So, it has come to this—Rick Perry, the man who seven years ago couldn’t remember that the Energy Department was one of the government agencies he wanted to eliminate is now essentially going to be entrusted with running the nation’s electricity grid as secretary of the very same department for the next two years.

Or, at least that is the indication from the latest memo (which can be found here) circulating around Washington in the Trump administration’s never-ending effort to rewrite the rules of capitalism, that wonderful free market enterprise the GOP has so often defended in years past. Democrats have frequently been at the receiving end of GOP barbs about the free market, with Republicans warning anyone listening that they were the only thing standing between the country and, that’s right, socialism. See Secretary Perry’s particularly relevant quote below about President Obama from 2012. Oh my, how things have changed.

I think Barack Obama is a socialist. I think he cares for his country – don’t get me wrong about that – but I think he truly misunderstands what this country was based upon, the values that America was based upon, which was free enterprise and having the ability to risk your capital and having a chance to have a return on your investment.

–Rick Perry

Anyway, the general GOP defense of the free market used to run something like this: When cheaper, better products come along, incumbent industries get hurt, some survive and evolve while others go out of business. It’s messy, but that’s what makes America great.

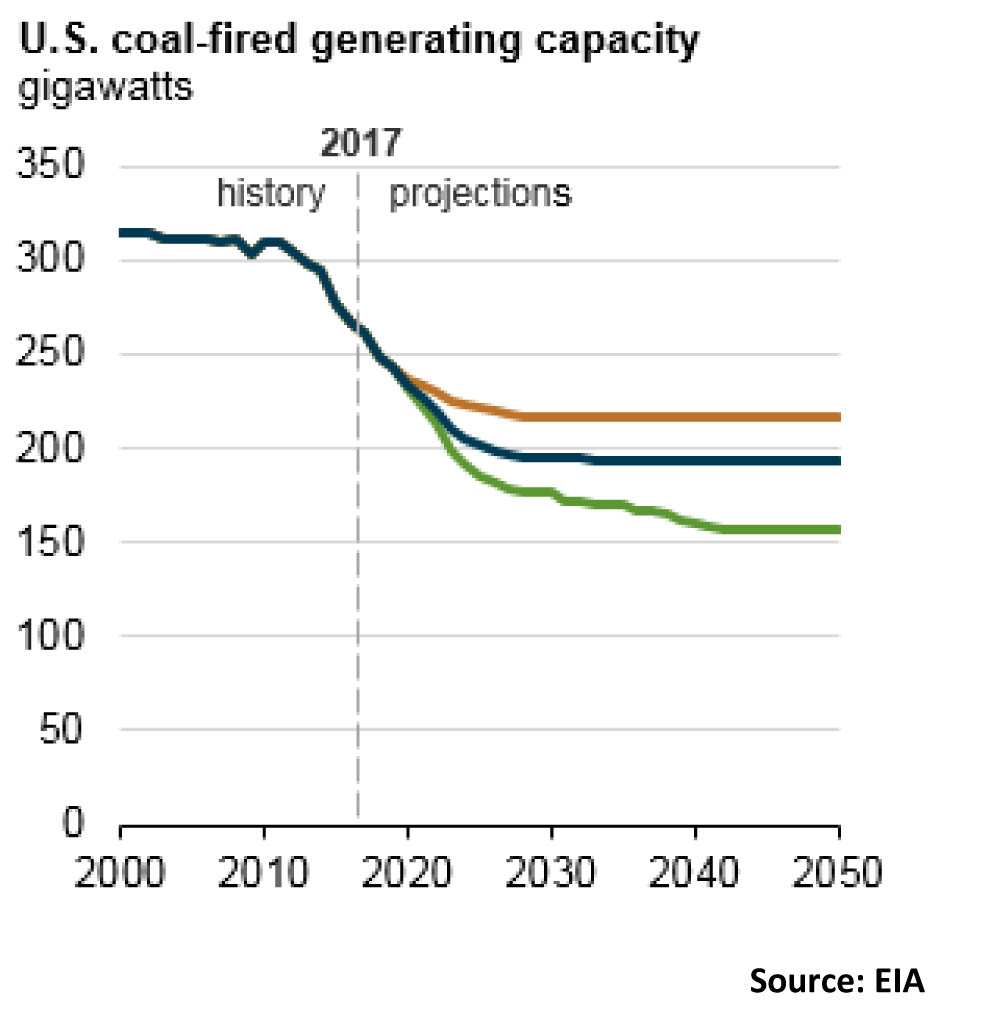

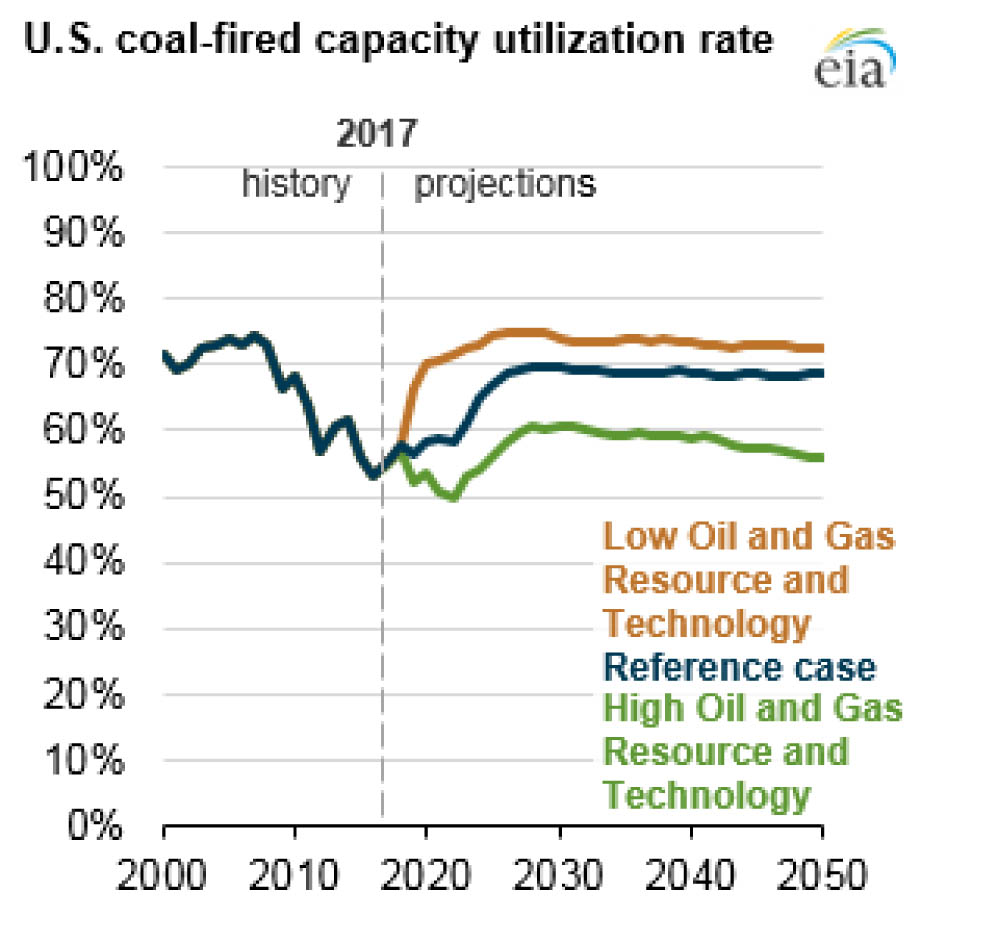

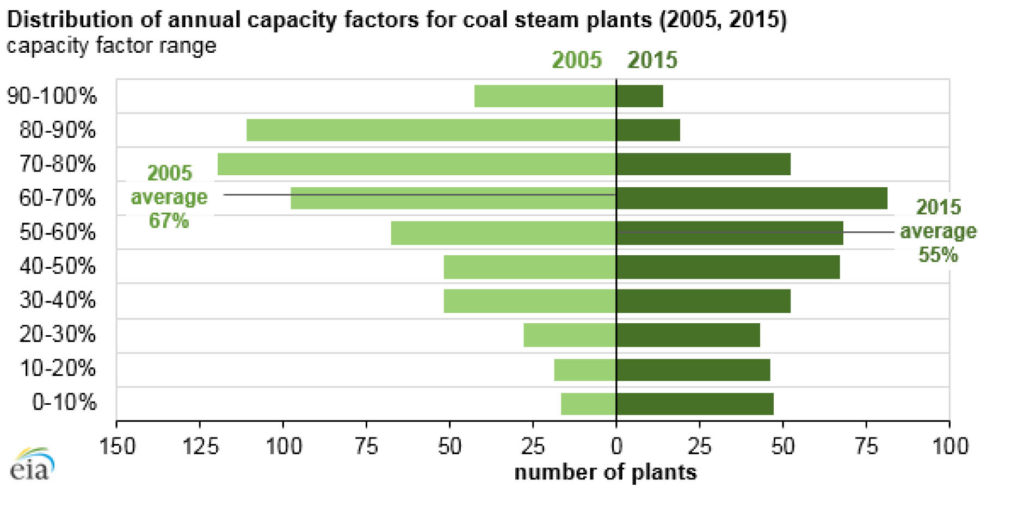

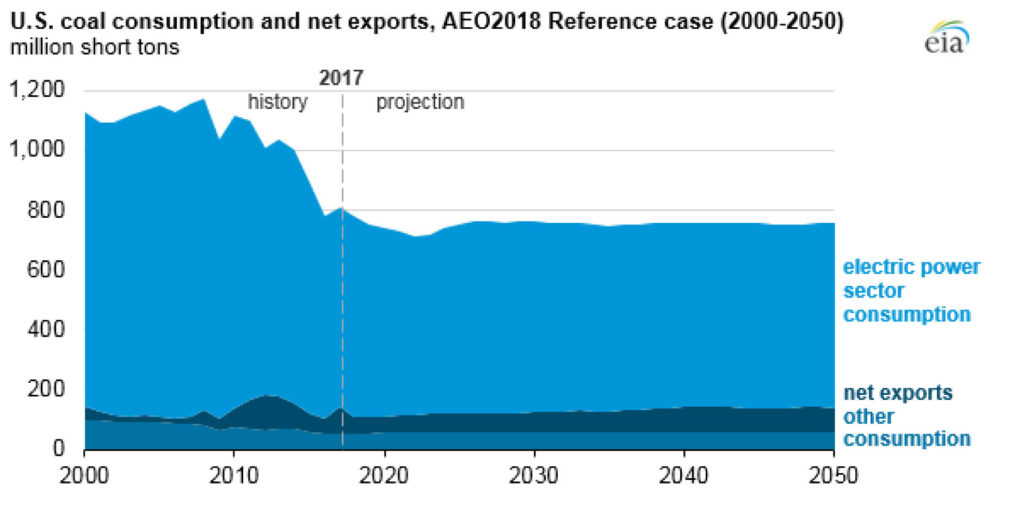

Well, that exact messy transition is under way now in the electric power industry, and not even a two-year grid nationalization, for that in effect is what is being considered, is going to stop it.

Renewable energy is getting cheaper almost by the day and, coupled with storage, offers the much ballyhooed “baseload” power that seems to appeal to Trump and his tag-alongs. At the same time, the administration’s own energy dominance agenda ensures that natural gas will be in plentiful supply and remain low in cost for all the existing and planned new natural gas-fired generating facilities across the country. Those facts can’t be wished away by half truths about resilience and reliability.

Continue reading Trump’s Coal Obsession

To Force Perry, GOP

To Abandon Free Market

Follow

Follow