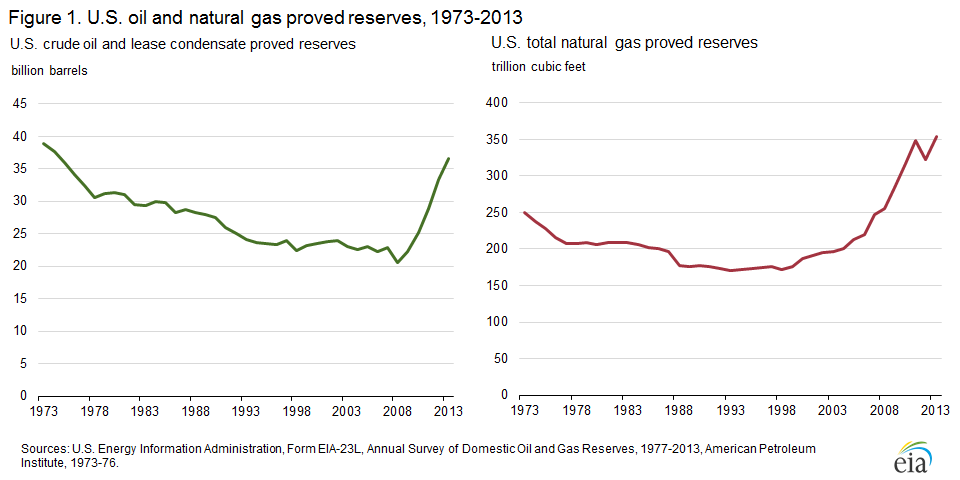

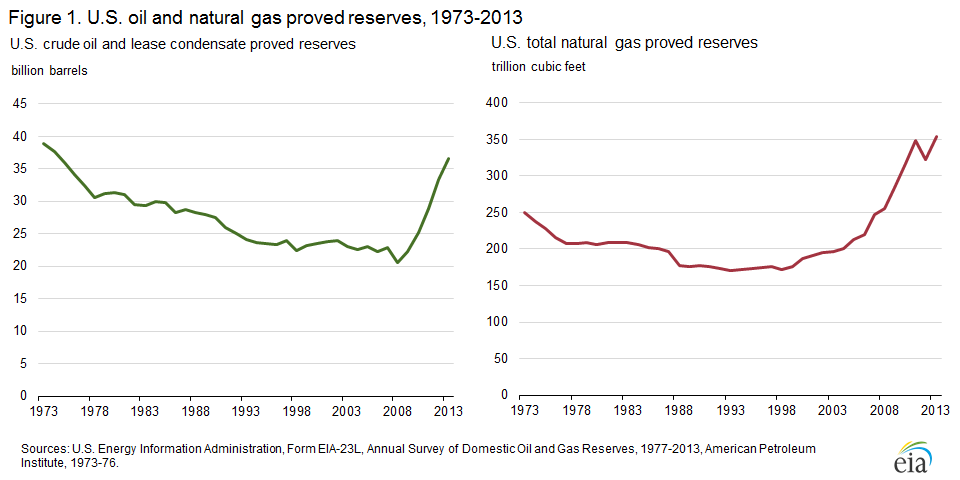

Call it an early Christmas present for the U.S. economy—the Energy Information Administration released eye-opening data this month showing continued sharp upward movement in proved U.S. oil and natural gas reserves.

The surge, which has been driven by the widespread commercialization and deployment of hydraulic fracturing and horizontal drilling technologies since the mid-2000s, pushed oil reserves above 36 billion barrels in 2013 for the first time since 1975 according to EIA. The news on the gas side is just as dramatic, with proved reserves hitting a record 354 trillion cubic feet, completing a 10-year period which saw natural gas reserves shoot up 75 percent from roughly 200 tcf in 2003.

Equally notable is that U.S. reserves have been increasing even as domestic production has been climbing. For example, proved U.S. oil reserves rose 3.1 billion barrels in 2013, up more than 9 percent from 2012, even as the country produced an estimated 2.7 billion barrels during the year. This is the fifth year in a row that both crude production and proved reserves have increased, EIA said. Similarly, on the natural gas side total proved reserves increased 31 tcf in 2013, up 10 percent from the year before. At the same time, natural gas production hit a record 26.5 tcf during the year, up 1.4 percent from 2012 and the eighth consecutive year of rising gas output according to the agency.

The big winners on the gas side were Pennsylvania and West Virginia, which sit atop the massive Marcellus Shale gas play. Combined, the two states accounted for 70 percent of the national increase in proved gas reserves in 2013: Proved reserves climbed 37 percent in Pennsylvania during the year, rising by 13.5 tcf, while West Virginia added 8.3 tcf to its proved reserve base in 2013. Overall, shale gas now accounts for 45 percent of the nation’s overall proved natural gas reserves—almost 160 tcf—according to EIA.

On the oil side, the unconventional resources in North Dakota’s Bakken and Three Forks fields accounted for most of the growth in proved reserves EIA said. All told, the agency said, reserves there climbed 1.9 billion barrels in 2013—51 percent of the national increase for the year. Overall, tight oil plays (those that benefit the most from fracturing and horizontal drilling) now account for almost 30 percent of total U.S. crude and lease condensate proved oil reserves.

In another piece of good news, EIA said it still expects U.S. crude production to climb in 2015—notwithstanding the recent sharp decline in crude oil prices, which have fallen into the $50 per barrel range this month from their peak of $112 in June.

Drilling activity is likely to decline in the new year, EIA said. “However, projected oil prices remain high enough to support development drilling activity in the Bakken, Eagle Ford, Niobrara and Permian Basin, which contribute the majority of U.S. oil production growth.’’

Overall, the agency said it expected U.S. crude production to average 9.3 million barrels per day in 2015, up 700,000 barrels per day from 2014.

All in all, these presents are likely to be among the most popular ever—keeping prices in check and ensuring ready access to supplies for the foreseeable future.

Merry Christmas to all.

–Dennis Wamsted

Follow

Follow