It is a small project by almost any objective standard, but the just-completed LED lighting retrofit at NRG Stadium, home to the NFL’s Houston Texans, is big news, underscoring the dramatic changes under way in the commercial/institutional lighting market—changes that threaten to undercut future demand growth in the already slow-growing electric utility sector.

The stadium retrofit, which is scheduled for a national unveiling during the Texans’ Thursday, Oct. 9th home game, the first night game using LED lighting according to NRG, involved replacing the existing lighting system with some 65,000 light emitting diodes. At full power, NRG said, the new lighting array will use 337 kilowatts of electricity—60 percent less than the 842 kilowatts used by the old unit.

And that is why this smallish project is such big news—companies and local and municipal governments around the country are doing exactly the same thing as NRG, they are replacing older, inefficient incandescent lighting with highly efficient and long-lasting LEDs, and along the way they are cutting deeply into future utility electricity sales.

While sports arenas seem like a natural fit for LEDs, one area where the technology has really taken off is in the streetlight/stoplight market. A number of the nation’s largest cities—New York, Los Angeles and Boston, in particular—already have launched major LED retrofit programs, with predictably positive results. In Los Angeles, for example, the city has replaced some 155,000 street lights, and cut its annual electric consumption by roughly 80 million kilowatt-hours (kwh), with more savings expected in the years ahead as the sprawling city completes retrofit work on its remaining 60,000 streetlights. For its part, New York launched an aggressive program in 2013 to replace all 250,000 of its streetlights with LED retrofits by 2017. When completed, the city expects the new LEDs to cut its annual electric bill by about $6 million annually, and save $8 million in maintenance costs. Boston, meanwhile, began a planned five-year retrofit program in 2010 in which it hopes to convert all 64,000 of its existing streetlights to the more efficient LED technology. In a 2012 program update, the city said streetlight electricity consumption already had been cut by 10.2 million kwh and savings had climbed to roughly $2.8 million annually.

What is crucial to remember about all these projects is that the reductions in electricity consumption are permanent—the host utility is never getting that load back. Beyond that, this is the worst type of load to lose as it is as predictable as clockwork; the sun goes down, the lights click on and the meters start turning. For an electric utility, little could be better than that. But that large, dependable market is soon to be a thing of the past: Current projections done for the Energy Department indicate that by 2025 essentially all of the streetlight/stoplight market will have gone LED; cutting annual electricity demand by upward of 41 terawatt-hours. That’s clearly good news for local governments and their residents, but not so much for utility executives worried about sales.

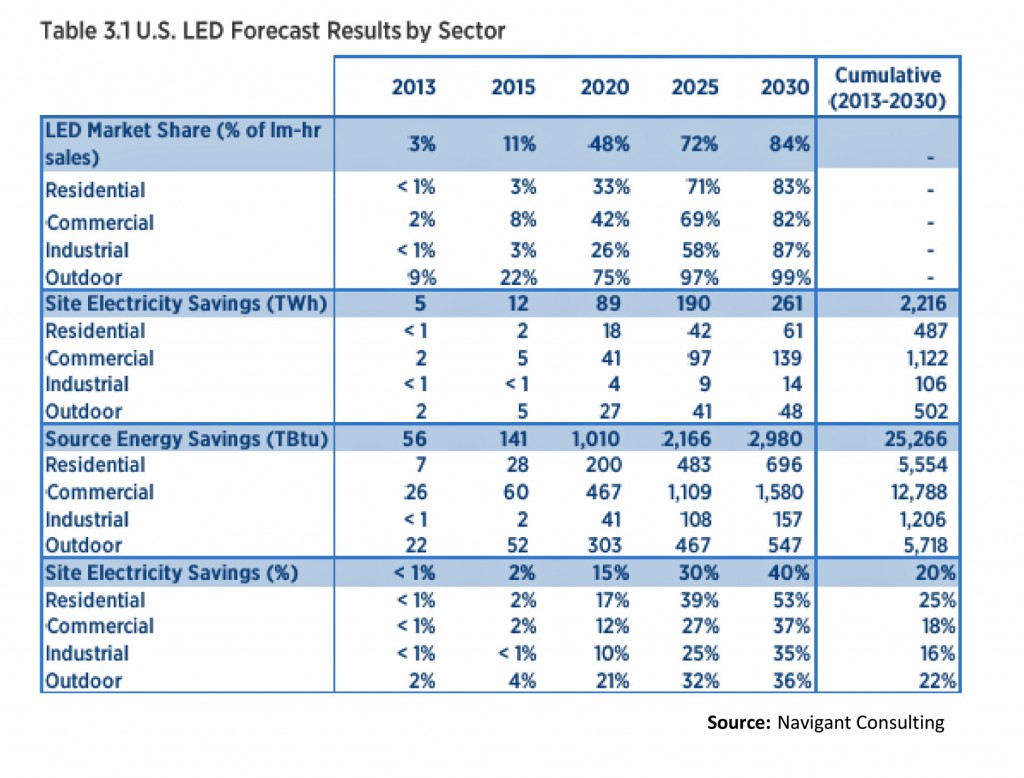

The truth is, utility executives have a lot to worry about, since the outdoor lighting market represents just the tip of the LED iceberg: In an August 2014 report for DOE, Navigant Consulting predicts that there also will be widespread adoption of LED technology in both the residential and commercial markets in the coming 10 years. On the residential side, Navigant said, LED technology will account for about 71 percent of all sales by 2025 and will cut electricity demand that year by 42 billion kwh. For comparison’s sake, DOE’s Energy Information Administration estimates that overall residential lighting consumption totaled about 186 billion kwh in 2012—accounting for about 14 percent of total residential electricity consumption.

The switch is even more pronounced on the commercial said, Navigant reported in “Energy Savings Forecast of Solid-State Lighting in General Illumination Applications.” By 2025, the firm said, LED sales in the commercial market will hit 69 percent of the total and will be saving companies 97 billion kwh annually compared to a scenario without the new lighting technology. In 2012, by comparison, EIA says the commercial sector consumed 274 billion kwh for lighting, about 21 percent of total commercial sector electricity consumption.

All together, the savings attributable to LED technology in 2025 are projected to top 190 twh. For the utility sector, already worried about flat sales, that’s a BIG problem.

Another problem is that the transition may well be accelerating. In its 2012 report on the LED market, Navigant projected that the new lighting would account for 36 percent of sales in the overall market by 2020, growing to 74 percent in 2030. Just two years later, the latest Navigant report has much higher estimates—projecting that LED sales will account for 48 percent of the sector’s overall sales in 2020 and 84 percent in 2030. Given this rapid increase, it is fair to ask: What might the 2016 estimates look like? The industry won’t say it, but these lost sales hurt, a lot.

While a topic for another column, it is worth adding that an unrelated new report by Navigant, “Smart Thermostats,” predicts that there will be a sharp increase in global sales of these advanced devices over the next 10 years. Specifically, the consulting firm said it expects sales of smart thermostats to jump from 926,000 in 2014 to more than 19 million by 2023. Smart thermostats (fancier versions of older programmable units) are capable of learning your habits and cutting energy consumption when not needed. One longstanding estimate on DOE’s web site shows that turning down your thermostat 7+ degrees when you are out of the house at work or overnight while you are sleeping can cut energy consumption by upward of 10 percent over a year’s time. Yet more lost load for utility executives to worry about.

It’s enough to keep you tossing in your sleep.

–Dennis Wamsted

Follow

Follow

2 thoughts on “LEDs Pose Big Threat

For Slow Growing

Electric Utility Industry”