For utility executives used to 40-year planning horizons, the past 10 years have been, shall we say, a difficult learning experience.

Ten years ago shale gas production was still at miniscule levels and natural gas prices were well above $6 per million British thermal units (mmBtu) and showing no signs of decline; today gas is the go-to fuel and price projections have essentially flat-lined well under $5 per mmBtu. Ten years ago nuclear was in the midst of a renaissance, with utilities considering plans to build upward of 28 new reactors; today just four new reactors are being built (by two utilities) and they are way over budget and long-delayed. Ten years ago renewables were a far-off hope, with EIA’s 2005 energy outlook pegging solar PV at 0.00 quads through the 2025 forecast horizon; today solar is shining, with 20 gigawatts of installed capacity to date and much more on the way, while wind accounts for more than 4 percent of the nation’s electric generation.

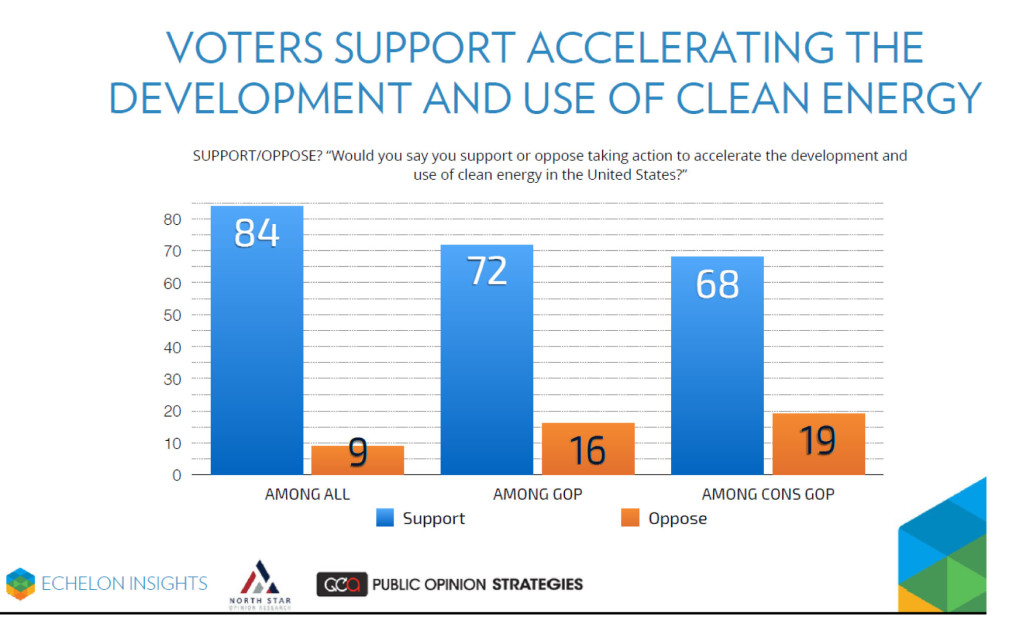

Another change in the past 10 years, harder to quantify but just as real, has been the complete shift in customer expectations. Previously, customers simply bought what their utilities offered—“We don’t have any of that clean power today, you’ll have to buy this brown stuff.” Today, customers are going out and finding the cleaner, greener power they want—a fact I see regularly in press release after press release touting company X’s decision to buy the output from a new solar or wind project or, even more telling, to develop the project themselves.

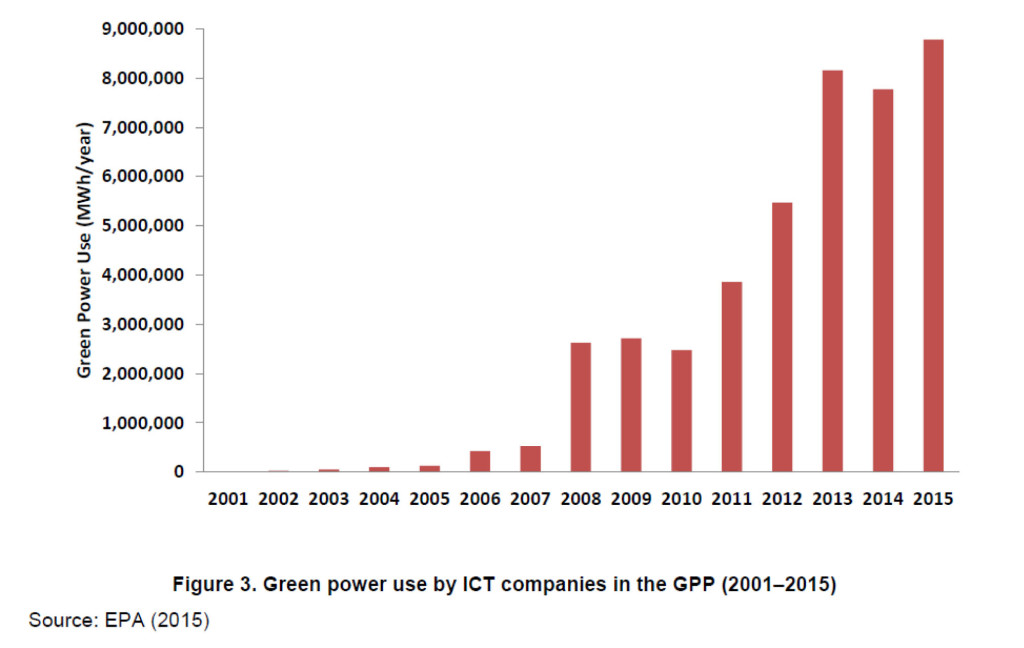

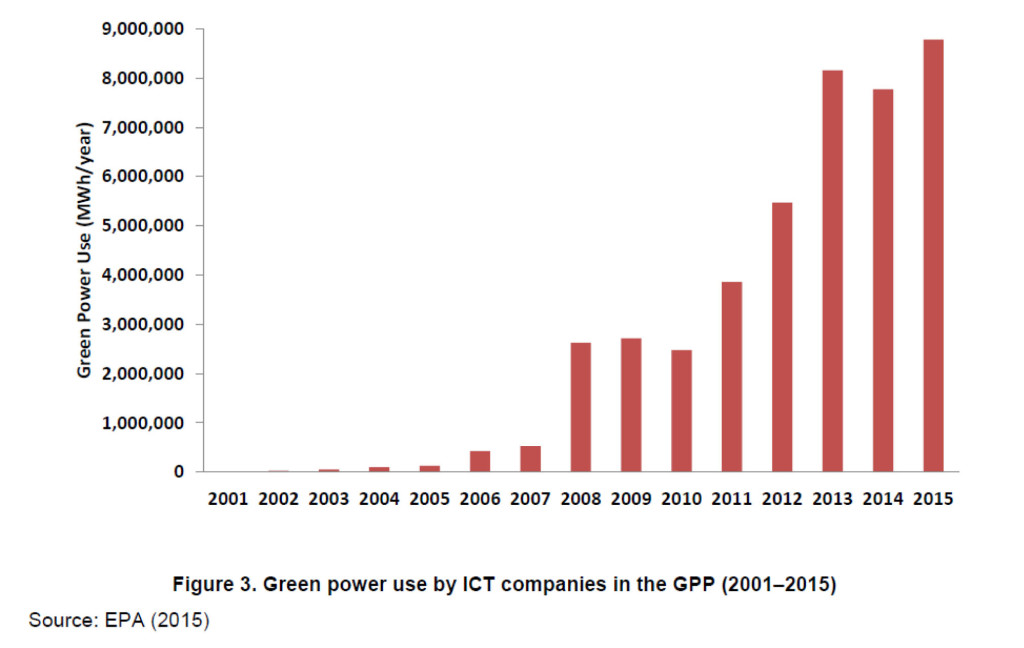

It has been hard to put numbers on this change, but a new report from DOE’s National Renewable Energy Laboratory (Renewable Electricity Use by the U.S. Information and Communication Technology (ICT) Industry, which can be found here) provides clear evidence of the shift within the information/telecommunications sector. Ten years ago, the companies in an EPA initiative called the Greenhouse Power Partnership purchased essentially zero renewable energy; today, those companies (the number participating has now climbed to 68) purchase 7.8 million megawatt-hours (mwh) of green power—amounting to almost 44 percent of their total electricity consumption in 2014.

Taking a broader slice of the ICT market, NREL tracked 113 companies that reported information either through EPA’s GPP or another program called the Carbon Disclosure Project Worldwide and estimated overall electricity use in the sector at more than 59 million mwh in 2014. Of this total, which is well over 1 percent of annual U.S. electric consumption, 8.3 million mwh—or about 14 percent—was renewable. According to NREL, the green electricity is sourced from a mix of power purchase agreements (PPAs), on-site generation, utility green power products and renewable energy certificates (RECs). In other words, in large part, the companies are going out and getting what they want, not waiting for their supplier to bring it to them.

This growth is almost certain to continue in the years ahead, NREL said, projecting that by 2020 the amount of renewable energy used by the 113 will more than double, climbing to at least 18.5 million mwh even under a low growth scenario. In a more aggressive estimate, NREL said renewable consumption by the 113 could shoot up to more than 37 million mwh.

And some of the firms have even grander plans. Amazon, Apple, Facebook and Google, for example, all have publicly announced corporate plans to purchase 100 percent of their electricity from green sources. That won’t happen overnight, but don’t be surprised if 10 years from now they have met that goal.

These commercial customers clearly are driving huge changes in the utility industry—it’s time, past time in fact, for the industry to respond and give them what they want or risk losing them as customers entirely.

–Dennis Wamsted

Follow

Follow