Executives at Akron, Ohio-based FirstEnergy Corp. have perfected the art of talking out of both sides of their mouths: Just look at their approach to competition, which they whole-heartedly support—except when they don’t.

In Maryland, where Republican Gov. Larry Hogan recently vetoed a bill overwhelmingly approved by the state legislature that would have increased the state’s renewable portfolio standard (RPS) from 20 percent in 2022 to 25 percent by 2020, FirstEnergy is all for competition and letting the free market decide. “Competitive markets, not regulatory mandates, provide the most economical solution for renewable generation supply needs in Maryland,’’ the company wrote in March urging state legislators to oppose the new higher standards. Those tighter standards, the company warned, “would result in significant increases in the cost of generation in Maryland.”

And when there was a move back in 2007 to re-regulate the electric market in Ohio, the company argued forcefully in favor of competition. Tony Alexander, FirstEnergy’s chairman and CEO at the time, repeatedly criticized moves to re-regulate the state’s utilities, testifying in October, 2007 before the Ohio Senate that:

- “…competitive markets for electricity—like any other market—drive innovation, efficiency and investment and, over time, produce the lowest prices.”

- “…we’re now faced with legislation that would turn back the clock on competition and return Ohio to the failed policies of regulated generation rates.”

- “…it’s clear that competitive markets, over time, will produce the lowest prices for customers. This basic economic theory applies to all markets, it applies to electricity.”

- “Re-regulation may sound like a good idea,…. But if re-regulation becomes a reality in Ohio, we should expect significant increases in regulated rates….”

- “Re-regulation and government mandates, controls and preferences are not the answer to Ohio’s energy future. They failed in the past, and have been challenged in virtually every aspect since the 1970s.”

- “Rather than relying on regulation and government mandates to meet our state’s energy objectives, FirstEnergy believes that the competitive marketplace will deliver better products and prices and drive innovation and efficiency improvements.”

Got to hand it to FirstEnergy, they are all in for competitive markets, and have been remarkably consistent for the past 10 years—except when they aren’t.

The problem here is that FirstEnergy really only wants competition when it suits them, not as a general principle, as is evident in their years-long effort to get the Public Utilities Commission of Ohio to approve patently uncompetitive support for two of its Ohio generating facilities, the 900 megawatt Davis-Besse nuclear plant and the 2,200 MW W.H. Sammis coal-fired facility.

These two aging facilities—the Sammis plant’s newest unit is 45 years old while the oldest is 57; the Davis-Besse facility is 39 years old but it has a history of serious maintenance problems—have been battered by the drop in natural gas prices, the influx of new wind and solar generation, and the continued stagnation in overall electricity demand. The battering has been so bad that they essentially can’t compete in the current market, and FirstEnergy is asking state regulators to bail them out while hitting customers with new monthly charges that could run into the billions of dollars over the coming eight years.

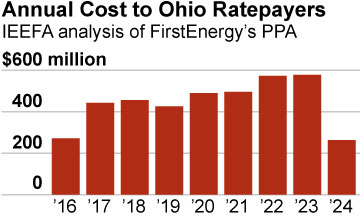

[The graphic is from the Institute for Energy Economics and Financial Analysis’ February, 2016 report on FirstEnergy’s bailout proposal; the full report can be found here.]

In its pleadings with the Ohio PUC, FirstEnergy has said the bailout is essential to keep the plants operating, and that the plants, in turn, are needed to maintain reliable, affordable electric supplies in the state—in other words, could I get a little re-regulation here, please.

In defending the company’s proposal, Doug Colafella, a FirstEnergy spokesman, told the Toledo Blade: “We like to think of it as an insurance policy against volatility and the future uncertainty of the marketplace. It’s a concept we think will benefit customers because it considers the long-term volatility of the marketplace.”

That doesn’t sound at all like the pro-competition track laid down by former CEO Alexander (Remember, “competitive markets, over time, will produce the lowest prices for customers.”) or the pro-competition testimony offered just months ago in Maryland regarding renewables (Remember, “competitive markets, not regulatory mandates, provide the most economical solution….”).

Well, the competitive markets have spoken in Ohio (and the broader PJM territory in which FirstEnergy’s generating units operate), and Sammis and Davis-Besse simply can’t compete. This point was driven home by PJM itself in a recent report: “The simple fact that a generating facility cannot earn sufficient market revenue to cover its going-forward costs does not reasonably lead to the conclusion that wholesale markets are flawed,” PJM wrote. “More likely, it demonstrates that the generating facility is uneconomic.”

It’s time for FirstEnergy to stand by its competitive mantra and close those two plants, not seek to soak its customers for billions for plants that are no longer economic.

–Dennis Wamsted

Follow

Follow

One thought on “FirstEnergy Fails the Test

On Utility Competition

With Its Bailout Bid”