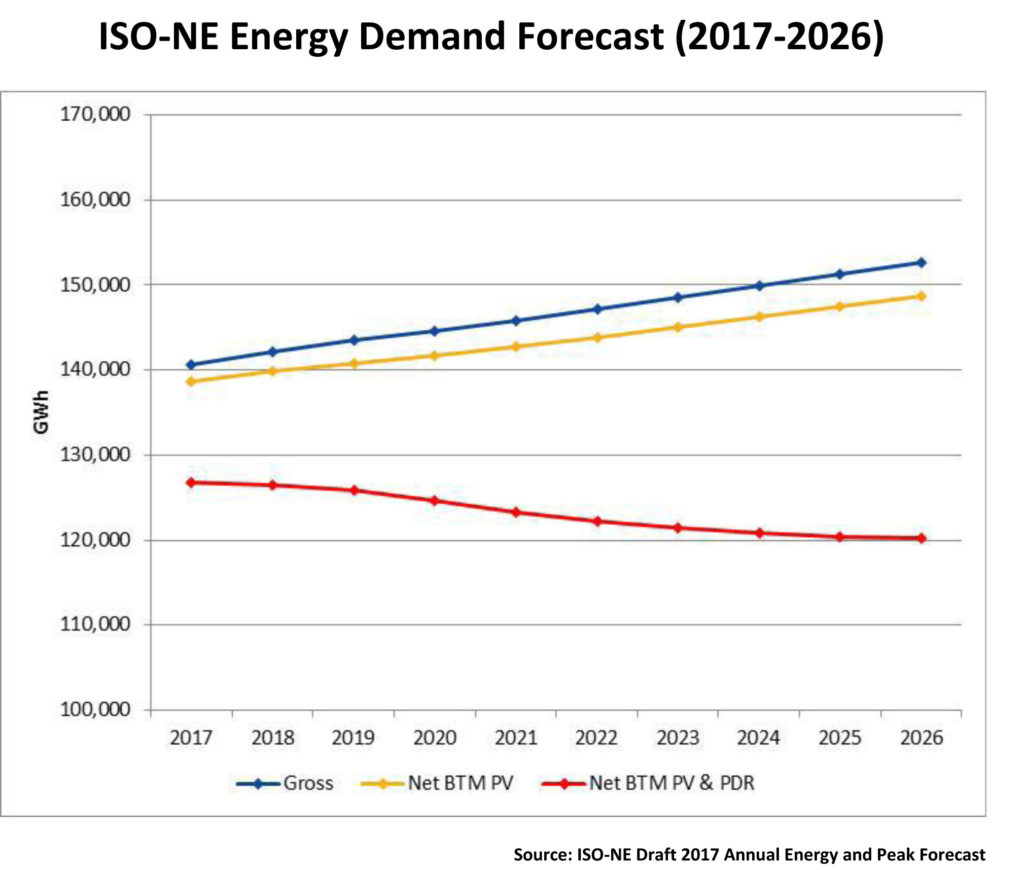

And FPL is far from the only utility skating on the edge of declining demand. In its latest 10-year outlook for the region, ISO-NE, the transmission system operator for the six New England states, projected that gross energy demand would climb from 140,583 gwh currently to 152,593 gwh in 2026—a paltry but still positive annual growth rate of 0.9 percent. However, once regional energy efficiency plans and behind-the-meter PV are factored in, ISO-NE said net usage would actually decline at an annual rate of 0.6 percent, falling from this year’s 126,800 gwh hours to an estimated 120,181 gwh in 2026, even as annual economic growth in the region is pegged to climb by an estimated 1.9 percent. (The ISO-NE forecast is here.)

All told, the transmission organization expects efficiency and demand response measures to cut 28,486 gwh from regional consumption in 2026, almost double the 14,380 gwh notched in 2016. The organization also expects BTM PV to grow strongly in the next 10 years, climbing from the current 1,918 MW of installed capacity to 4,362 MW by 2026. This, ISO-NE said, will cut regional demand by almost 4,000 gwh and lower peak demand needs by about 1,000 MW.

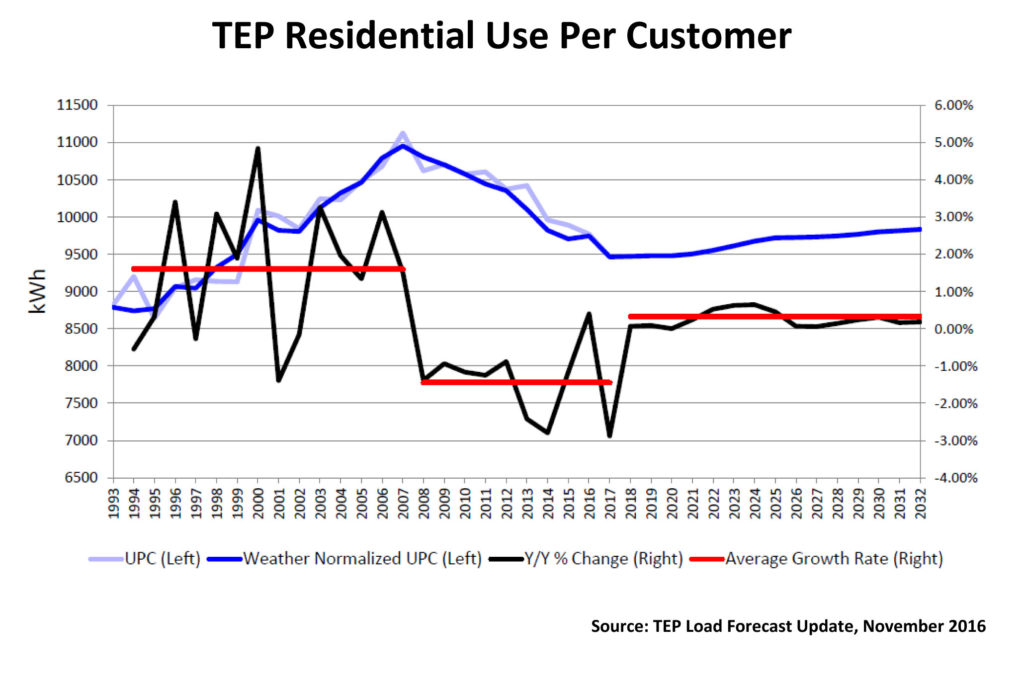

The story is much the same in TEP’s much-more compact service territory in Arizona. Growth through 2032 (TEP’s IRP covers a 15-year planning horizon), will be due almost solely to increases in population, not usage per customer. Residential usage accounts for just over 41 percent of the utility’s sales so, as with FPL, it is vital to get the numbers in this sector correct. As the chart below shows, TEP expects residential use per customer to recover somewhat from the recessionary lows of the past 10 years, but then to essentially flat-line at 8,500 kwh per customers for the foreseeable future. Translation? Any demand growth will be due solely to increases in the utility’s customer base.

On this score, TEP is projecting a modest 1 percent annual increase in its forecast. This is substantially below the area’s boom years in the early 2000s, when customer growth averaged roughly 2 .4 percent annually, but also significantly higher than the 2008-to-present results, which averaged well under 1 percent, with a couple of years falling close to zero. Clearly, where the average falls going forward will have a major impact on new capacity needs.

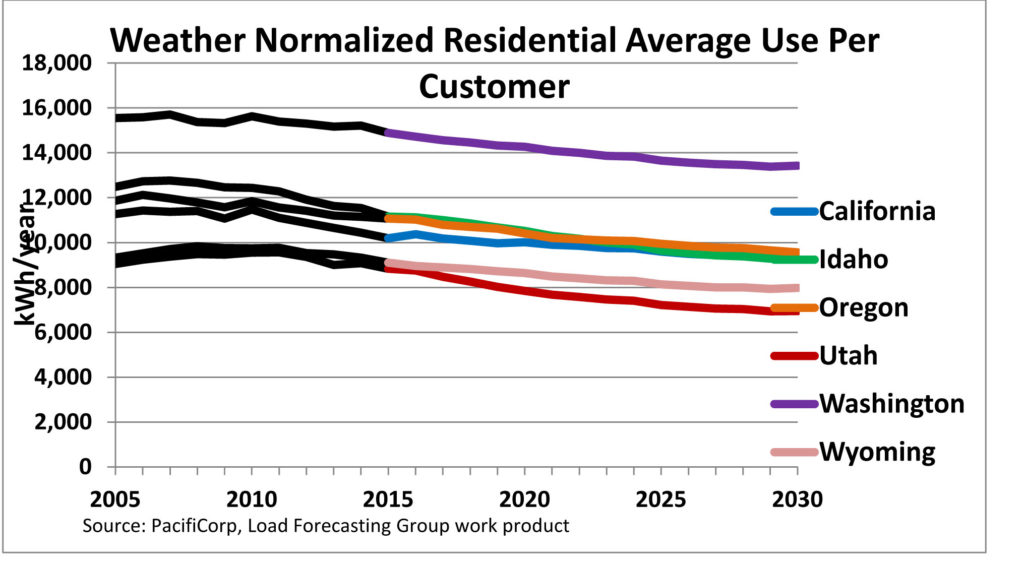

To the north, PacifiCorp is expecting similarly slow growth in its much larger service territory. All told, the company said, it expects annual growth in load to average .94 percent during its 20-year forecast. But even this minimal growth won’t translate into significant new generation needs, as the utility expects incremental energy efficiency resources to cover 88 percent of this demand over the next 10 years.

What may be most telling in PacifiCorp’s forecast is the chart below, showing per capita residential consumption falling in all six of the states it serves, despite the very obvious differences between the bustling city of Portland and rural Wyoming.

So where does that leave us?

First, while coal is never again going to generate 50 percent of the electricity in the United States, the utility industry’s more efficient units are going to be around for a long time to come. For example, despite its aggressive renewable plans, TEP still says 38 percent of its generation will be coal fired in 2032 (down from the current 69 percent). Interestingly, though, it raises the possibility that it could retire or sell the 793 MW it gets from Units 1 and 2 at the Springerville facility, and replace that capacity with a small modular nuclear reactor should that sector develop as its proponents hope. Similarly, PacifiCorp’s move away from coal, while steady, will be long-running, with the last of its capacity (some 909 MW) not scheduled to go off line until the end of 2036.

Second, the slow growth expected during the coming decade should be beneficial for the renewable energy and storage industries, which can further hone their commercial capabilities meeting small chunks of new demand while working to convince any still-hesitant utilities that these green options make sense, both for customers and the companies as well.

Finally, this vanishing demand is almost certain to push efforts to change existing utility business models and/or alter state regulatory rules. In an industry that has relied on growth to cover increasing costs, the lack of growth poses huge problems, a point acknowledged by Great Plains Energy CEO Terry Bassham in a recent hearing before the Missouri Public Service Commission concerning the company’s planned $12.2 billion purchase of neighboring Westar Energy.

According to a story by E&E News, Bassham told the commission that the merger was needed to help keep consumer costs under control.

“As revenues are flattening out because usage is flattening out…you begin to have to manage costs because wages and other costs are rising. The ability to create synergies, cut costs, however you want to put it, is critical to be able to continue that quality service to our customers while at the same time not increasing rates constantly. Without additional revenues, increasing costs get passed through.”

Mergers may be one answer, but clearly they are not the only one, and long-term they don’t really solve the problem. The growth Bassham and others are looking for isn’t there; it will be fascinating to see how utility executives cope with this reality.

–Dennis Wamsted

Follow

Follow

A widespread take-up of electric cars would alter utilities’ forecasts. In Australia (I haven’t made an estimate for the USA), average household demand is 16 kWh, and household demand is 25% of total electricity demand. An electric car with, say, an 80 kW battery, would need 10 -15 kW per day of charging which would roughly double household demand, or increase total demand by 25%.

It certainly could, and I will be watching that as we move forward. Exactly how much demand EVs will generate remains to be seen, especially since there is a distinct linkage in the U.S. between EV ownership and PV ownership. If you throw a home-sited storage system into the mix it is unclear how much extra demand that would amount to for a utility.

I had been thinking that EV uptake was being ignored as well. I see your point about PV following EVs, especially since we added 9.5 kW DC of solar after buying 3 EVs, covering 80% of our consumption. But these are early days of EV ownership, where most EVs are parked at single family homes. As that changes and apartment dwellers with charging in their off-street parking start to buy EVs, electricity demand is likely to increase.