The nuclear morass that has ensnared utility executives, state regulators, and legislators in South Carolina and Georgia shows no signs of easing its grip. Southern is set to decide soon whether its Georgia Power subsidiary will seek to complete Vogtle 3 & 4 even though the total cost for the much-delayed nuclear project has now ballooned to an estimated $25 billion. How those economics can ever pencil out is beyond me, but that is not the topic for today. Across the border in South Carolina, the blame-passing game has now started in the wake of Santee Cooper’s decision to pull out of the similarly delayed and way-over-budget V.C. Summer 2 & 3 project: Legislators in the state launched a series of hearings this month on the project, and the first order of business for Kevin Marsh, chairman and CEO of SCANA Corporation (the parent of South Carolina Electric & Gas, the lead partner in the Summer project) was to remind everyone listening that the company had done everything by the book, and that state regulators had continually vouched for the prudence of the utility’s decisions. But that is for another column as well.

What caught my eye, and what nobody at either utility ever wants to talk about, was the first bullet on the first page of Marsh’s presentation (which is available here). “Why did we choose nuclear in 2008?” he asked, rhetorically, I hope. His lead answer? “Growing customer demand required the addition of new base load generation.”

And therein lies the rub. Growing demand in the early 2000s clearly played a major role in pushing both Georgia Power and SCE&G to ask regulators to approve their respective nuclear projects. But the absence of similar growth, in fact the absence of any growth at all since the 2008-2009 recession and its consequent impact on the need for the projects, has been largely ignored by both utilities, as is abundantly clear in a review of their state-mandated integrated resource plans. Let’s take a look.

SCE&G can be excused in part for missing the mark in its 2009 IRP, when it confidently predicted that growth in its service territory would climb by an average of 1.7 percent per year in the coming 15 years. The utility industry, especially in the growing Southeast was used to growth and lots of it, hence the rationale behind the company’s optimism: While acknowledging the recession, the company concluded that “there is strong historical evidence that sustained growth will reoccur in the long run. SCE&G must plan its system to serve that growth.”

Apparently, the planners at SCE&G forgot the time-honored Wall Street maxim that past performance is no guarantee of future results—it’s going on 10 years now and that sustained growth still has not reoccurred.

In its 2012 IRP, the company acknowledged that there was some lingering uncertainty about the future pace of sales growth, but still projected growth of 1.2 percent annually in the forecast period through 2026—even though total systemwide sales had only risen 60 gigawatt-hours since 2009, a paltry 0.2 percent.

Skip to 2015 and the narrative is much the same, with the company forecasting annual growth going forward of 1.4 percent per year, even though sales that year, at 22,635 GWh, were actually below those recorded in both 2009 and 2012. The company’s IRPs have consistently made a head fake at studying the impact of efficiency measures on future growth, noting for example the rollout of standards to lower heat pump energy consumption and reduce electricity usage in the lighting sector. But the company did little with that information, as is evident in its cursory coverage of the major changes under way in the lighting industry.

The company, in what can only be termed intentional neglect, lifted the same paragraph from its 2012 IRP and inserted it into the 2015 document, as if nothing had happened in the intervening three years. SCE&G wrote, in both 2012 and 2015:

“A third reduction was made to the baseline energy projections beginning in 2013 for savings related to lighting. Mandated federal efficiencies as a result of the Energy Independence and Security Act of2007 took effect in 2012 and will be phased in through 2014. Standard incandescent light bulbs are inexpensive and provide good illumination, but they are extremely inefficient. Compact fluorescent light bulbs (“CFLs”) have become increasingly popular over the past several years as substitutes. They last much longer and generally use about one-fourth the energy that incandescent light bulbs use. However, CFLs are more expensive and still have some unpopular lighting characteristics, so their large-scale use as a result of market forces was not guaranteed. The new mandates will not force a complete switchover to CFLs, but they will impose efficiency standards that can only be met by them or newly developed high-efficiency incandescent light bulbs. Again, this shift in lighting represents a change in energy use which was not fully reflected in the historical data.”

While not technically wrong, this graph is woefully inadequate to describe the lighting market circa 2015, particularly given the absence of ANY mention of light emitting diodes (LEDs), which already had made significant inroads into the lighting market then and were forecast to turn the sector on its head in the years to come. For example, I wrote a story in October 2014, which you can find here, that outlined the huge reductions in electricity demand likely from the broad adoption of LEDs in both the residential and commercial sectors: Annual savings by 2025 in the residential arena were pegged at 42 billion kilowatt-hours, while commercial sector savings were estimated at 97 billion kwh. Clearly not a development that should have been ignored, and yet it was.

The term LED bulbs did make it into the 2017 IRP, but only as an off-hand insertion. (The paragraph cited above is the same, except for this slightly revised sentence: “The new mandates will not force a complete switchover to CFLS, but they will impose efficiency standards that can only be met by them, LED bulbs or newly developed high efficiency incandescent light bulbs.”) That hardly qualifies as analysis, particularly given that by 2016 CFLs had essentially lost the battle with LEDs: For example, GE announced early that year that it was phasing out its CFL production in favor of LEDs, pointing out that LEDs already accounted for 15 percent of the 1.7 billion bulbs sold annually in the U.S. and were expected to hit 50 percent by 2020 (see my story here).

The idea that this and other efficiency measures might lower long-term growth still didn’t make it into SCE&G’s forecast, however. In its latest IRP, it is forecasting that electric sales growth in its service territory will average 1.4 percent for the coming 15 years. Sales this year are expected to total 22,972 GWh—up just 136 GWh from 2009. That comes out to an increase of just under 0.6 percent TOTAL, nowhere near the annual 1.2 to 1.7 percent ANNUAL increases forecast in each of its last four IRPs. When is the new low growth reality going to hit home at SCE&G?

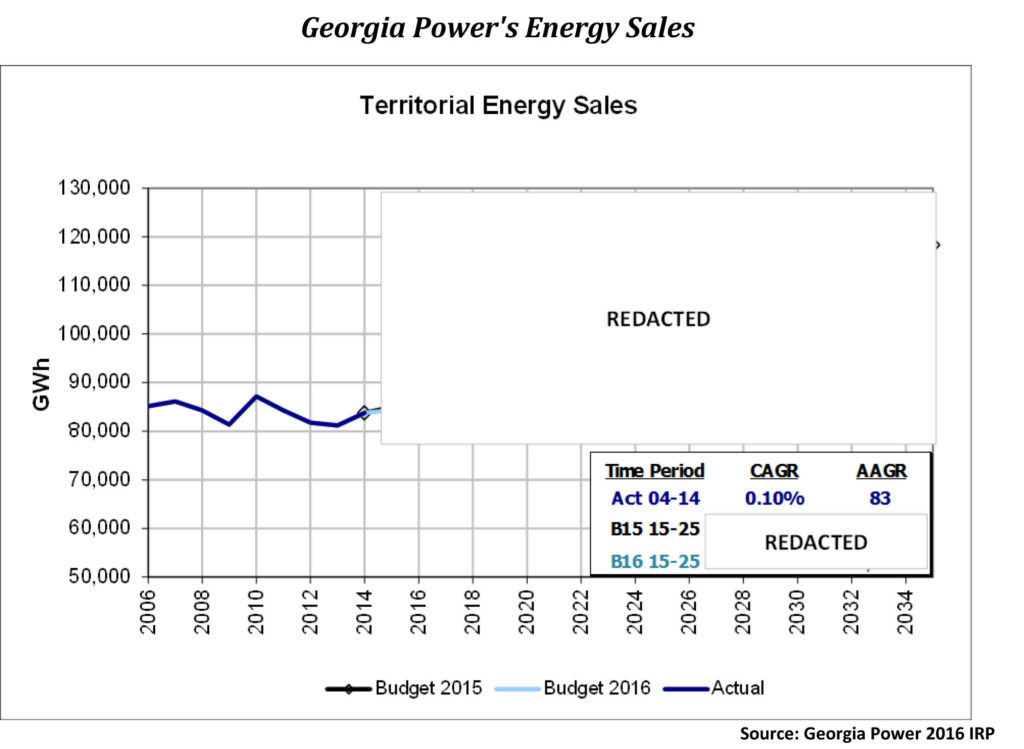

The record at Georgia Power isn’t much better, although it is harder to track because of the utility’s galling ability to get the state public service commission to redact information from its IRPs. This paragraph from the company’s 2016 IRP is indicative:

“A territorial peak demand of 17,985 MW was set on August 9, 2007 for the Georgia Power service territory. In 2018, weather normal peak demand is expected to be REDACTED MW and then to grow to REDACTED MW in 2025. Figure 1.1-1 shows the comparison of the Budget 2015 and Budget 2016 peak demand forecasts. Peak demand is expected to grow at a compound average annual rate of REDACTED% or REDACTED MW per year from 2014 to 2024. Budget 2015 anticipated REDACTED% compound annual growth for the same period.”

Even though the PSC lets the company hide these forecasts, as is evident in the chart below as well, it can’t squash the historical data, which is available from SEC documents and EIA. And that data tells a significantly different story than the company’s prediction of growth going forward.

As the chart above illustrates, the company’s growth from 2004-2014 has been a paltry 0.1 percent per year, and EIA data show that the flat line has continued through 2016. The company’s total retail sales were 84,873 million kWh in 2016, still below the pre-recession peak of 86,084 million kWh set in 2007. Much of this decline has come on the industrial side, according to the company, but as of the end of 2015 sales in all three rate classes remained below 2007 levels.

Despite this, Georgia Power sees growth ahead: “Although underperforming for the past few years, Georgia’s economy is expected to regain significant strength over the next several years,” the company wrote in its 2016 IRP. “Surveys show that the state remains an attractive place to do business and that living costs remain favorable relative to those in many other states.” Translation? Electric sales growth is coming, just wait (but don’t try to see how much, it’s been redacted).

My question for both utilities is simple: When does 10 years of no/little growth become the new normal? The two companies’ nuclear construction plans were both based on the strong growth witnessed in the early 2000s, and expectations of more to come in the future. But that hasn’t happened, undercutting any last justification for continuing either project.

–Dennis Wamsted

Follow

Follow

Dennis, though it appears your feelings were hurt by multi-$billion utility SCE&G’s refusal to consider the energy-efficiency hypothesis presented on your blog in 2014: “LEDs Pose Big Threat For Slow Growing Electric Utility Industry”, don’t take it personally. I’m sure they’re the recipients of thousands of works of important research bestowed upon them by other freelance journalists and consultants.

But indeed, “let’s take a look”. Your article here is based on several remarkable premises: 1) you, in 20-20 hinidsight, could have done a better job at forecasting the future of energy demand than SCE&G’s own market analysts; 2) SCE&G was either woefully negligent or, for unspecified reasons, intended to commit financial suicide; 3) that improvements in efficiency will extend in linear fashion indefinitely into the future, in contradiction with every prior example in history.

A lot to swallow, but consistent with the blind hubris of antinuclear/renewables advocacy from the start.