The Trump administration’s budget proposal for the coming year threatens to do exactly what the president promised as a candidate: eviscerate federal funding for climate change programs. The Energy Department’s highly successful renewable energy office would be particularly hard hit, with the administration’s proposal calling for a roughly 70 percent cut in funding—from just over $2 billion currently to $639 million next year. While wrong-headed, the proposals won’t slow the nation’s renewable transition, which is now being powered, to a large extent, by the corporate sector.

This change, which I discussed here, was highlighted in an interview last month by Chris Beam, the new president of American Electric Power’s Appalachian Power subsidiary, which currently gets 60 percent of its electricity from not-so-clean coal. Speaking to editors and reporters at the Charleston Gazette-Mail, Beam said: “At the end of the day, West Virginia may not require us to be clean, but our customers are.”

And that is exactly what is happening across the country, corporate customers are forcing utilities to expand their renewable energy offerings, whether that is to keep existing customers or to attract new companies into their service territories. As Beam added, according to the Gazette-Mail’s Ken Ward Jr.: “So if we want to bring in those jobs, and those are good jobs,…they [corporate customers] have requirements now, and we have to be mindful of what our customers want.”

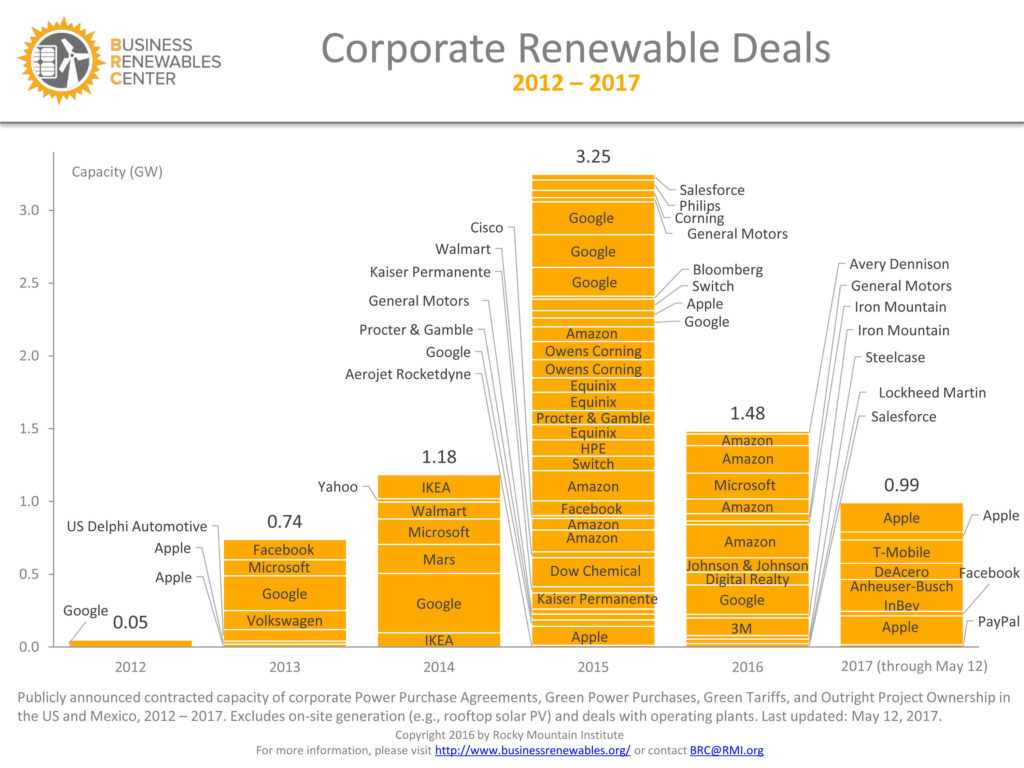

What those customers want is cleaner energy. According to Ceres’ latest report, Power Forward 3.0 (which you can download here), 240 of the companies in the Fortune 500 have specific climate or energy targets. Greenhouse gas reduction targets, which often entail boosting renewable energy purchases, are particularly common, with 211 of the 500 having some type of emissions reduction goal. In addition, 53 of the 500 have specific renewable energy purchase goals, with 23 pledging to get 100 percent of their energy needs from renewables by some point. All told, Ceres notes that corporate players, including some companies not in the Fortune 500, have signed contracts for almost seven gigawatts of off-site renewable energy just since 2014 (see the chart below for specifics). In addition, citing statistics from the Solar Energy Industries Association, Ceres said corporate entities have installed more than 1 GW of onsite solar capacity.

This drive for cleaner energy is having an impact throughout the utility industry, but particularly in the still-regulated states where it has largely been impossible for corporations to buy anything other than what their local supplier was selling. But now, following Beam’s admonition above, utilities are beginning to offer green tariffs and other options to allow corporate buyers to secure the renewable energy they are seeking.

Here, the recent proposal by Michigan’s Consumers Energy is instructive. Earlier this month, the Jackson, Mich.-based utility officially proposed a green tariff program that will allow its larger corporate customers to secure part or all of their power needs from local renewable sources. While open to all companies that meet the program’s criteria, the new tariff essentially was designed to comply with a demand by the telecommunications firm Switch that it be able to meet the needs of its new data center near Grand Rapids with 100 percent new renewable energy. No green tariff, no new data center.

This was not an idle bluff: In an earlier deal in Nevada, Switch had threatened to leave NV Energy’s system and provide for its own power needs unless it could contract through the Las Vegas-based utility for its power needs, which had to be new and had to be green. The result was the development of a green tariff by the utility and state regulators that gave Switch exactly what it wanted—new, green power, in this case solar PV.

Commenting on the Michigan deal, Adam Kramer, Switch’s executive vice president, said the key factor was the agreement to build new capacity, not just purchase renewable energy credits from some project elsewhere in the country. “Our relationship with Consumers serves as a model for how utilities can work with companies going forward,” he said.

Another example of the growing utility interest in green tariffs can be seen in Puget Sound Energy’s April roll-out of a program called GreenDirect, which will allow corporate customers to buy portions of the output from a renewable energy project—sort of like community solar, but on a bigger scale. In green-leaning Washington state, PSE’s plan has met with strong support: Among the first subscribers are REI, Starbucks, Target, King County and Western Washington University.

While clearly good for Washington businesses, the program also has national implications according to Letha Tawney of the World Resources Institute: “PSE’s new tariff is the first of its kind, offering a model for other utilities around the country to offer affordable renewable energy through the grid to smaller, existing customers.”

Xcel Energy has a similar program called Renewable Connect that will allow smaller corporate customers to buy green energy in its Minnesota and Colorado service territories. Much like AEP’s Beam, after the program was approved by Minnesota regulators this winter, Laura McCarten, Xcel’s regional vice president, told Midwest Energy News “this is something our customers want from us.”

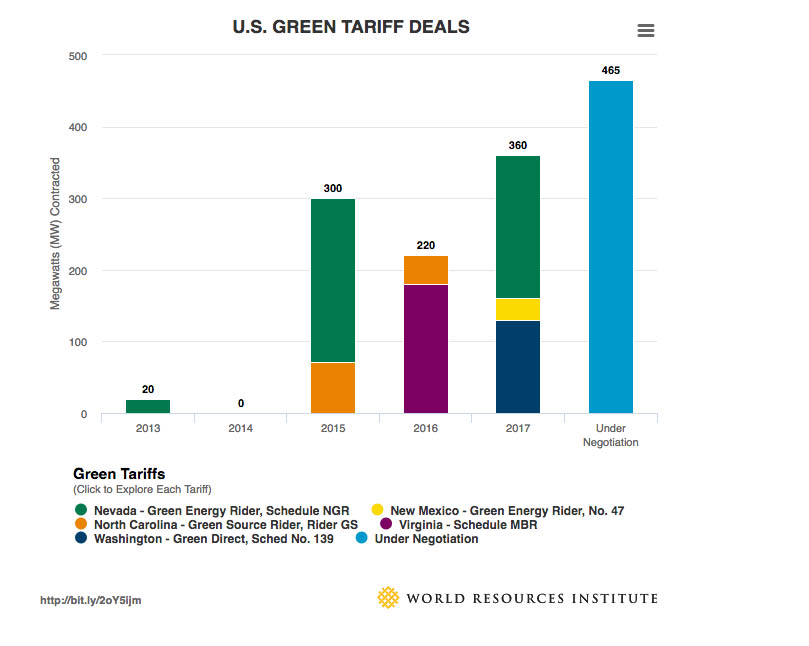

The following chart shows where these green tariff deals have been negotiated to date; note first how new the concept is and second that it doesn’t yet include the new Michigan tariff or the planned Colorado and Minnesota programs.

Whether large or small, the development of these programs has occurred with almost-lightning speed, at least by utility standards. Five years ago there were no such programs or tariffs, according to WRI data. Now there are 11 states (counting the still pending Michigan proposal) with green tariffs of one sort or another and six states where direct utility-customer deals have occurred. Couple that with the 13 states with retail choice where such deals are easily negotiated and you can see that a new picture is coming into focus. The chart below from WRI does a good job of sorting out what is available where.

Today’s utility executives, across the board, are now moving aggressively to meet the renewable energy demands of their corporate customers and embracing a greener grid—regardless of the budget battles being fought in Washington, D.C.

–Dennis Wamsted

Follow

Follow

One thought on “Corporate Green Goals

Playing A Key Role

In Pushing Utilities

Toward Renewables”